Hello, that is Pratik Bhakta in Bengaluru. For those who assume that the edtech sector is the massive bubble that’s bursting proper now, add yet another to that checklist. The cryptocurrency ecosystem appears to be dying a sluggish dying too. At the very least in India.

If declining buying and selling volumes (greater than 90% final 12 months) due to the tax imposed by the union authorities was a serious indicator of the evaporation of curiosity, the hardening stance of the banking regulator has chased away demand farther.

By calling out the widespread adoption of personal cryptocurrencies as a danger to financial stability, the RBI has indicated to the market that its stance will solely get tougher going ahead.

“Their (non-public cryptocurrency) large-scale adoption would result in cryptoisation of the financial system, which might result in main forex mismatch dangers on the steadiness sheets of banks, companies, and households’’, the regulator wrote in its June Monetary Stability Report (FSR).

By cryptoisation, the regulator meant higher use of crypto-assets as an alternative to fiat forex and conventional monetary belongings.

Business insiders have all the time identified that the banking regulator and senior bankers themselves weren’t in favour of the adoption of digital currencies. However by pitching for monetary inclusion, difficult the domination of the greenback, and enabling fast cross-border settlements, crypto operators thought they may push their case.

Nevertheless it appears to be heading nowhere now. And business insiders would agree.

“I don’t assume the federal government will ever help these currencies, regardless of how a lot lobbying or advertising we do,” stated a high business advisor who works with a number of crypto platforms.

Within the June FSR, the regulator has even stated that the purported advantages of those currencies are but to be ‘realised’.

Lately, crypto buying and selling platform CoinSwitch informed ETtech that they want to go stay with fairness buying and selling providers.

CBDC appears to be dropping favour too

However what about CBDCs (central financial institution digital forex), you might ask. Is the federal government going to exchange non-public cryptocurrencies with one in every of its personal and hijack the area?

As per my understanding, the Reserve Financial institution of India (RBI) just isn’t passionate about CBDC, but.

Whereas innovation is one thing that everybody loves worldwide, innovation with out widespread adoption is love’s labour misplaced.

Banks like Axis Financial institution and IDFC First Financial institution are operating pilots with their customers. ET spoke to 2 individuals who have participated in these pilots, who stated that their expertise had been underwhelming.

“I’m a crypto fanatic so I did reactivate a dormant account to open a digital forex pockets with a personal financial institution, however what occurred put up that’s I began getting calls from them so as to add extra steadiness to my financial savings account,” he stated.

The digital forex might hardly be used anyplace provided that the acceptance infrastructure just isn’t there but.

“So total my expertise was unhealthy. To not say that it’ll not be nice sooner or later, however as of now it’s fairly boring’’, he added.

I spoke with a high govt at a funds agency, asking if they’re engaged on creating an acceptance infrastructure for CBDC funds.

The chief stated that there have been talks about some pilots with the Nationwide Funds Company of India (NPCI), however nothing had moved.

“Given that buyers have simply began making funds utilizing UPI, providing one other QR code-based answer to maneuver them to CBDC can be complicated for the market and a nasty expertise total,” he stated.

I agree. What precisely is CBDC attempting to unravel? The price of printing cash and managing money. Now money just isn’t going away anytime quickly. So CBDC will all the time be a aspect hustle, as long as money is king, and UPI the crown prince.

G20 and India’s crypto push

One of many said targets of the finance ministry is to leverage India’s presidency at G20 to create a consensus round crypto amongst all the foremost economies of the world.

It’s apparent that for one thing like crypto, there are not any borders. So main economies might want to work collectively to control this area.

In November final 12 months, finance minister Nirmala Sitharaman had stated that regulating this area ought to be a precedence for G20.

Now it should must be seen if India can persuade the world that they should regulate (learn: shun) non-public crypto currencies, push them to the margins, and guarantee they don’t change into mainstream.

That is simply what the regulator has stated: “A globally coordinated strategy is warranted to analyse dangers posed to EMDEs (rising markets and growing economies) vis-à-vis AEs (superior economies), particularly on macroeconomic challenges (dropping financial management; native forex volatility), growth challenges (weaker capability to handle AML / CFT dangers), and cross-border challenges (oversight)’’.

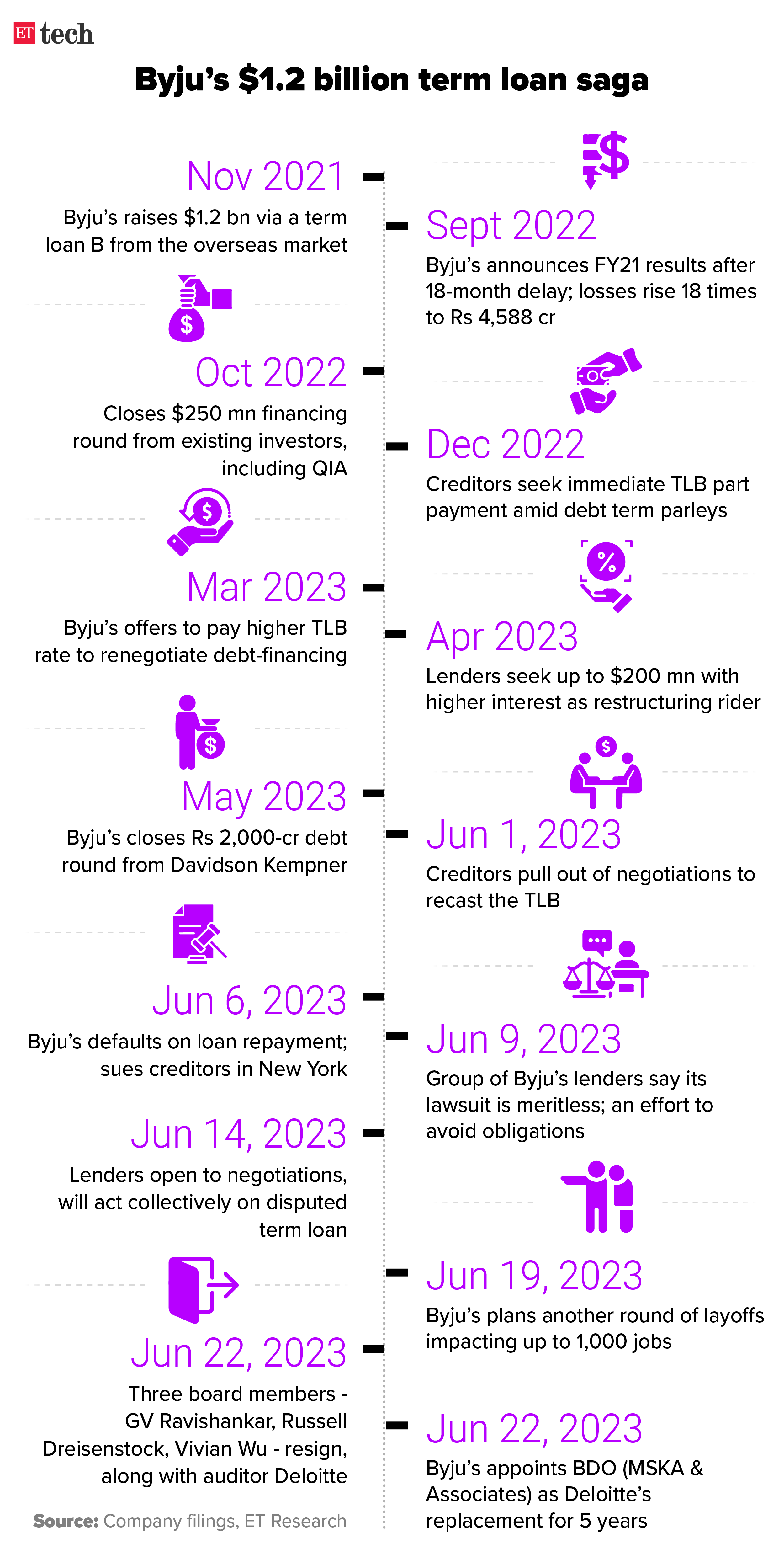

Byju’s Week of Woes

Issues will not be as unhealthy as you assume, Byju’s CEO tells workers: Byju Raveendran reassured workers at a townhall assembly that “issues will not be as unhealthy as you assume — as you learn within the media, for positive”.

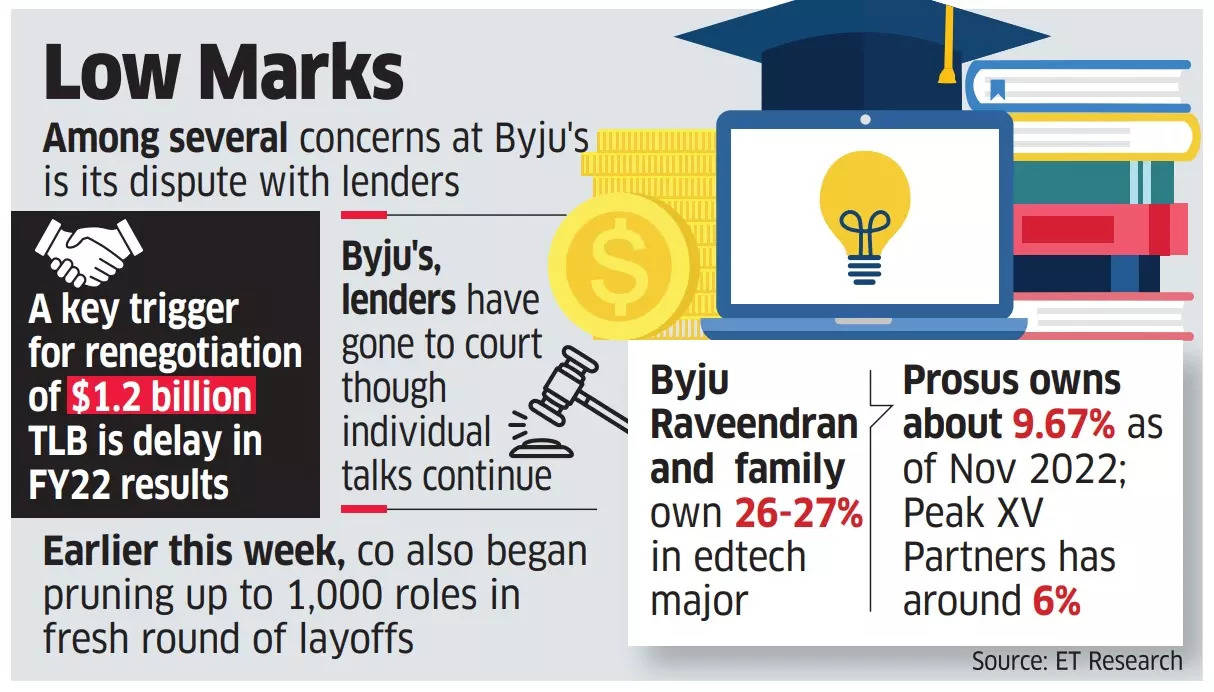

Byju’s but to get full Rs 2,000 crore pledged by Davidson Kempner: Byju’s is but to obtain your entire Rs 2,000 crore sanctioned by Davidson Kempner Capital final month because the edtech firm had failed to satisfy the mortgage phrases put forth by the US asset administration agency.

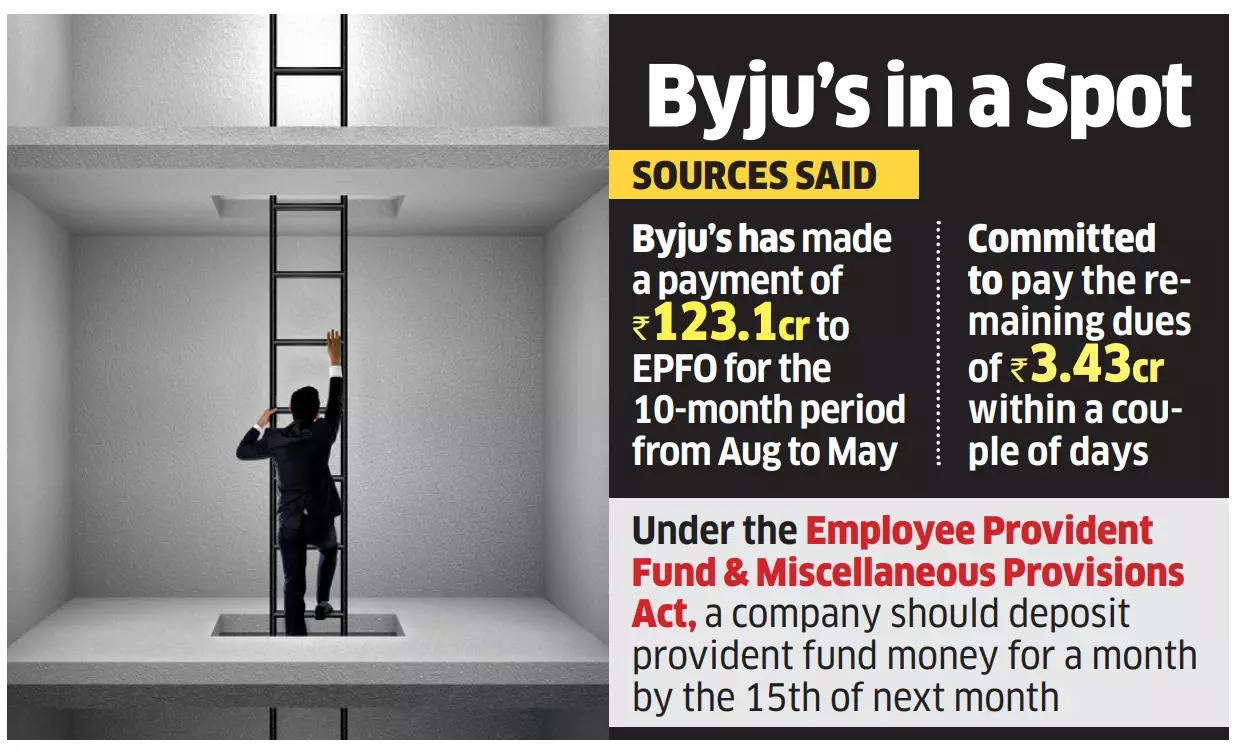

Byju’s remits Rs 123 crore workers PF dues to EPFO: Assume & Be taught, the mum or dad firm of Byju’s, has remitted the provident fund dues of its workers for August 2022 to Could 2023 to the Staff’ Provident Fund Organisation, following a directive from the retirement fund physique.

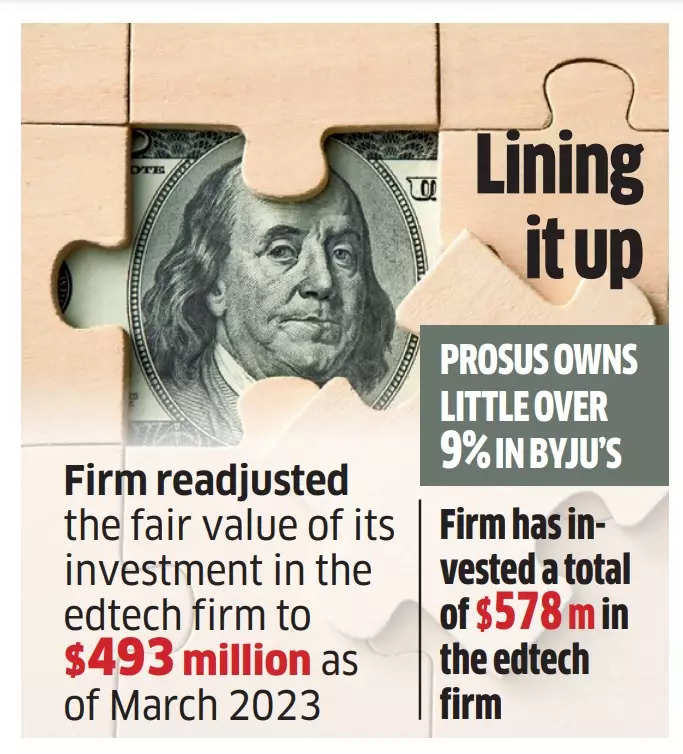

Prosus cuts Byju’s honest worth, writes off its ZestMoney funding: Prosus has marked down the honest worth of its stake in Byju’s and written off its funding in troubled buy-now-pay-later startup ZestMoney, disclosures made within the Netherlands-based expertise investor’s annual report present.

Delaware court docket spikes Byju’s TLB lenders’ probe plea: A US court docket has rejected a lawsuit filed in opposition to Byju’s by a bunch of lenders, who had sought an investigation right into a $500 million fund switch made by a subsidiary of the Bengaluru-based edtech agency to different entities.

CVs of Byju’s workers flood slump-hit edtech job market: Virtually half of Byju’s workers are in search of jobs elsewhere amid layoffs and monetary troubles on the high edtech agency, however most of them will not be discovering takers amid a hiring slowdown within the sector, recruiters informed ET.

Byju’s guarantees its traders audited FY22 outcomes by Sept: Byju’s has informed its traders that it’ll file the much-delayed audited monetary outcomes for the fiscal 12 months 2022 by this September, whereas the outcomes for the 12 months ending March 2023 can be submitted by December.

Disaster at Byju’s highlights e-lenders’ asset high quality drawback: The way in which the story at edtech large Byju’s is unravelling, there’s expectation it might have an effect on the nation’s fledgling digital lending section too. As a result of if the biggest participant within the sector flames out, others might really feel the warmth as properly.

ETtech Exclusives

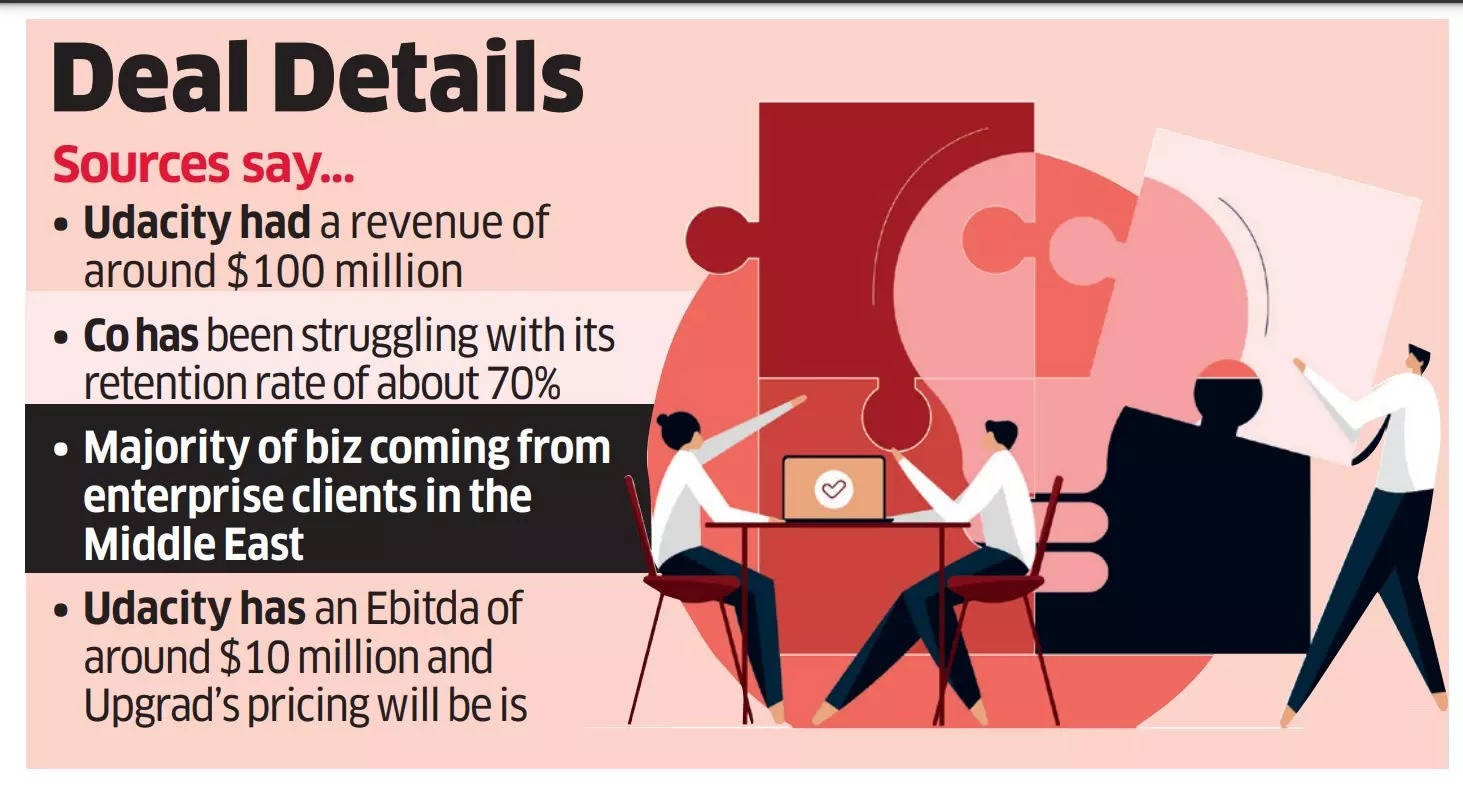

Upgrad in talks to purchase majority stake in Udacity: Greater training and upskilling-focussed edtech Upgrad is in talks to amass US-based Udacity, sources informed us. Udacity, which has been on the block for just a few months now, is speaking about promoting a majority stake within the firm by means of an fairness swap.

Udacity might at present be valued at over $100 million. It had quoted about $200 million to an earlier suitor, however the prospect had handed.

Foxconn exploring new ties as chip JV with Vedanta stalls: Taiwanese contract manufacturing agency Foxconn has began reaching out to massive Indian enterprise homes because it seeks to associate with them to additional its semiconductor manufacturing ambitions within the nation, a number of sources informed ET.

Additionally learn | EV elements to iPhones, Foxconn making India second house

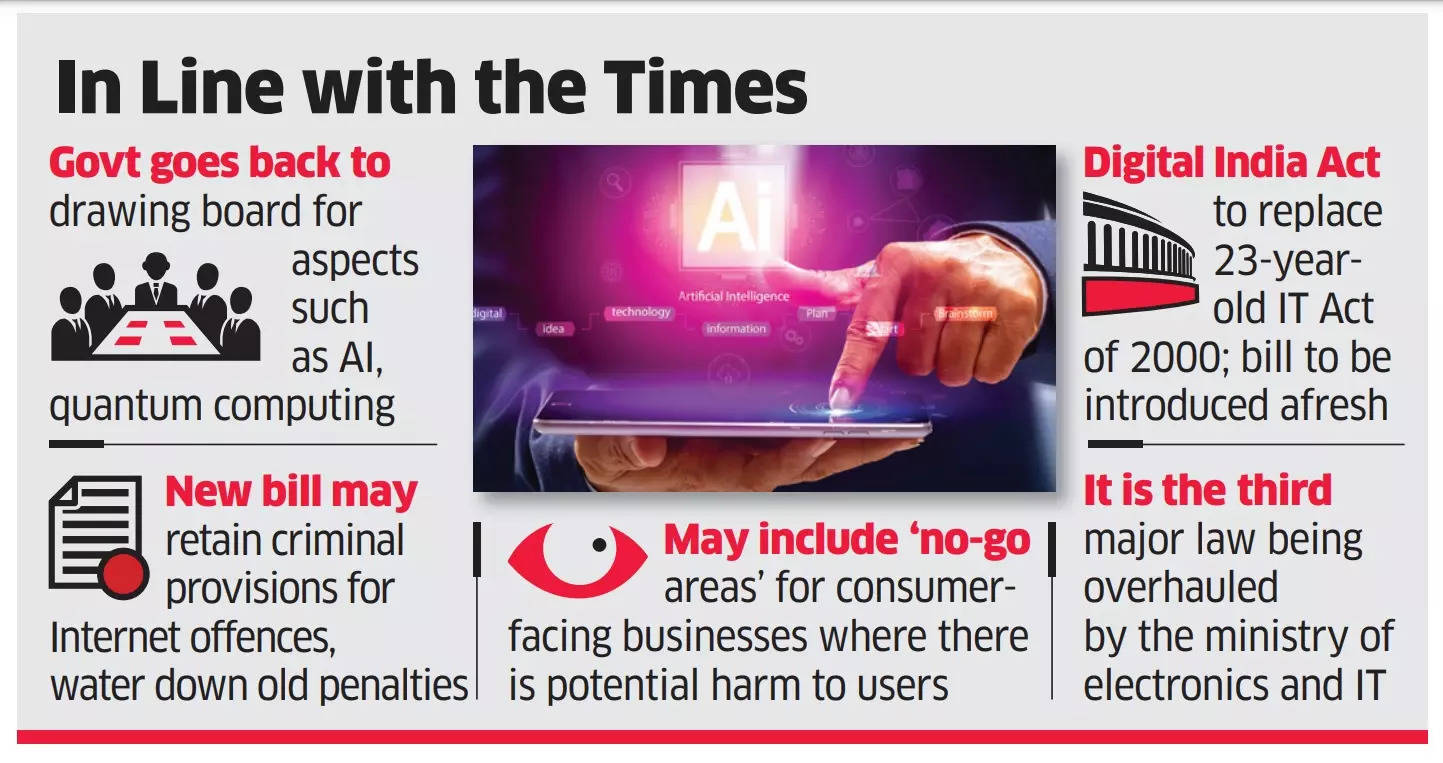

Digital India invoice draft seemingly inside 15 days: The draft of the much-anticipated Digital India invoice to manipulate rising applied sciences reminiscent of synthetic intelligence (AI) and quantum computing is more likely to be opened for public session throughout the subsequent fortnight, senior officers informed ET.

Stakeholders search extra open dialogue on e-competition act: A complete of 58 organisations and people representing completely different stakeholder communities from throughout the nation have written to the Ministry of Company Affairs (MCA), to carry an “open consultative public engagement course of” whereas drafting the Digital Competitors invoice, and think about considerations about its impression on end-consumers and small companies.

Fintech Updates

NPCI asks PPIs to shutter co-branded UPI wallets: The Nationwide Funds Company of India (NPCI) has requested all pay as you go fee instrument (PPI) issuers to right away cease permitting their wallets for use on unregulated associate functions for Unified Funds Interface transactions.

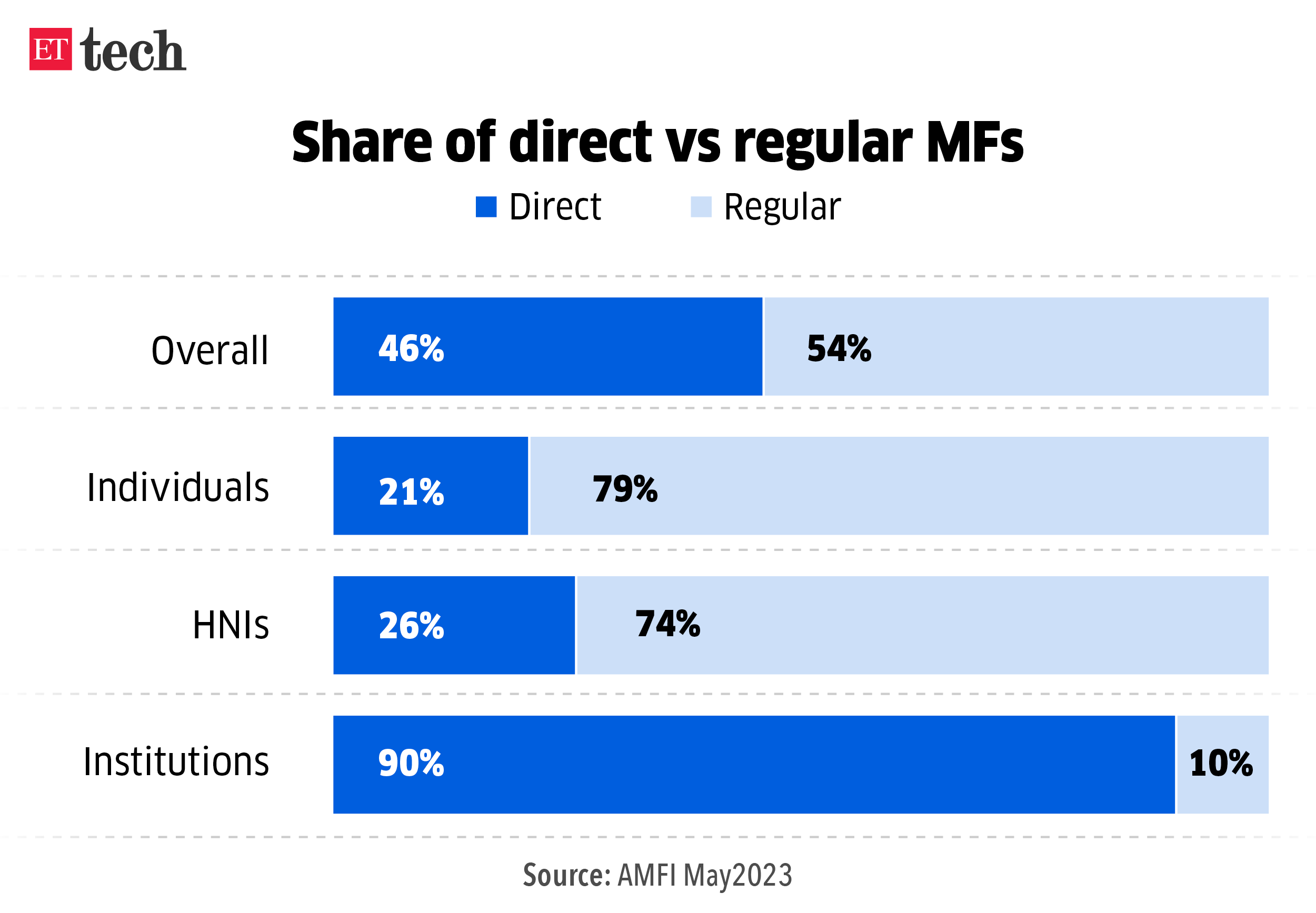

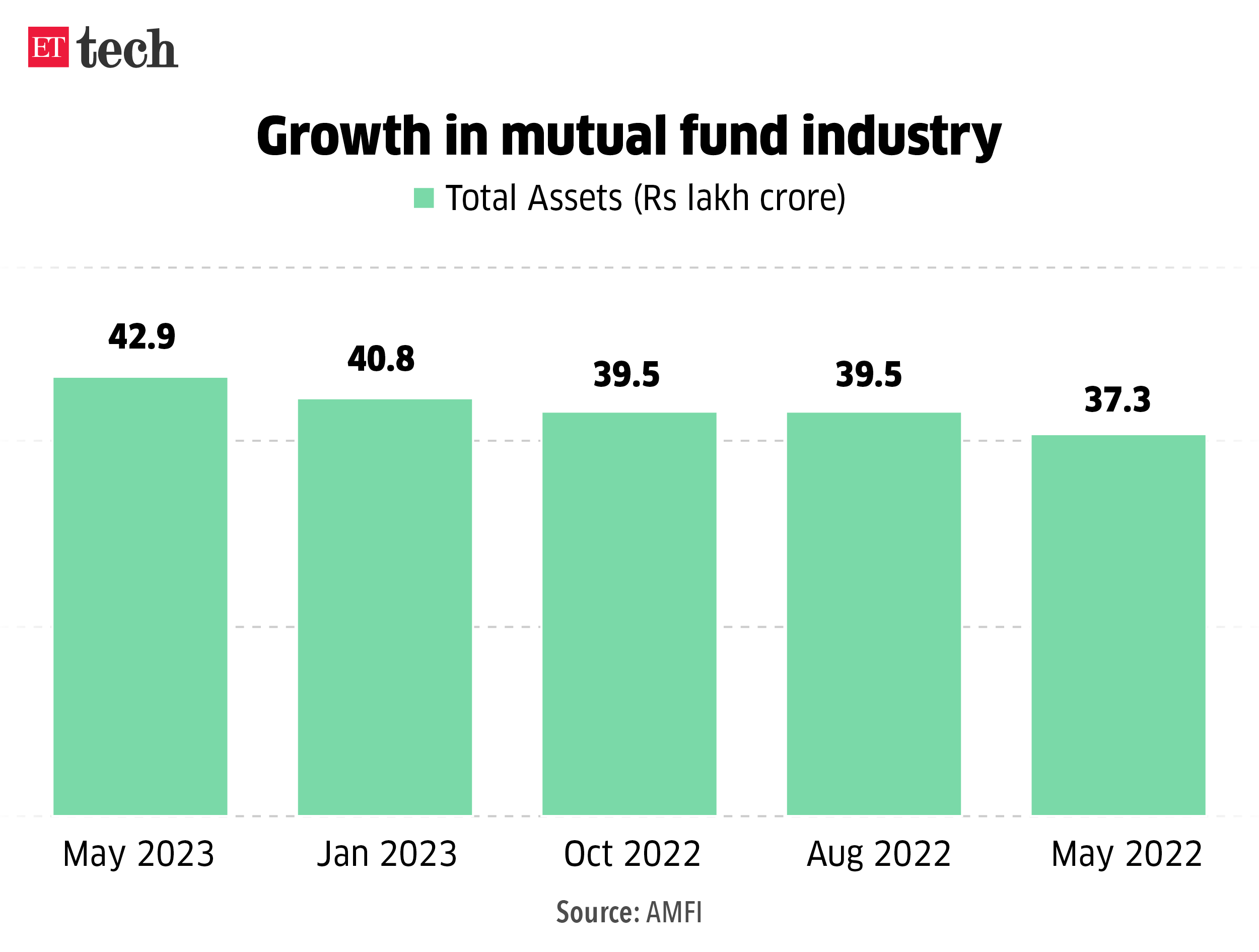

To cost or to maintain free, direct MF gamers fret over this core query: EOPs (execution-only platforms), who facilitate funding in direct mutual funds, lastly have a path to generate revenues because the markets regulator has come out with pointers for them. Nonetheless, these firms will not be positive the way to monetise their providers.

Gamers like Groww, Zerodha’s Coin, ETMoney, and others who had been providing direct mutual funds to their customers without cost will now have the ability to cost for his or her providers.

IT Nook

Jobs rip-off: TCS fires six workers, bans as many staffing companies | Tata Consultancy Companies has sacked six workers and blacklisted as many staffing companies following complaints about discrepancies in its recruitment course of, Tata Sons chairman N Chandrasekaran informed shareholders on the firm’s 28th annual normal assembly on Thursday. Investigations are ongoing into the conduct of three extra workers, he stated.

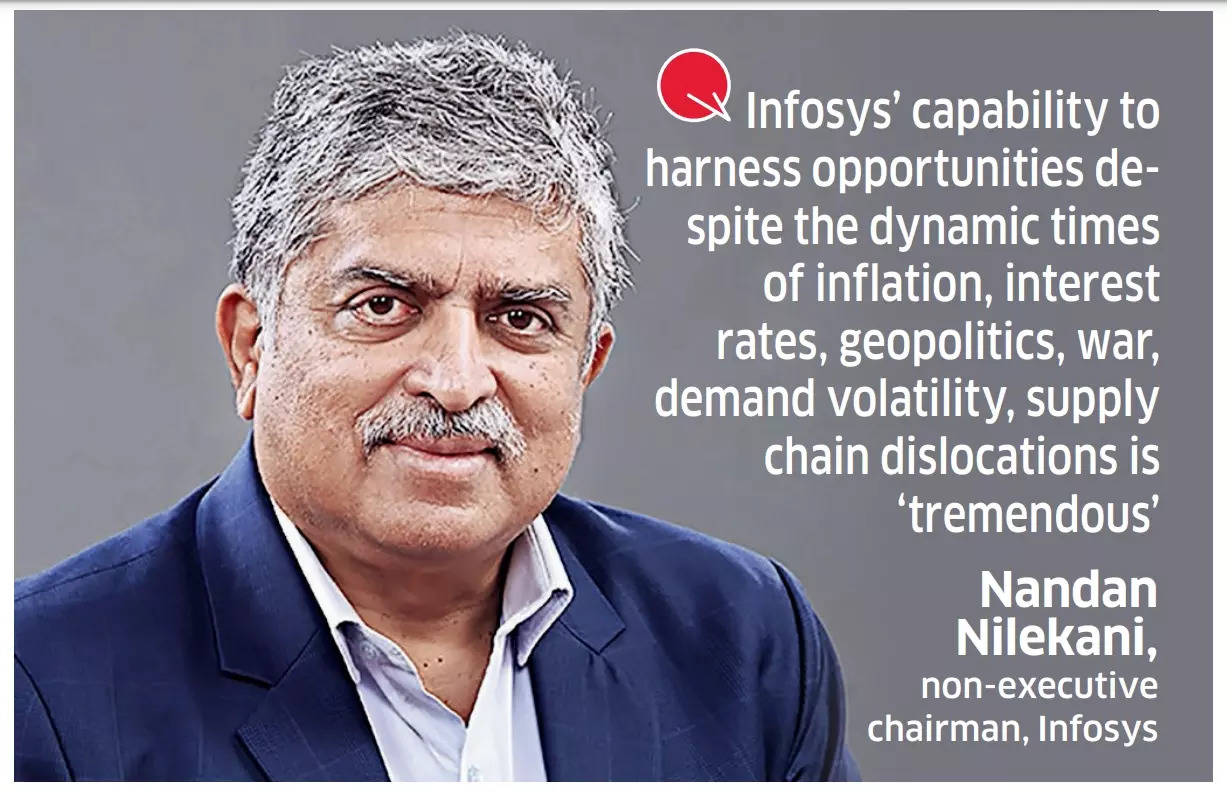

Infosys inked 95 massive offers in FY23, 40% of them new: Nandan Nilekani | Infosys is on a “stable basis” to develop on the again of enormous offers bagged within the fiscal 12 months ended March 31, 2023, non-executive chairman Nandan Nilekani stated.

“We had 95 massive offers valued at $9.eight billion for the 12 months, of which 40% had been new (offers). This guarantees a stable basis to develop and construct resilience within the months to return,” Nilekani stated Wednesday on the 42nd annual normal assembly of India’s second-largest IT firm.

Additionally learn | IT Business Wants Guardrails to Weed out Graft: Staffing Consultants

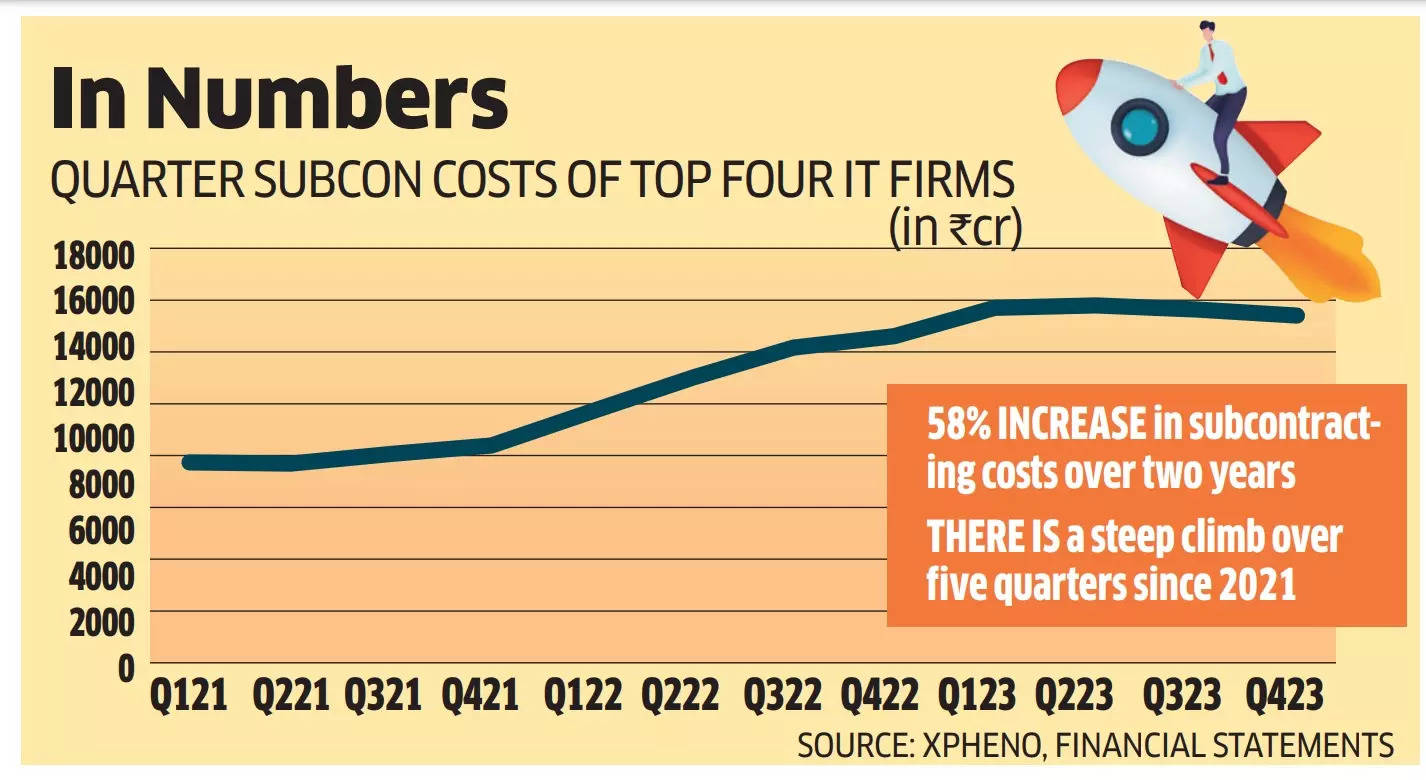

Subcontracting prices up 60% in two years for high 4 IT companies: Subcontracting prices incurred by India’s high 4 IT companies have risen practically 60% within the final two years, fuelled by heightened attrition and digital demand that the sector witnessed after the pandemic.

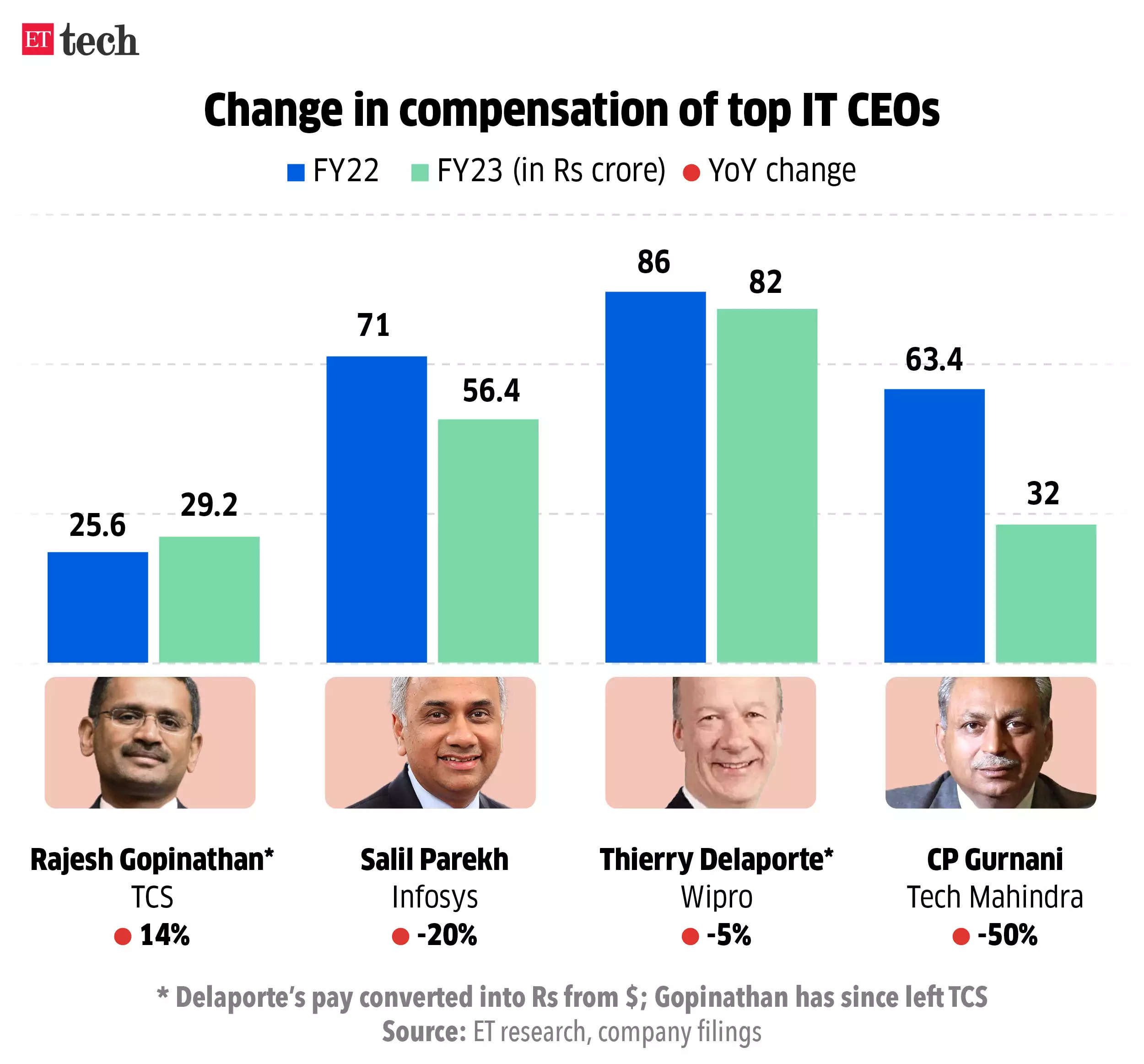

Tech CEO pay packages replicate muted development outlook: A weak fourth quarter and muted income development projections by high tech firms have been mirrored within the compensation paid to C-suite executives. Whereas Tech Mahindra chief govt CP Gurnani took a 50% wage reduce, Infosys CEO Salil Parekh noticed a 21% pay reduce in comparison with the earlier 12 months.

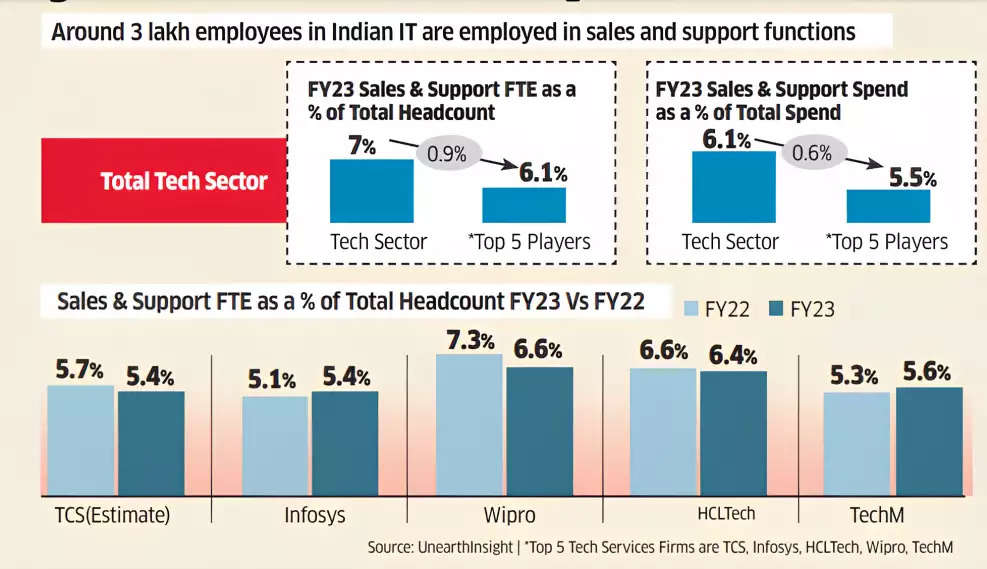

How would generative AI Impression IT jobs? Generative AI’s use circumstances might impression the scope of labor of near 1% of India’s 5.4-million IT workforce, unfold throughout gross sales and help departments, and create a further income potential of $2-Three billion for the business, a brand new examine has stated.

Traders Elevate Funds

From left: RTP International (Asia) funding companions Nishit Garg and Galina Chifina

RTP International closes new $1 billion fund: International early-stage investor RTP International, which has backed the likes of Cred, Insurgent Meals and Cellular Premier League in India, has introduced the shut of its fourth fund (RTP IV), with a corpus of $1 billion. It’s trying to make investments nearly a 3rd of that capital in India and southeast Asia. The fund has earmarked $660 million from the corpus for brand new early-stage investments globally. It is going to look to speculate the remaining $340 million to double down on its high performers.

Omnivore managing companions Mark Kahn and Jinesh Shah

Omnivore raises $150 million for third fund: Agritech enterprise capital agency Omnivore on Wednesday stated it has raised $150 million for the primary shut of its third fund, that focuses on startups growing applied sciences for agriculture, meals, local weather, and the agricultural financial system. With this, the Bengaluru-based Omnivore Agritech & Local weather Sustainability Fund expects to make 25-30 new investments in seed and sequence A rounds of agritech startups and micro, small, and medium enterprises, with preliminary cheque sizes ranging between $15 million.

Epiq Capital closes its second fund at $225 million: Rishi Navani-founded enterprise capital agency Epiq Capital stated on Wednesday that it closed its second India-dedicated fund at $225 million, larger than the preliminary goal of $150 million. The VC agency’s first fund had a corpus of $100 million.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Worthwhile, and ET Ecommerce Non-Worthwhile – to trace the efficiency of not too long ago listed tech companies. Right here’s how they’ve fared to date.

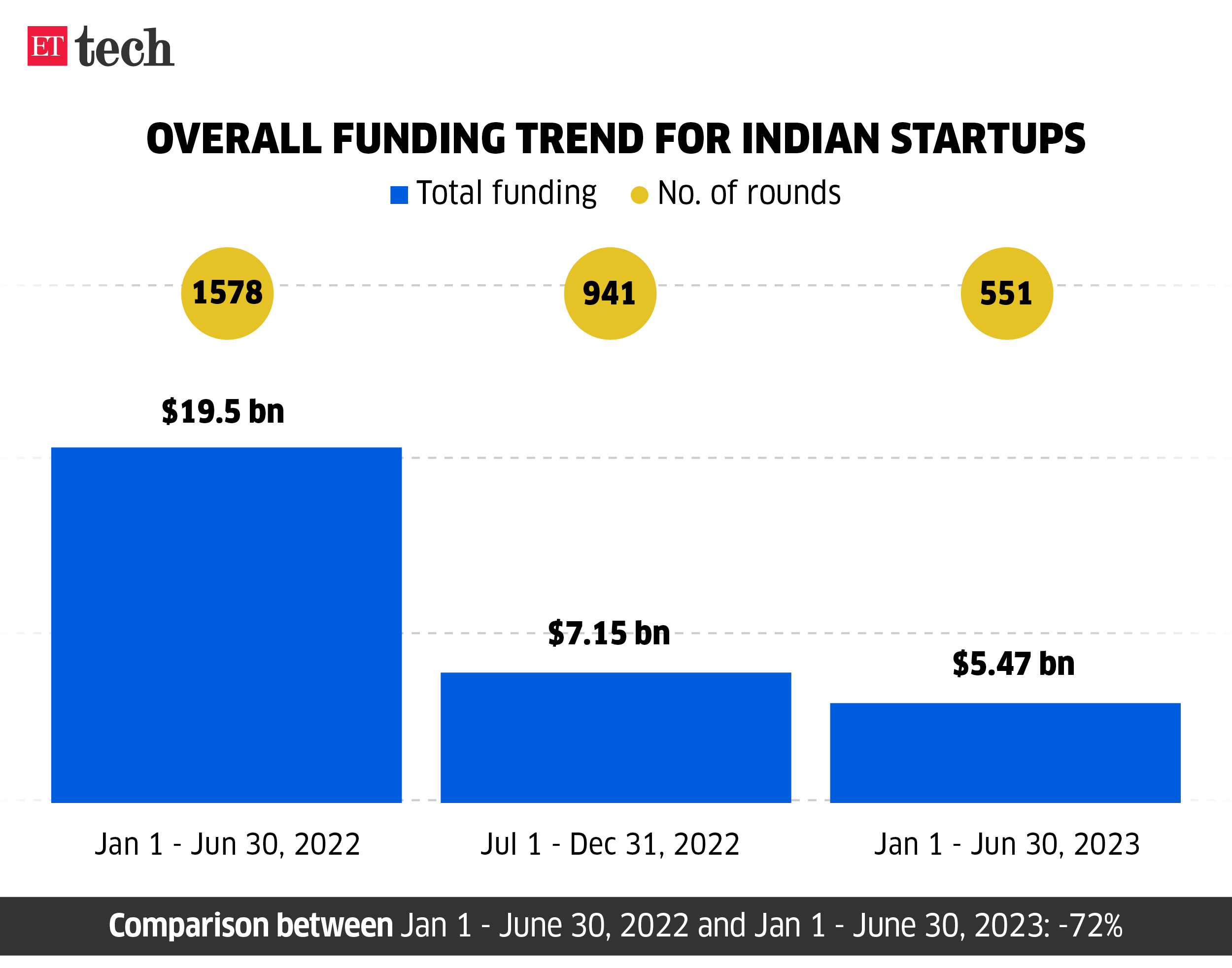

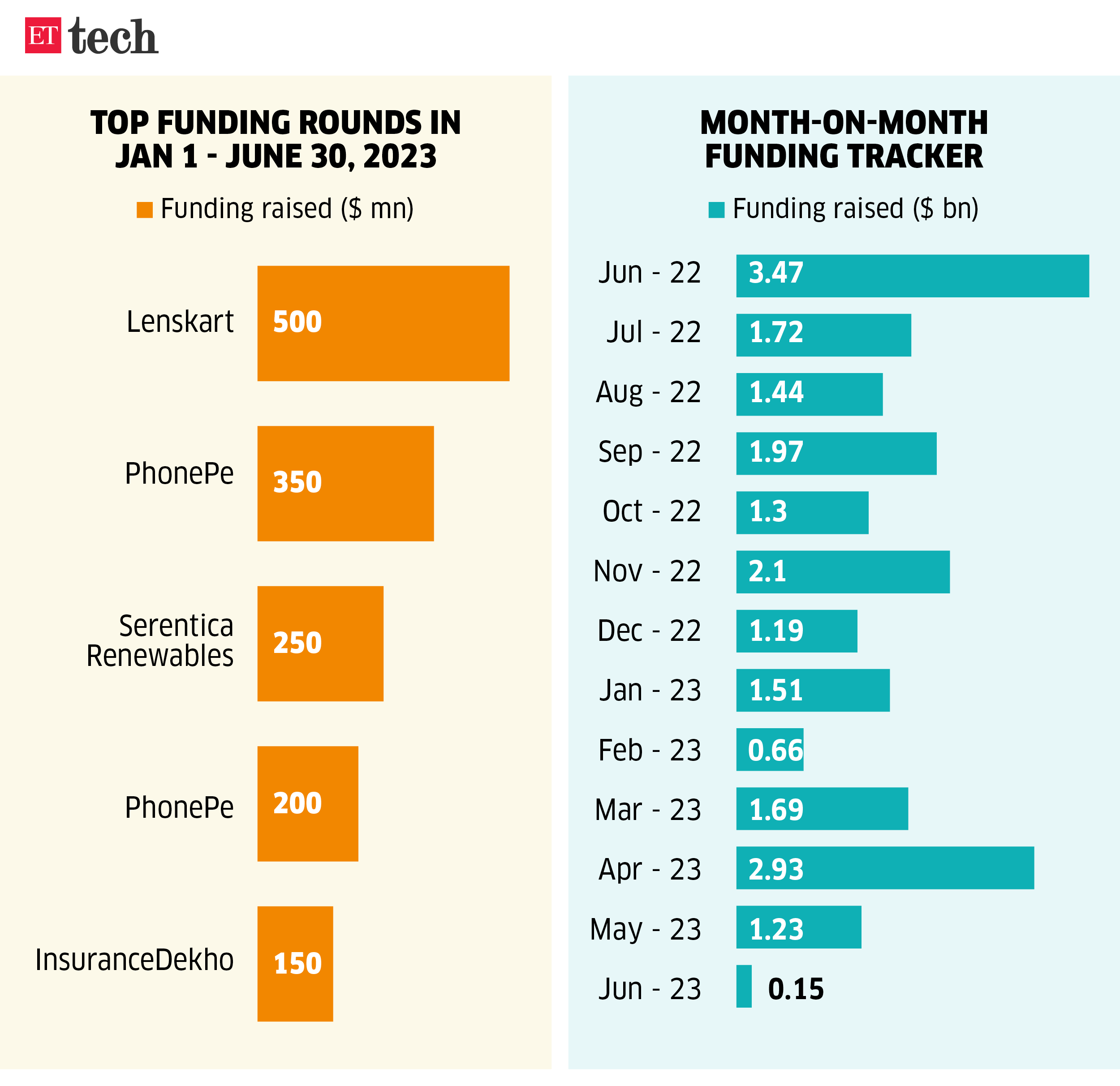

ETtech Offers Digest| Startups elevate $5.5 billion in first six months of 2023, down 72% YoY

New-age tech firms secured solely $5.5 billion throughout 549 rounds within the first six months of the 12 months.

The funding panorama for startups witnessed a 72% drop in comparison with the earlier 12 months. In H1 2022, $19.5 billion was raised throughout 1,576 funding rounds.

And compared to the second half of 2022, when the funding winter took maintain, investments have additional declined by 23%. Throughout H2 2022, startups secured $7.1 billion in funding.

The funding slowdown was secular, because it was evident throughout all phases, from seed to late stage. Through the first half of 2023, investments on the seed stage amounted to $352 million, unfold throughout 386 rounds. Nonetheless, this determine marked a big decline of 65% when in comparison with the $1 billion that startups obtained in seed funding through the corresponding interval in 2022.

Different Prime Tales This Week

Prosus has wager $200 million on Indian early-stage companies, says CEO: Prosus Ventures has infused $200 million in early-stage startups in India, its chief govt Bob van Dijk stated in an earnings name on Tuesday. The early-stage enterprise investing arm of Dutch agency Prosus has backed startups reminiscent of Mensa Manufacturers, City Firm, Meesho, Elastic Run, IndiGG, Fashinza, and The Good Glamm Group in India.

Additionally learn | Prosus studies 80% leap in Swiggy’s loss, 26% development in GMV

Krafton’s BGMI return revs up Indian e-sports scene: The return of the favored on-line sport Battlegrounds Cellular India has boosted optimism within the Indian esports sector, as event organisers and streaming platforms look to reap advantages. The lifting of the block on a three-month trial foundation in Could has streaming platforms and event organisers alike projecting a bump in viewership and revenues. On the similar time, skilled BGMI groups are seeing their calendars replenish with tournaments and the chance to symbolize India overseas.