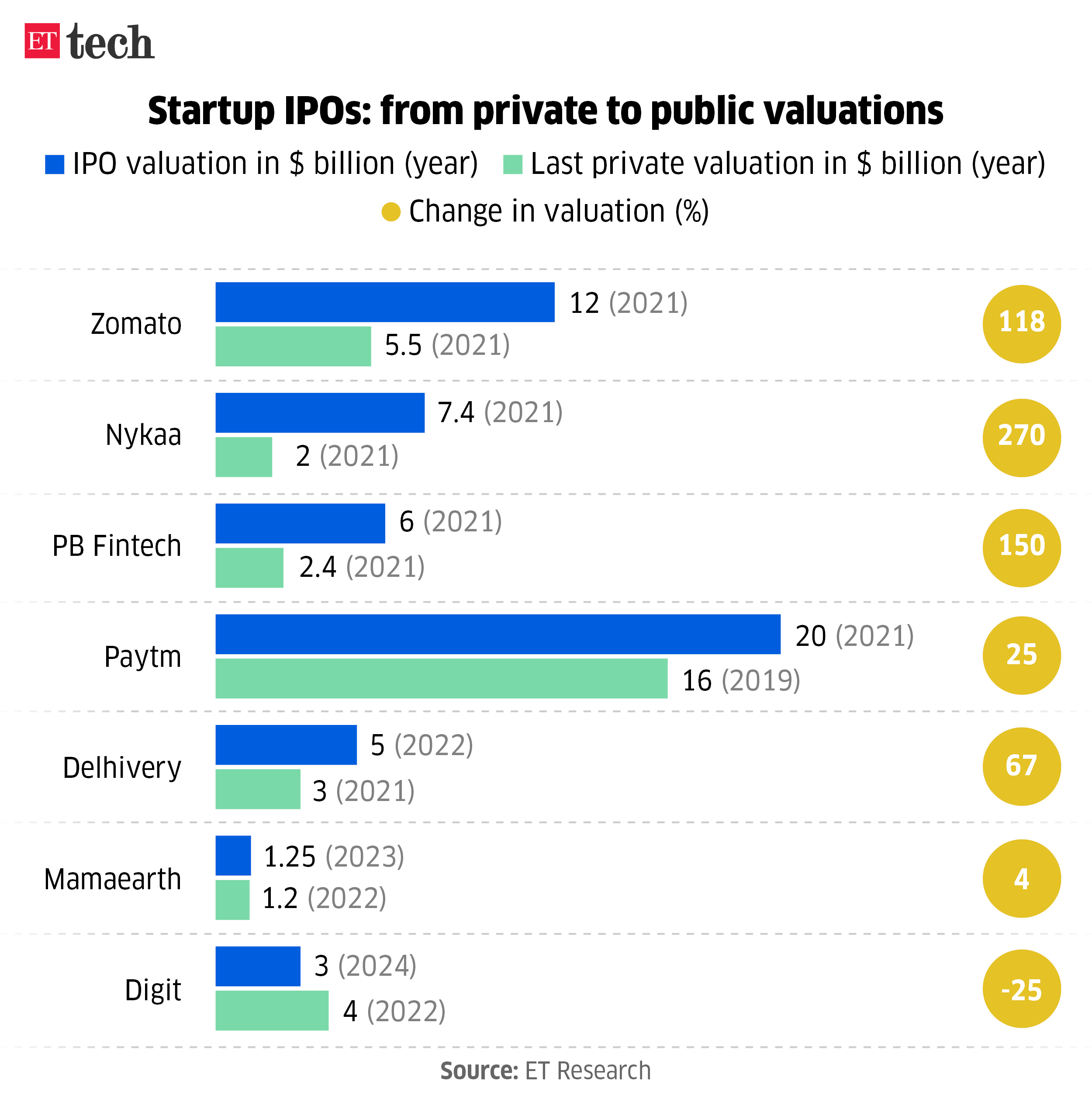

That is Pratik Bhakta in Bengaluru. Insurance coverage startup Digit, by valuing itself at a reduction of 25% to its final recognized non-public market valuation, appears to have caught its neck out. And it’s a transfer that’s actually acquired everybody speaking.

The valuation conundrum

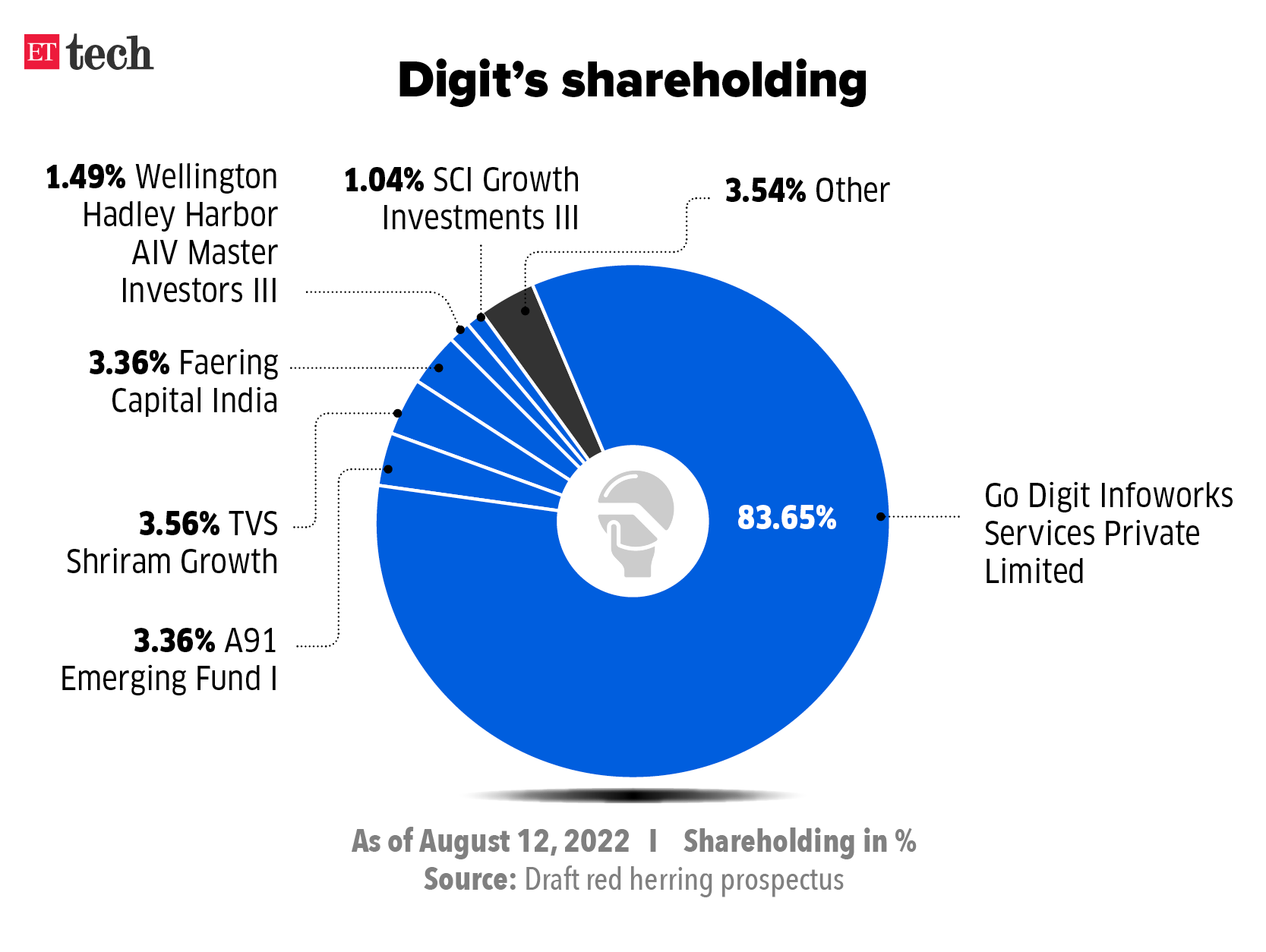

At a value band of Rs 258 to Rs 272, Digit is seeking to worth itself at $Three billion by the IPO when it lists. Based on regulatory filings accessed by information platform Tracxn, in 2022 Digit had picked up $54 million from Peak XV Companions, previously Sequoia Capital India, which valued it at $four billion. In 2021, the insurance coverage agency was in talks to boost $200 million, however solely managed to shore up round $140 million.

Kamesh Goyal, chairman, Digit Insurance coverage

Talking at a pre-IPO media briefing in Mumbai, Digit chairman Kamesh Goyal mentioned the value band was based mostly on the evaluation made by funding bankers and that the corporate was leaving worth on the desk for public buyers. The event underscores how Indian startups are coming to phrases with the valuation reset throughout the tech world with the tip of the Zero interest-rate coverage (ZIRP) period.

By the numbers: General, it’s a smaller IPO. When it comes to recent funding, the corporate is elevating Rs 1,125 crore in comparison with the preliminary plan of Rs 1,250 crore, whereas the supply on the market from present shareholders has additionally been diminished to 54 million shares in comparison with the preliminary plan of 109.four million shares.

At Rs 272, the upper finish of the value band, Digit is looking for a a number of of 680 instances, in comparison with an business common of 46.13 instances. The query is: given the dependence of the enterprise on a bodily distribution community, will this valuation maintain over the subsequent few years, or will Digit get valued nearer to the likes of ICICI Lombard Normal Insurance coverage?

Digit has constructed a community of greater than 61,000 key distribution companions with round 58,532 bodily level of gross sales brokers. Going ahead Digit expects the vast majority of its clients to be acquired by its agent and dealer community, the corporate mentioned in its prospectus.

“If Digit is looking for the valuation multiples of a tech startup, then it must construct extra of a tech-based direct enterprise which is able to preserve prices underneath examine and permit it to innovate on buyer engagement. Presently, it is extremely much like different conventional insurers,” mentioned a founding father of an insurtech startup who tracks Digit intently.

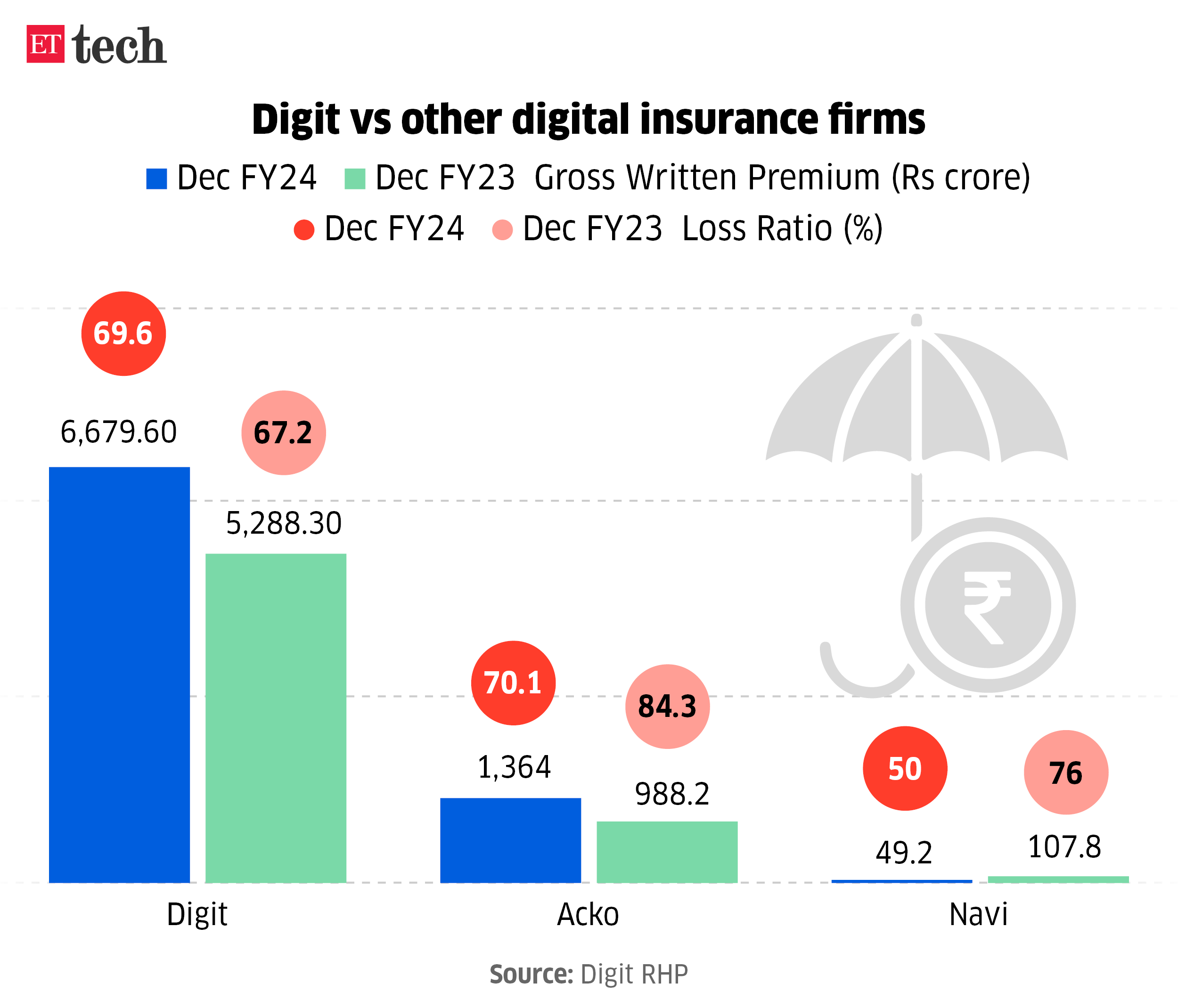

Digit’s competitor Acko has raised $489 million in fairness funding reaching a unicorn valuation as of 2022.

Additionally learn | Virat Kohli, Anushka Sharma to attain 263% return, Rs 7 crore revenue with Go Digit IPO

Enterprise mannequin

Presently, motor insurance coverage makes up 61% of Digit’s enterprise in a extremely aggressive market. Medical insurance, which is a stickier product with higher margins, contributes round 14% of the gross premium.

Whereas the well being enterprise has grown, by way of the share of the general medical insurance market, Digit continues to be at round 3%.

General, Digit should up its sport throughout a number of insurance coverage merchandise to proceed the premium progress which is able to justify its valuation multiples.

In a analysis report revealed by Muddy Waters on February 8, the US funding agency famous that Digit was capable of push up its valuation due to lack of funding self-discipline amongst Silicon Valley funds in 2021. “Sadly for Digit, as a result of Indian regulatory course of, it was unable to checklist whereas the market was nonetheless sizzling…. This can seemingly result in a down spherical IPO,” the report mentioned.

As issues stand, Digit is about to go public at a really essential time — when there’s a correction going down within the non-public valuations of your entire tech business. In these instances, for a new-generation insurance coverage firm to go public will make two issues clear: the actual potential of the Indian insurtech sector, and the precise urge for food of Indian retail merchants.

Fintech information

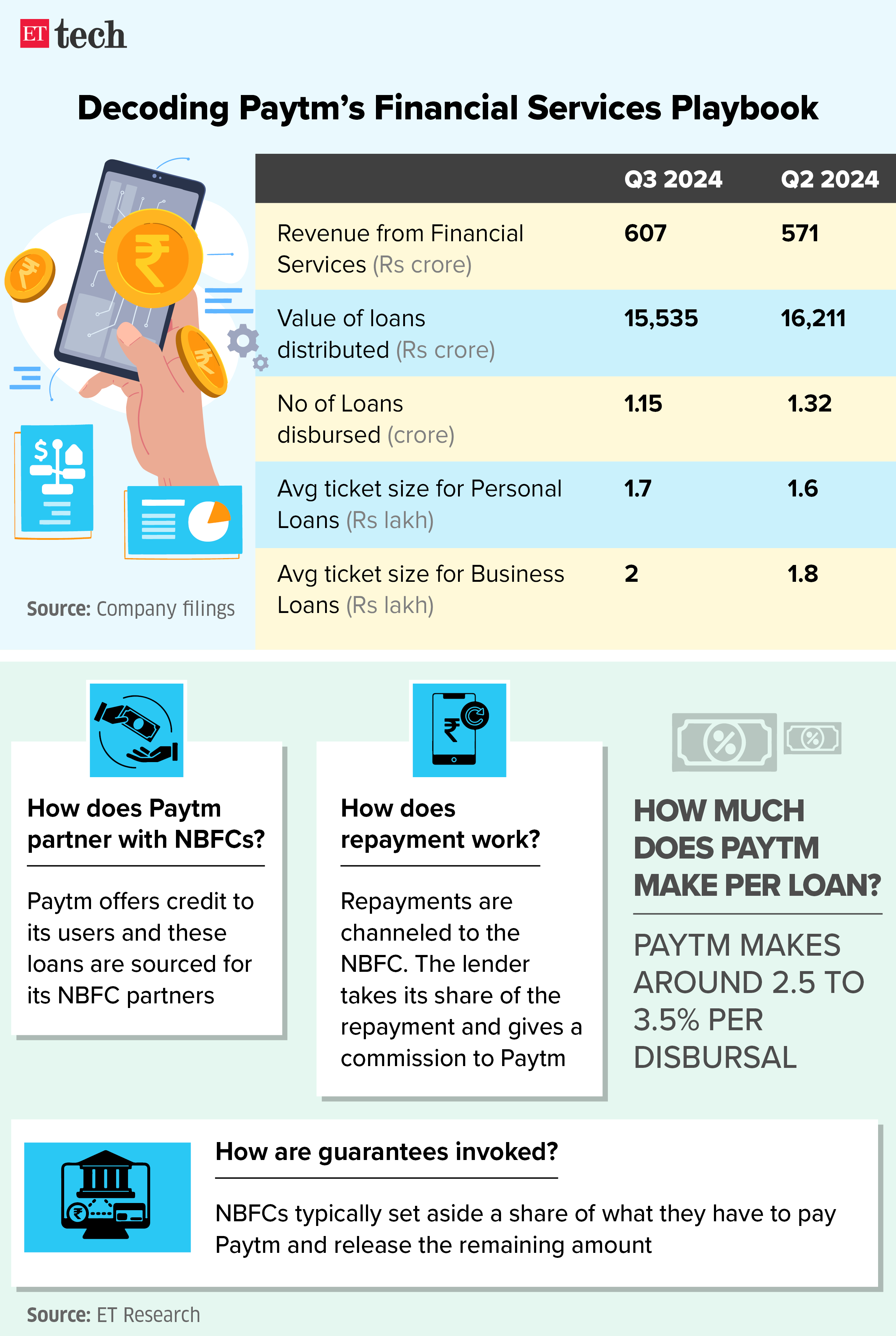

Aditya Birla Finance, others might have invoked Paytm’s mortgage ensures | Aditya Birla Finance, one of many key lending companions for One 97 Communications-owned Paytm, is learnt to have invoked mortgage ensures which the fintech agency had offered to the lender in lieu of reimbursement defaults from clients, individuals within the know of the matter informed ET.

Paytm Funds Financial institution strikes invoice pay enterprise to Euronet India: Paytm Funds Financial institution (PPBL) has migrated its invoice fee enterprise to Euronet Companies India, mentioned two individuals within the know. This comes after the shifting of PPBL’s retail level of gross sales enterprise to RBL Financial institution and the settlement enterprise for service provider funds to Axis Financial institution.

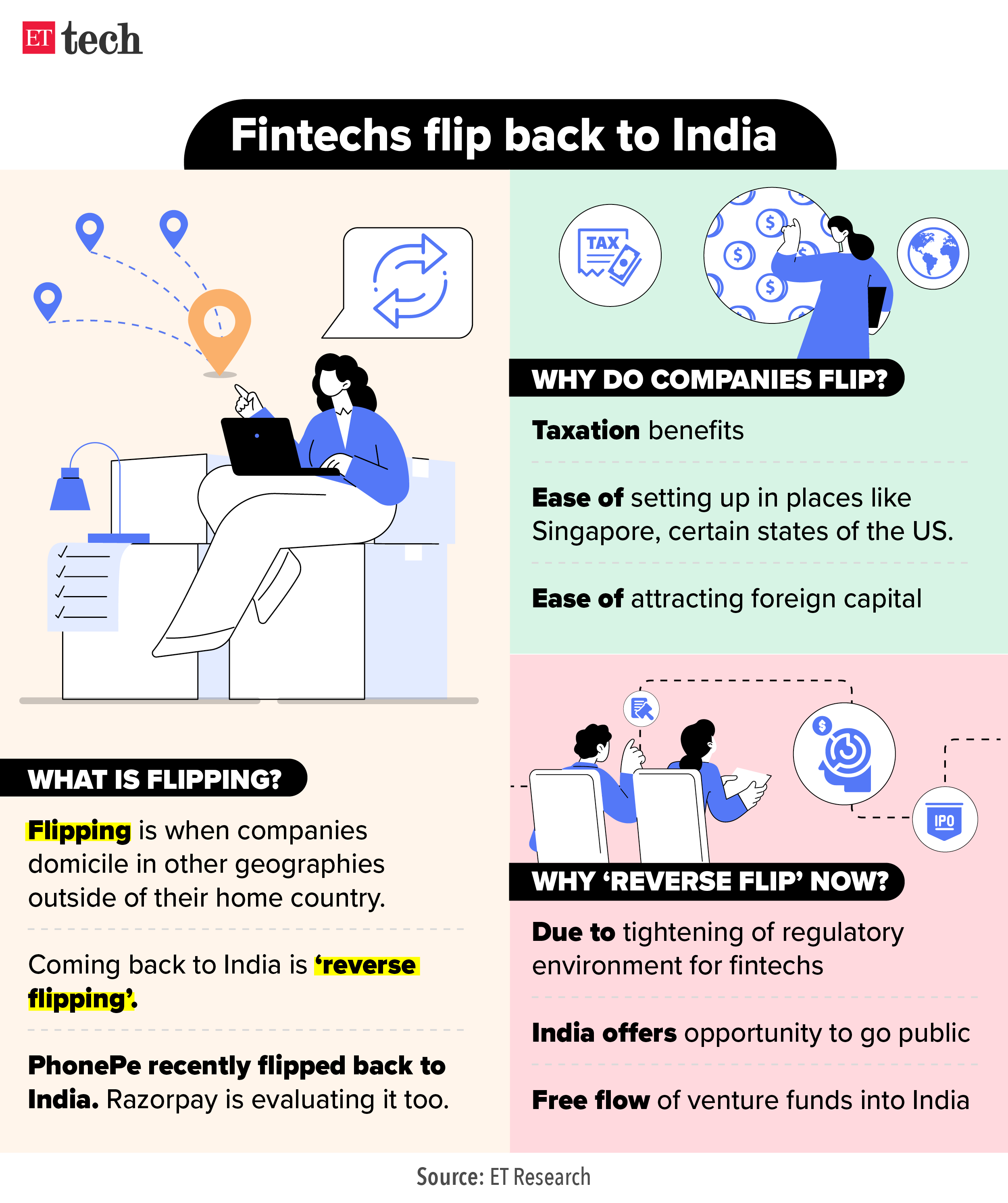

Groww strikes domicile to India from the US: Wealth administration startup Groww has moved its domicile to India from the US, following a development of ‘reverse-flipping’ by Indian startups looking for to capitalise on a maturing startup ecosystem within the nation.

Digital fraud-hit banks flip to startups to deal with dangers: A large rise in assaults on the nation’s digital banking ecosystem from fraudsters, coupled with regulatory stress on stringent implementation of buyer verification pointers, has pressured legacy monetary establishments to show to information analytics startups for tech assist.

ETtech exclusives

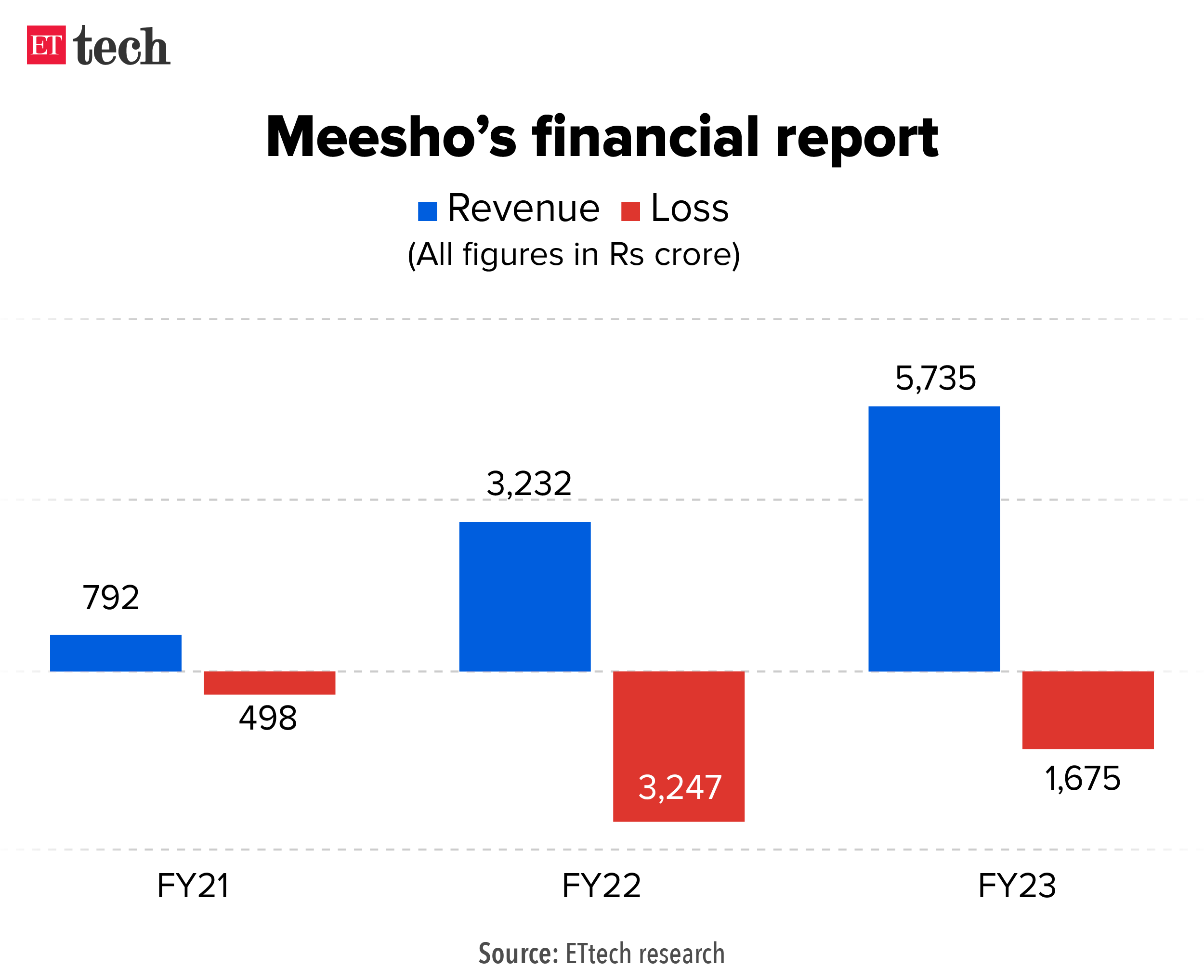

Vidit Aatrey, CEO, Meesho

Meesho closes $275 million funding in first tranche, in talks for extra: Ecommerce agency Meesho has closed a $275 million funding spherical by a mixture of main and secondary share gross sales, two individuals conscious of the matter mentioned. A regulatory submitting with the US Securities and Alternate Fee (SEC) additionally indicated share switch at Meesho’s US mother or father agency with out providing additional particulars.

SoftBank again at deal counter with Icertis deal talks: SoftBank, one of many largest know-how buyers, has begun early-stage talks to double down on present software program portfolio agency Icertis, which is stitching up a brand new funding spherical of about $150 million (about Rs 1,252 crore), in a secondary share sale, mentioned individuals conversant in the event.

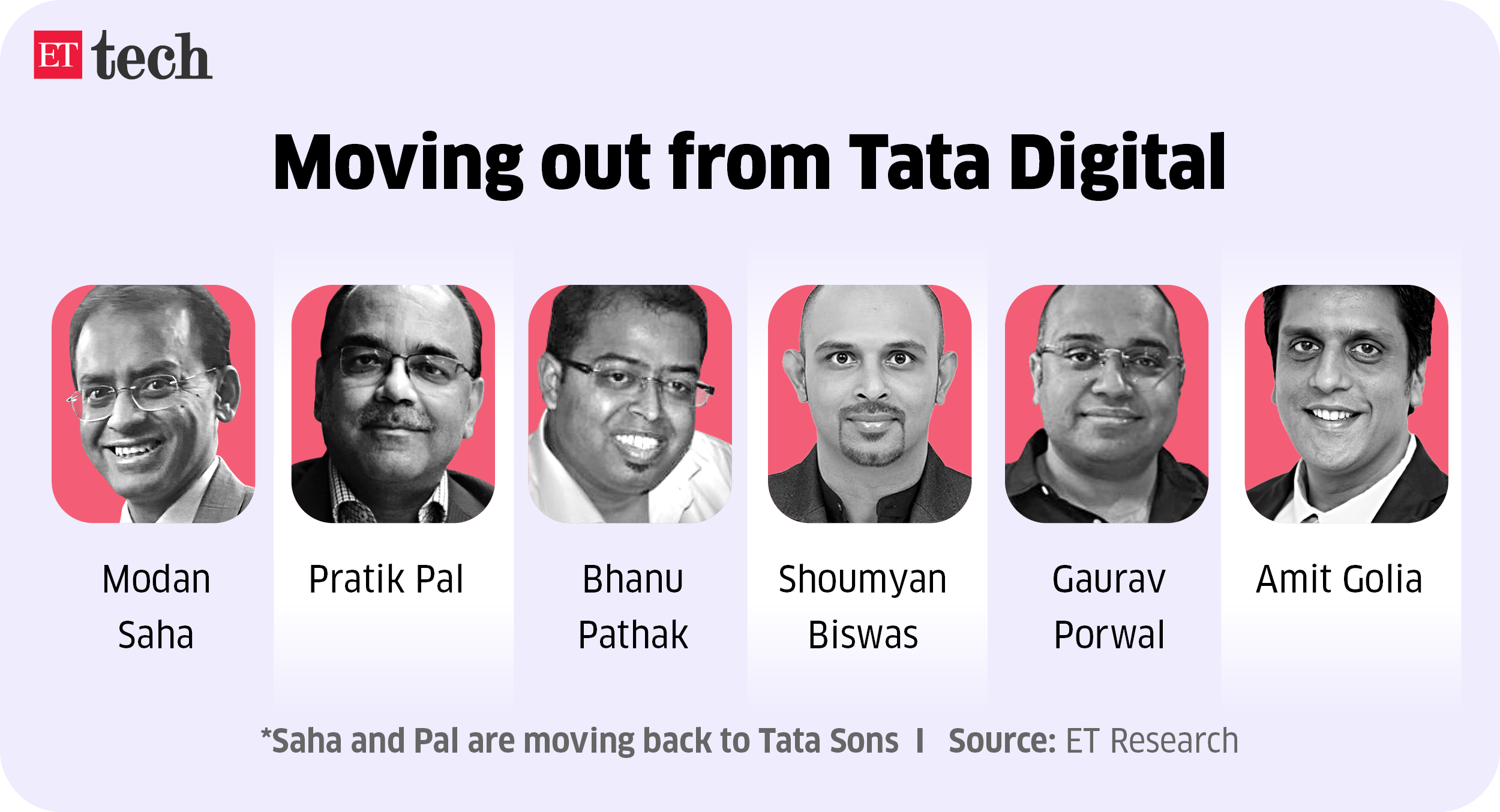

Outdated guard is out as Tata Digital’s new CEO revamps deck: Tata Digital is witnessing an organisational rehaul in its senior administration underneath new chief govt Naveen Tahilyani, with a number of exits from the previous crop that launched the Tata Neu superapp two years in the past, individuals conscious of the matter mentioned.

Uber ups hyperlocal deliveries as fast commerce takes off: Trip-hailing platform Uber is strengthening its hyperlocal deliveries from neighbourhood shops, individuals conscious of the matter mentioned, amid rising demand for fast commerce in India.

Different prime tales this week

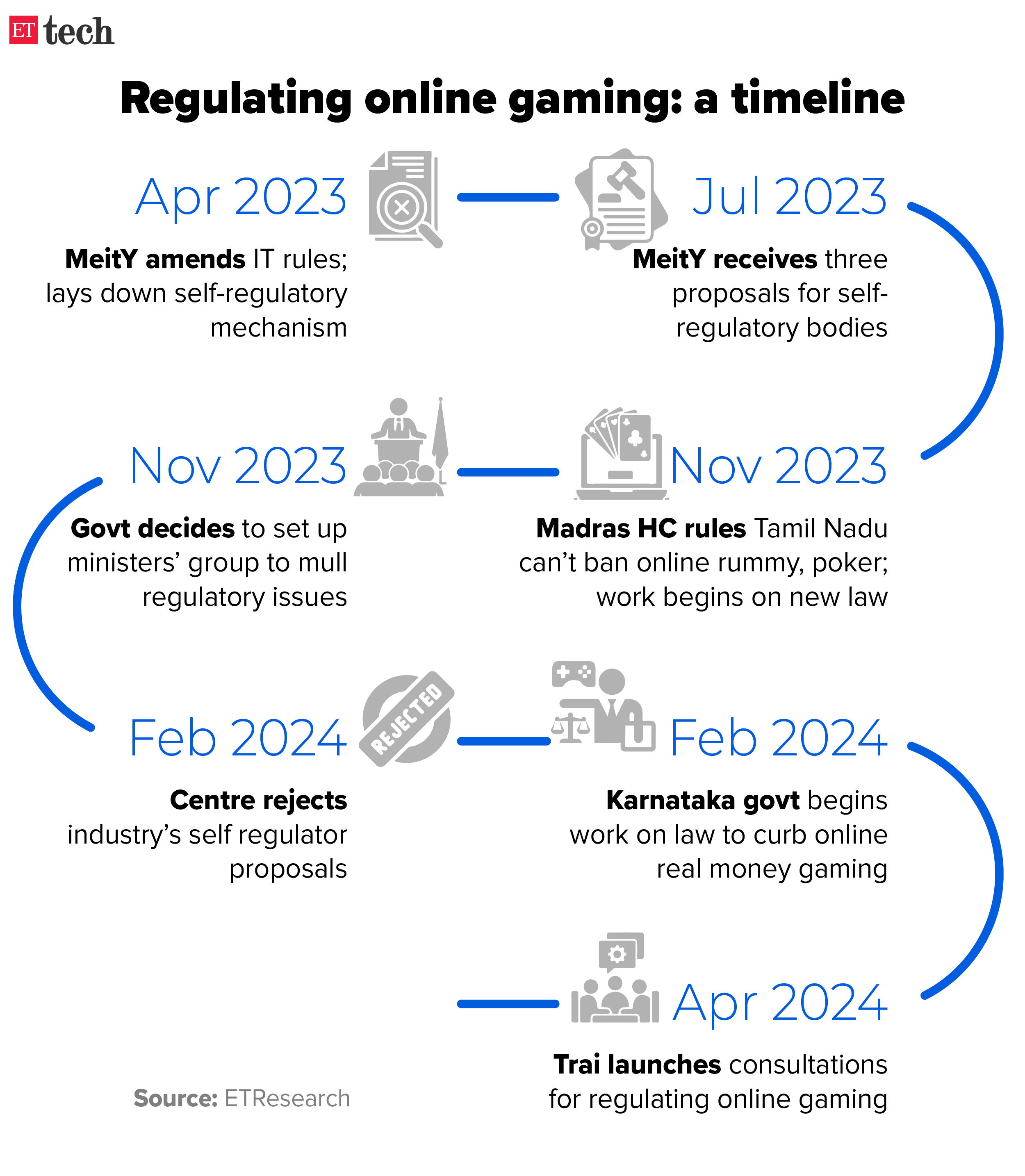

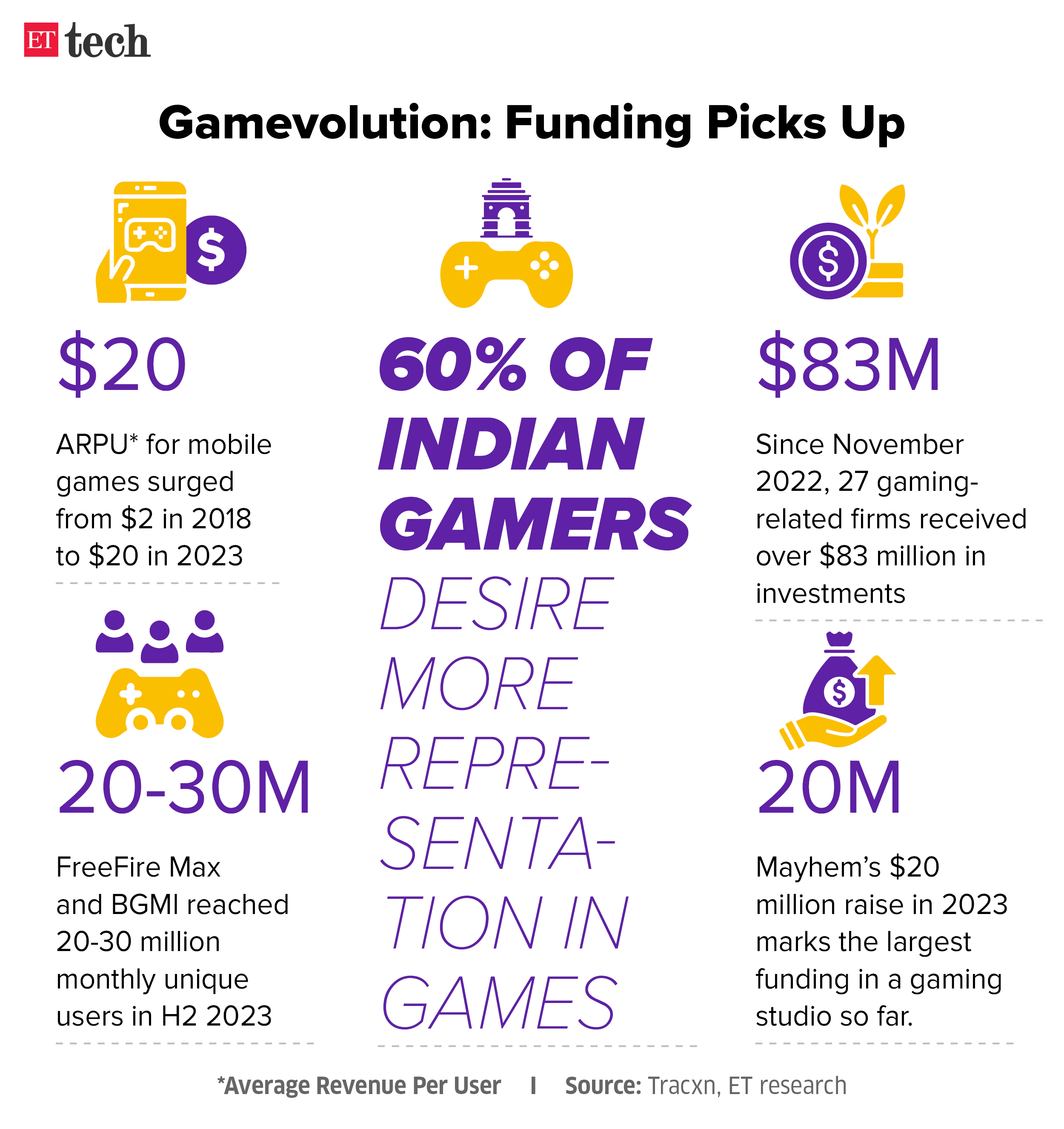

States, Trai bounce into the fray to manage on-line gaming | Within the absence of a self-regulatory mechanism for on-line gaming, a number of regulatory offshoots are rising for the sector. These embody legal guidelines being framed by states together with Tamil Nadu and Karnataka.

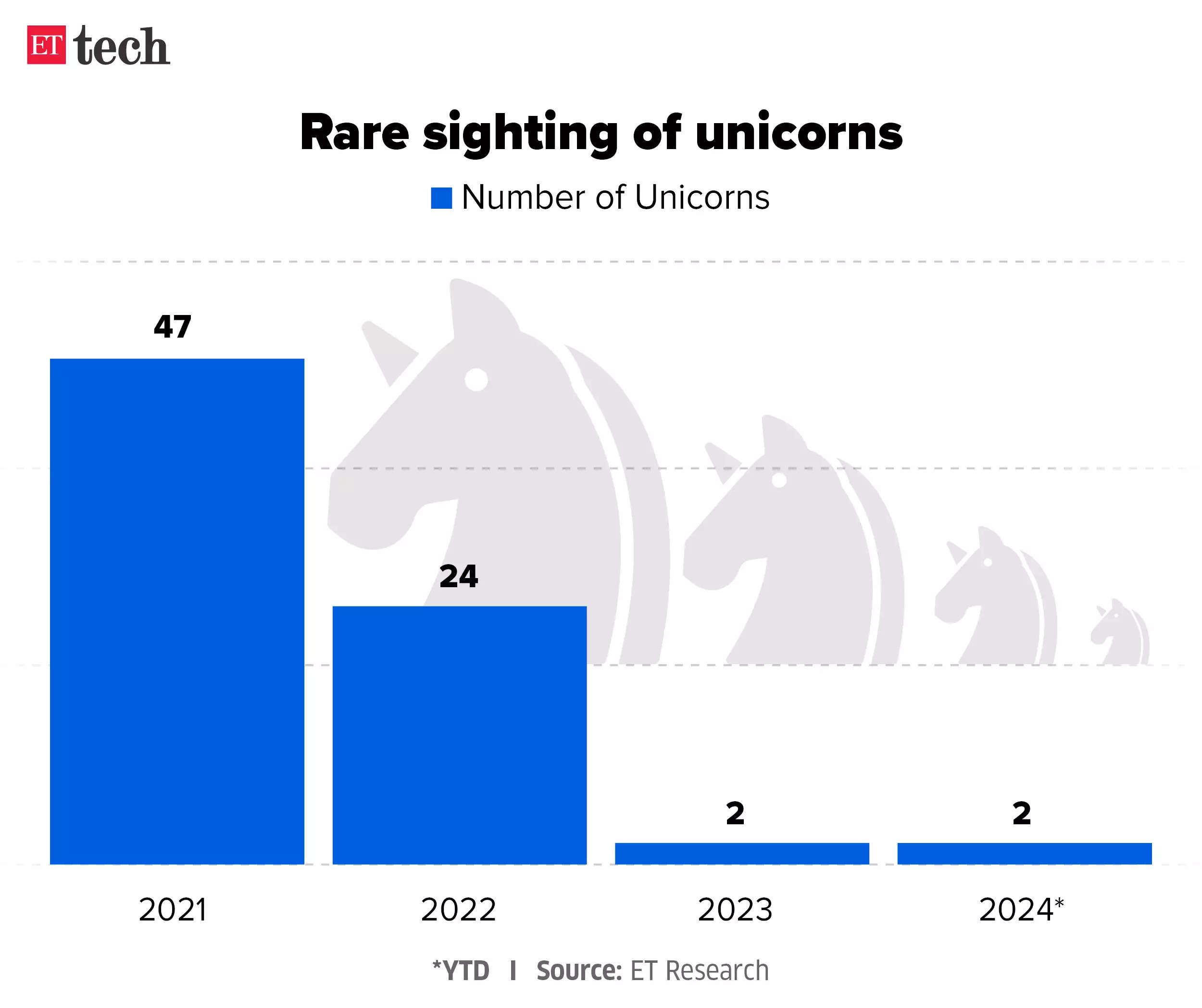

Unicorn sightings develop into uncommon as VCs shun that leap of religion: New unicorn sightings amongst early-to-mid-stage startups have develop into uncommon because the ‘leap of religion capital’ is lacking at the same time as there’s a flurry of exercise in late-stage firms, a number of enterprise buyers and startup founders informed ET.

VCs chasing Indian studios engaged on complicated video games: Indian studios engaged on complicated video games that require heavy investments — thus far the only area of worldwide publishers like Krafton and Garena — are seeing elevated curiosity from buyers, helped partly by fast-maturing shopper and expertise cohorts.

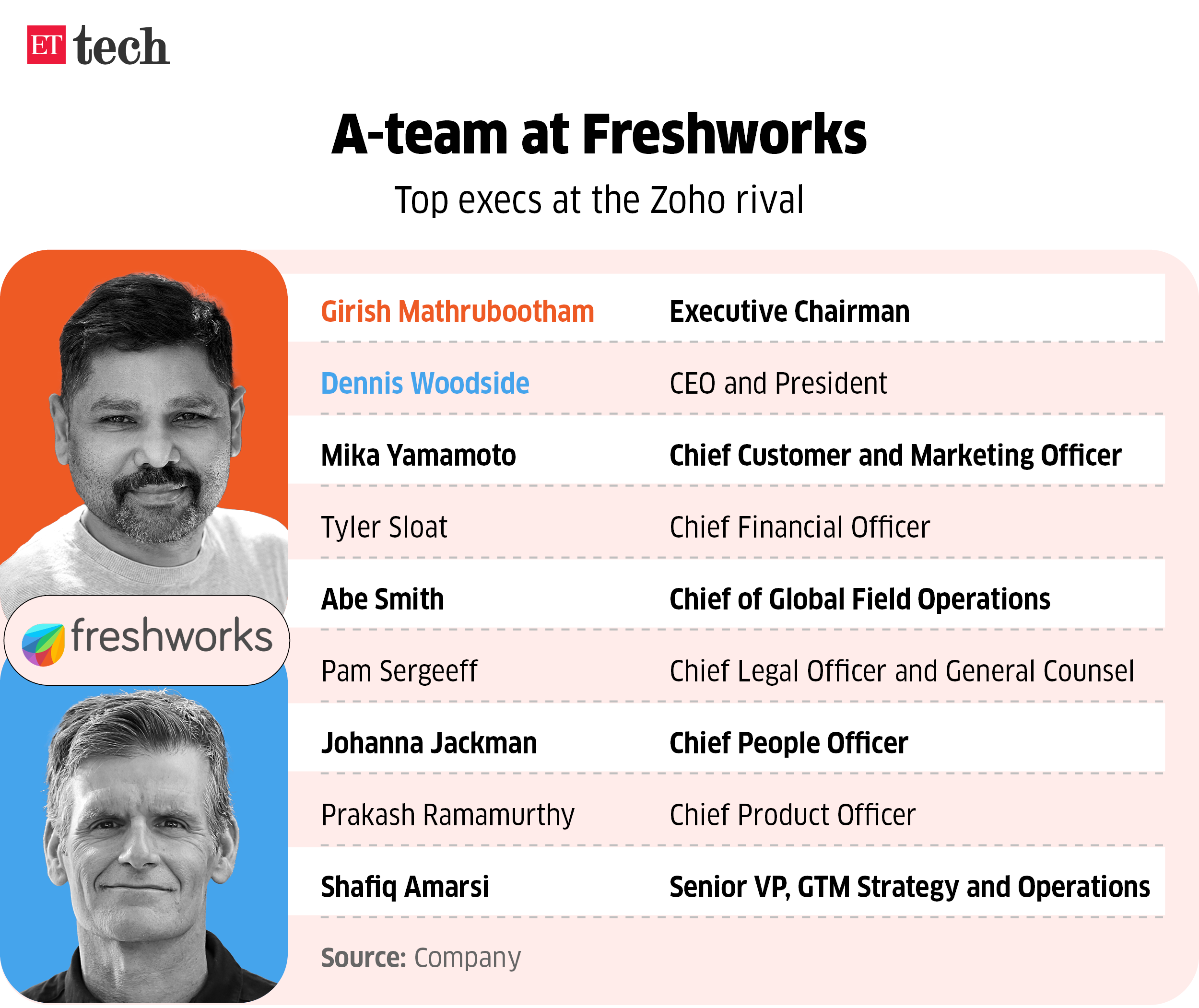

Freshworks inventory worth drop not on account of prime deck rejig: Girish Mathrubootham | Freshworks founder Girish Mathrubootham attributed a latest slide within the Nasdaq-listed firm’s inventory value to market nervousness relating to the affect of the bogus intelligence (AI) wave, dismissing the management transition or acquisition bulletins that the corporate made final week because the attainable causes.

IT in focus

Srinivas Pallia, CEO, Wipro

A month on, Wipro CEO Srinivas Pallia has townhalls, Q&As on guidelines: As Srinivas Pallia accomplished one month as CEO of fourth largest software program providers agency Wipro, which has been trailing its friends on progress and profitability, he has been travelling throughout the globe to satisfy workers and stakeholders.

Midcap IT corporations up M&A sport with winds of tech spends revival: India’s IT providers sector is witnessing a flurry of merger and acquisition actions, with a number of small and midsize corporations asserting offers previously 4 months in segments starting from consulting and startups to engineering providers, information and analytics.

Cognizant, Capgemini employed 1.5 lakh much less palms in 2023: The cumulative hiring by IT majors Cognizant and Capgemini globally declined by 151,607 workers in 2023 as in comparison with 2022, as per their regulatory filings. In 2023, Cognizant’s hiring quantity fell to only over 60,000, whereas Capgemini employed about 61,182. In different phrases, the numbers fell by 72,000 at Cognizant and 79,607 for Capgemini from the prior yr.