Glad Friday! Fintech startup Groww has accomplished the method of domiciling itself to India from the US. This and extra in as we speak’s ETtech Morning Dispatch.

Additionally on this letter:

■ Accel on D2C’s subsequent alternative

■ Digit IPO opens on Could 15

■ Smaller IT corporations up their M&A sport

Groww strikes domicile to India from the US

Lalit Keshre, cofounder and CEO, Groww

Wealth administration platform Groww has accomplished shifting its domicile to India from the US, founder Lalit Keshre stated. Listed here are the small print.

Homecoming: Groww — a Y Combinator-alumnus with its guardian within the US — has formally moved its domicile to India, CEO Keshre stated on X, previously Twitter. This makes Groww the second main fintech startup after Walmart-backed PhonePe to have accomplished the migration again dwelling.

CEOspeak: “As of March 2024, Groww has accomplished its domicile transition again to India. For our prospects, now we have at all times been an India-based organisation for all sensible functions since day 1. With this replace, the Groww group and its subsidiaries are fully primarily based in India,” Keshre stated in his put up on X on Thursday.

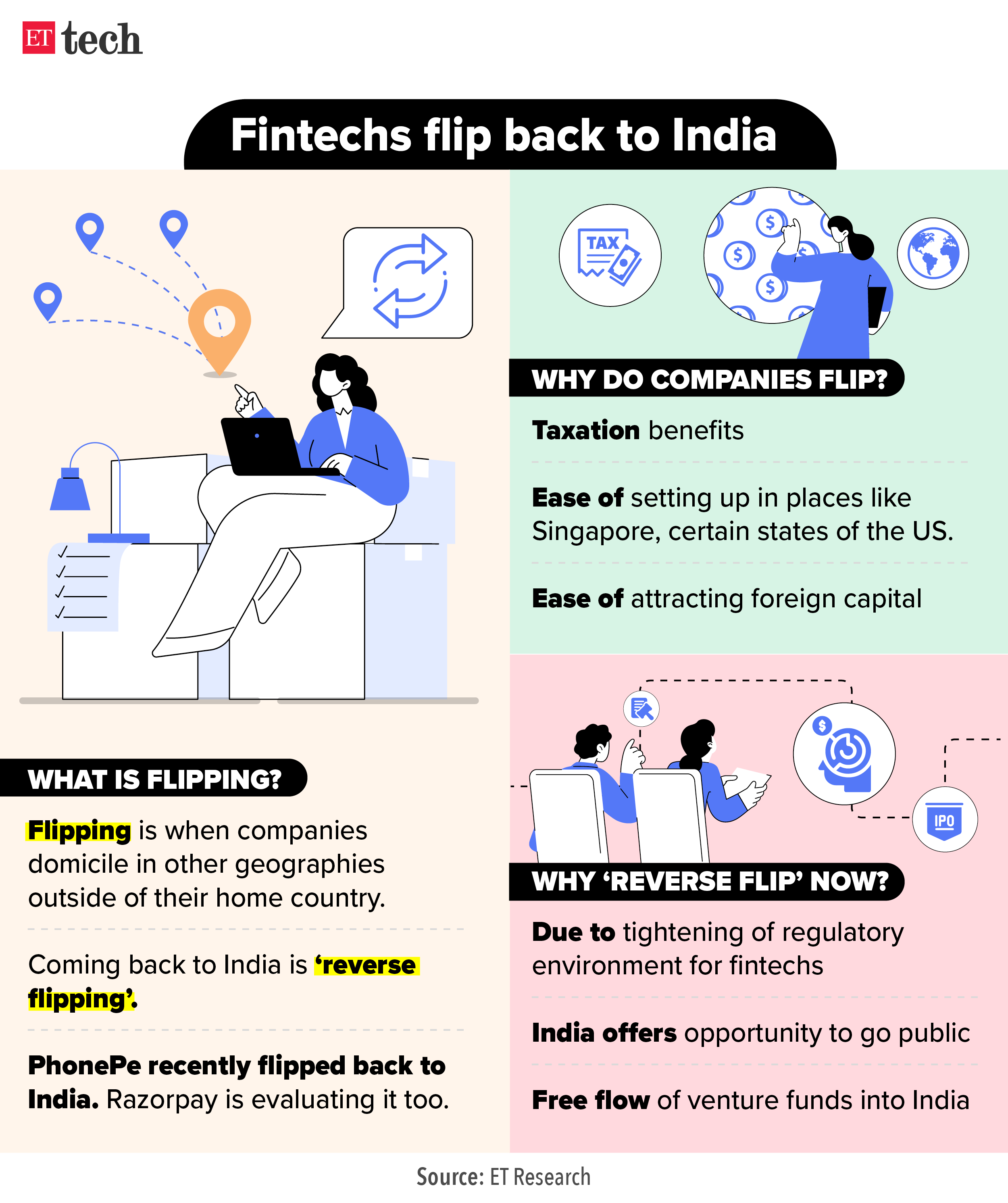

Lengthy queue: A number of startups have lined as much as ‘flip again’ from the US and Singapore to India. Fintechs like Pine Labs and Razorpay, together with quick-commerce agency Zepto, edtech Eruditus, ecommerce corporations Meesho and Udaan are additionally planning to maneuver their holding firms to India. They’re in numerous phases of the method presently.

Additionally learn | Extra startups India-bound, map ‘reverse flip’

Why does it matter: For fintechs, the reason being clear: the regulator desires startups within the sector to have holding firms in India, together with subsidiaries. Secondly, these corporations see extra worth in a home IPO market in comparison with abroad, prompting critical consideration about the advantages of shifting the guardian entity to India.

Tax googly: It is expensive. Razorpay might need to fork out $300 million in taxes to the US Inner Income Service, however its chief government Harshil Mathur stated the corporate has accounted for a similar already. The precise payout will depend on a number of components, together with the corporate’s valuation.

Razorpay was final valued at $7.5 billion whereas the identical for SoftBank-backed Meesho is sort of $5 billion. Meesho, which is domiciled within the US, is elevating a brand new spherical, and a part of the proceeds will go in direction of the tax payout for shifting the guardian to India.

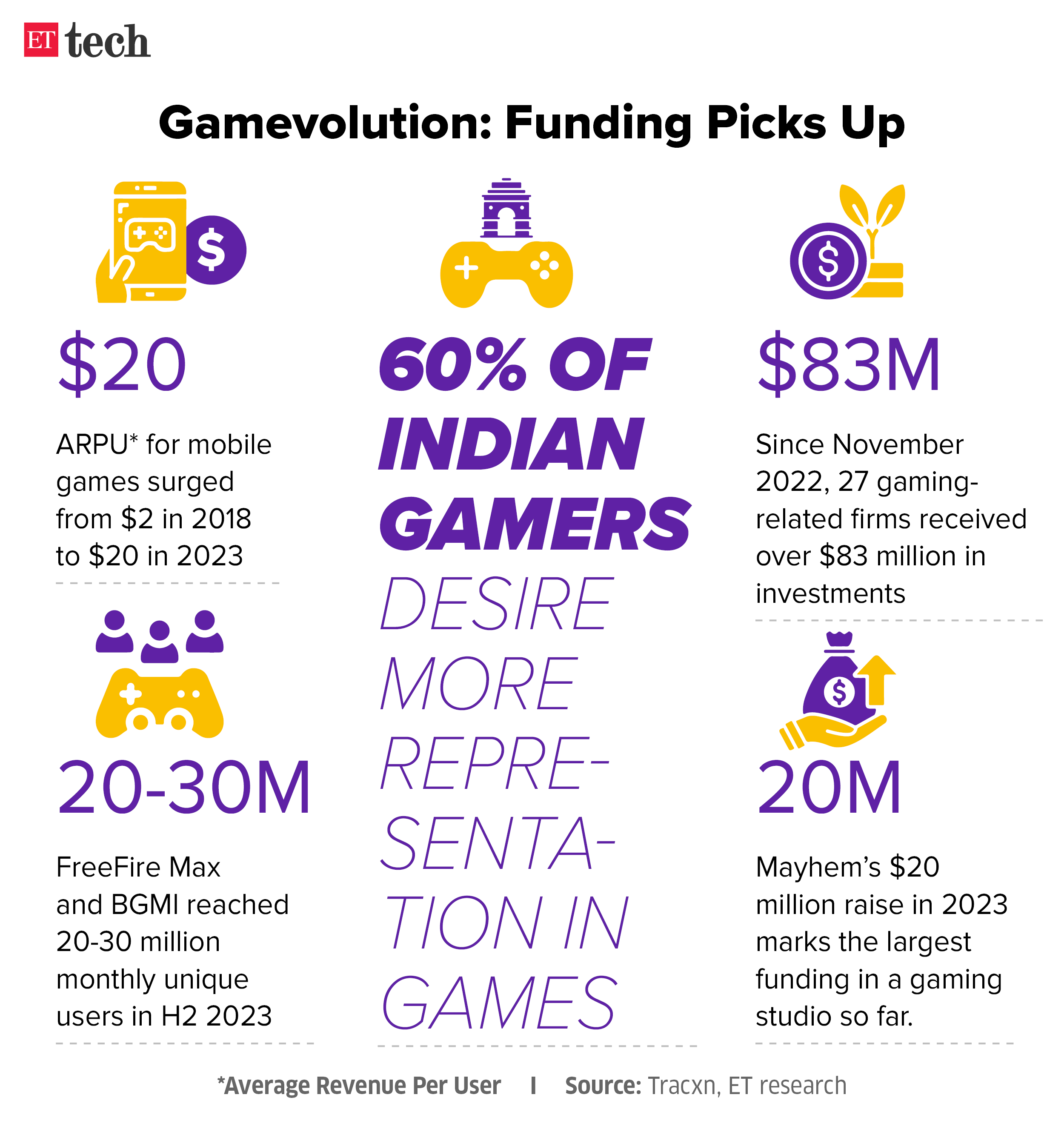

Traders eye gaming bets as Indian studios develop advanced video games

Traders are more and more getting interested by Indian gaming studios which are engaged on advanced, investment-heavy tasks, as each the customers of such video games and the expertise pool making them are maturing quickly.

What’s occurring: These video games, in contrast to informal ones resembling Ludo, are known as midcore and hardcore video games and require main investments, in addition to advanced technological work, to supply. They’re usually rated ‘AA’ or ‘AAA’, which signifies their excessive improvement and advertising values.

Native entrants: In latest instances, corporations like Mayhem Studios and LightFury Video games have taken on the duty of constructing such video games. Since November 2022, 27 gaming and gaming-adjacent corporations have seen investments of over $83 million, in keeping with information from Tracxn.

A great chunk of this has come from diversified traders like Peak XV Companions, Nexus Enterprise Companions and Blume Ventures.

Zero illustration: Worldwide publishers like Krafton, Garena, Activision, Riot Video games and Epic Video games dominate the midcore to hardcore gaming section in India, with standard titles like FreeFire Max, Battlegrounds Cell India (BGMI), Fortnite and Name of Obligation. Many of those video games make tens or tons of of tens of millions of {dollars} in annual income from India, business executives stated.

Omnichannel subsequent massive alternative for D2C corporations: Accel’s Prashanth Prakash

Prashanth Prakash, accomplice, Accel

Omnichannel is the following massive alternative for D2C corporations, enterprise fund Accel’s founding accomplice Prashanth Prakash advised us on Thursday.

Begin on-line, broaden offline: D2C manufacturers ought to nonetheless begin with on-line as that might enable them to iterate round product-market match and brand-building a lot faster than taking an offline method, Prakash stated. However after reaching a sure scale, they need to look to broaden offline to spice up gross sales. There are about 100 manufacturers making round Rs 100 crore, and scaling them to Rs 1,000 crore could be massively helped by a shift offline, he added.

The large image: Because the Indian retail market scales to $2.2 trillion in dimension by 2030, about 90% of it would stay offline, a joint report by Accel and Fireplace Ventures and market analysis agency Redseer stated. There are about 110 cities throughout India the place customers have each the buying energy and the attention to make purchases, Prakash stated.

The underside line: The price of establishing such shops and the complexity of managing them might be price it, Prakash stated, as an offline presence can vastly enhance the possibilities of “changing” a buyer.

Different Prime Tales By Our Reporters

Kamesh Goyal, chairman, Digit Insurance coverage

Digit IPO opens on Could 15, seems to lift Rs 1,125 crore | New-generation insurance coverage firm Digit is about to hit the general public markets on Could 15, seeking to increase Rs 1,125 crore by way of a recent situation of shares and a suggestion on the market of 54 million fairness shares. The preliminary public providing (IPO), which can shut on Could 17, comes virtually two years after the agency filed its draft prospectus with the markets regulator in August 2022.

With eye on tech spend revival, smaller IT corporations up their M&A sport | India’s IT providers sector is witnessing a flurry of merger and acquisition actions, with a number of small and midsize corporations saying offers up to now 4 months. These vary throughout segments, from consulting and startups to engineering providers, information and analytics.

GenAI manufacturing deployments on the rise in India | About 20% of generative synthetic intelligence (gen AI) proofs of idea (PoCs) in India went into manufacturing in fiscal yr 2024, as per estimates by consulting agency EY India. Moreover, 15-20% of home enterprises and 30-40% of world functionality centres (GCC) of multinationals have rolled out gen AI PoCs, an evaluation of the final two quarters confirmed.

International Picks We Are Studying

■ How good is OpenAI’s Sora video mannequin — and can it rework jobs? (FT)

■ AI Challenger Mistral Set to Almost Triple Valuation to $6 Billion in Six Months (WSJ)

■ OpenAI Is ‘Exploring’ Learn how to Responsibly Generate AI Porn (Wired)