Edtech main Byju’s lenders have sought as much as $200 million in prepayment together with a better rate of interest to restructure its $1.2 billion time period mortgage B (TLB).

This and extra in at this time’s ETtech Morning Dispatch.

Additionally on this letter:

■ NFT collectors ask WazirX’s founder Nischal Shetty to switch possession

■ Individuals have realised how a lot they miss touring: Expedia CEO

■ Binny Bansal’s fund leads Rs 300 crore financing in Curefoods

Byju’s lenders search $200 millon prepayment to restructure TLB

India’s most respected startup could should cough as much as $200 million (about Rs 1,600 crore) in prepayment together with a better price of curiosity as a precondition to restructure its $1.2 billion (Rs 9,600 crore) time period mortgage B (TLB), we’ve learnt.

What’s extra: Whereas Byju’s volunteered to boost the rate of interest, it’s but to agree upon the prepayment clause put forth by the lenders, folks conscious of the matter mentioned. We first reported on March 20 that the corporate’s founder, Byju Raveendran, has supplied to extend the mortgage rate of interest by 200-300 bps. A foundation level is a hundredth of a share level.

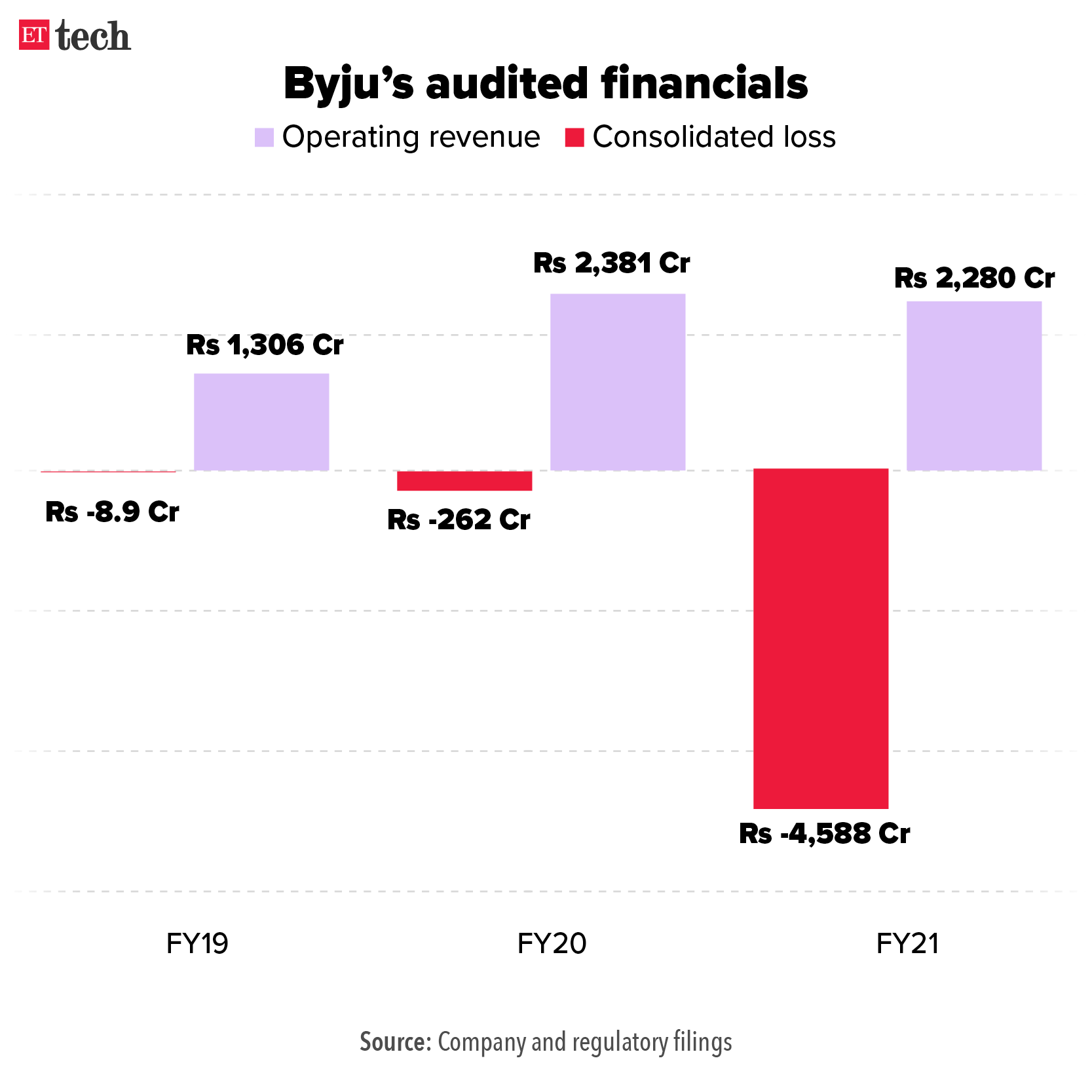

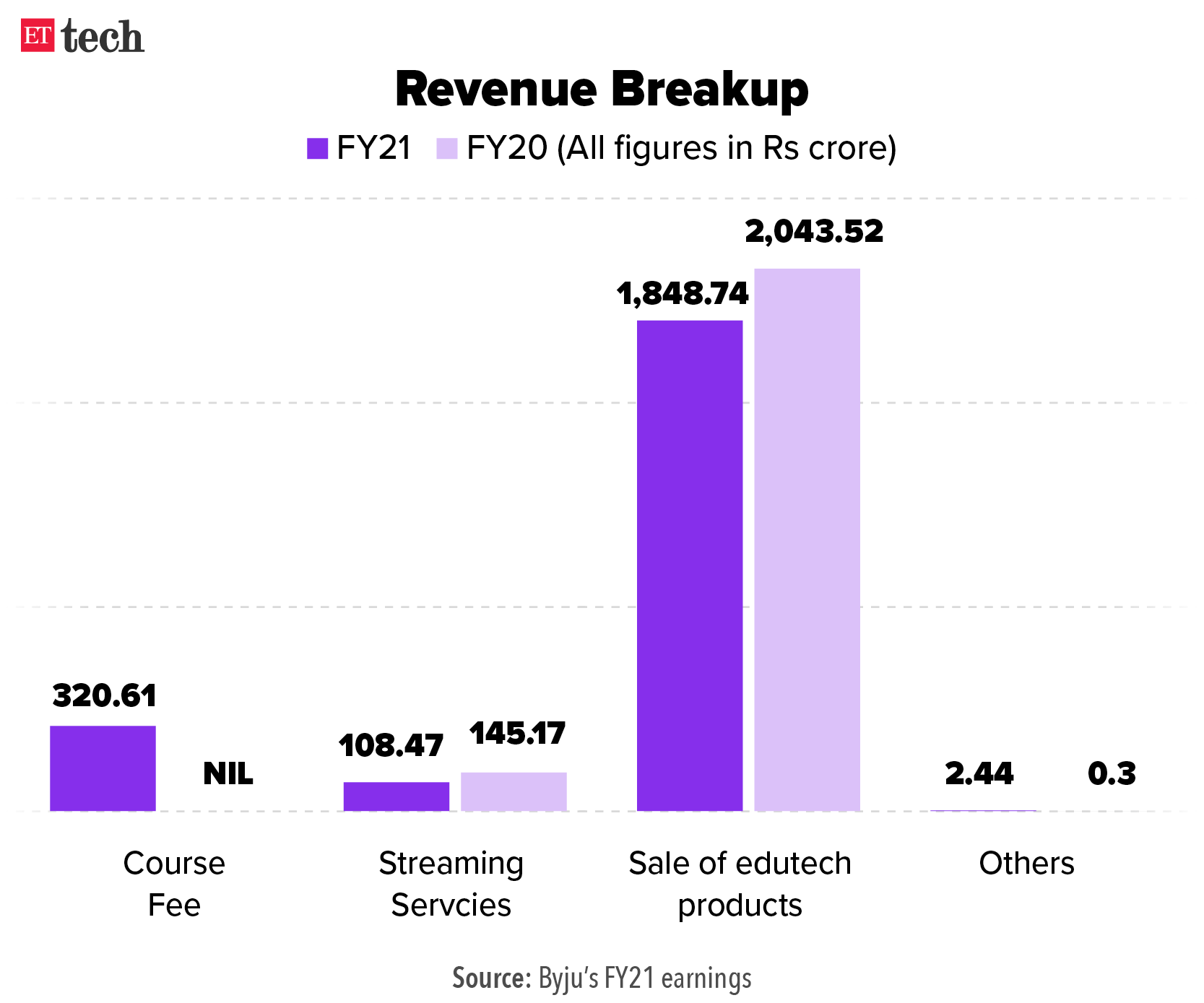

The renegotiation was prompted by the delays in posting the corporate’s audited financials.

Quantity could also be decrease: “The prepayment is changing into a sore level in negotiations, as a piece of lenders is refusing to play ball. Nevertheless, it’s potential that the lenders could lastly agree to cut back the quantum of prepayment,” mentioned one of many individuals.

Lenders have additionally requested Byju’s to offer fortnightly updates on its money place.

Byju’s can be within the superior levels of closing a $600-700 million funding by a mixture of fairness and convertible notes. A few new buyers in addition to present backers are anticipated to speculate on this financing spherical.

Catch-up fast: Byju’s had picked up this financing in November 2021 to finance its acquisitions and enlargement within the North American market. Nevertheless, the corporate has been underneath investor strain to enhance its financials and has put new investments on the again burner.

Authorities notifies guidelines for on-line gaming, to nominate a number of SROs

The Ministry of Electronics and Info Expertise (MeitY) on Thursday notified the ultimate guidelines for on-line gaming. Draft laws had been issued in January.

The brand new guidelines create a framework for disallowing on-line betting and playing whereas paving the way in which for on-line actual cash video games that don’t enable wagering on outcomes.

What do the brand new guidelines say? As per the ultimate guidelines, the federal government will appoint a number of self-regulatory organisations (SROs) comprising trade representatives, educationists and different consultants equivalent to baby consultants, psychology consultants, and so forth.

To start with, the federal government will notify three SROs. Additional, the brand new guidelines outline an ‘on-line recreation’ as “a recreation that’s supplied on the web and is accessible by a person by a pc useful resource or an middleman”.

SRO function: SROs will likely be liable for declaring on-line video games permissible on the idea of a number of components together with whether or not the video games enable wagers, and if the sport has the potential to trigger habit, person hurt, monetary loss, and many others.

Quote, unquote: “These guidelines do not take care of all of the nuances of video games of probability, video games of ability. We bypassed that and laid out a primary precept that the second an internet gaming trespasses into involving betting and wagering, then it falls afoul of those guidelines,” MoS IT Rajeev Chandrasekhar mentioned.

State authorities interpretations: However the brand new guidelines state governments will nonetheless have the ability to resolve in the event that they wish to enable playing, lottery of their jurisdictions.

Video games of ability will now have a transparent secure harbour being offered by the central authorities, which protects from any push and pull from the state as long as they’re licensed by an SRO however the lack of definition on wagering may imply that states may nonetheless doubtlessly interpret skill-based video games to be betting platforms.

Additionally learn | ETtech Explainer: timeline of India’s draft on-line gaming guidelines

NFT collectors ask WazirX’s founder Nischal Shetty to switch possession

Nischal Shetty, founder and CEO, Wazir X

Annoyed by the sudden closure of the WazirX non-fungible tokens (NFT) market coupled with a number of technical points in itemizing and accessing NFTs, a bunch of collectors have requested WazirX founder Nischal Shetty to switch the possession to the pockets of a community-run decentralised autonomous organisation (DAO).

Jargon buster: A DAO is an rising type of authorized construction that has no central governing physique and whose members share a standard objective to behave in the very best curiosity of the entity. It has grow to be in style with the rise of cryptocurrencies and their underlying blockchain know-how.

An NFT is a digital certificates of possession that represents the acquisition of a digital asset, traceable on a blockchain.

Totally different viewpoints: “WazirX at all times needed this market to be decentralised. Within the current scenario, it is sensible to provide it again to the neighborhood and allow them to kind a DAO,” they wrote within the e-mail on March 30, which we’ve seen. It was not clear if the group intends to arrange a recent DAO or would use one which already exists.

A WazirX spokesperson instructed us,“The group will want time to consider it. Advantages and danger evaluation will have to be carried out with the intention to take a call on this regard.”

Collectors’ challenges: Within the e-mail, the collectors had cited 5 main challenges — equivalent to the current Wazirx NFT contracts not being verified — which may result in the NFTs getting delisted by marketplaces. Additional, video and picture information of the NFTs weren’t discoverable on OpenSea — probably the most used and trusted NFT marketplaces on the earth.

The OpenSea challenge was resolved on Thursday morning.

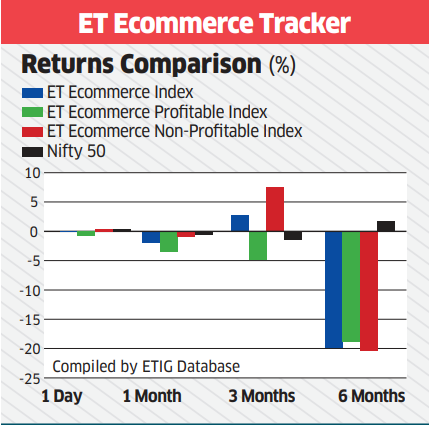

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Worthwhile, and ET Ecommerce Non-Worthwhile – to trace the efficiency of lately listed tech corporations. Right here’s how they’ve fared to date.

Individuals have realised how a lot they miss touring: Expedia CEO

Peter Kern, vice chairman and CEO Expedia Group

World journey and reserving platform Expedia Group is targeted on driving additional worth for its clients by versatile loyalty programmes and enhancing service by synthetic intelligence (AI), vice chairman and chief govt officer (CEO), Peter Kern instructed us in an unique chat.

Listed here are some key takeaways:

Journey proof against inflation: “Till we had the financial institution points, we had the query of inflation. How would inflation influence journey and different issues? The excellent news we have seen is that journey seems to be comparatively proof against inflation considerations. Now different classes of consumption have seen influence. However journey has not. Broadly, costs have held up and so they inflated quite a bit throughout covid and demand is held up fairly strongly,” Kern mentioned.

One Key for all: Commenting on the agency’s loyalty technique, he mentioned, “I believe we’re nonetheless within the early days comparatively in our journey on loyalty. Later this 12 months, we will likely be combining all our member applications to 1 which goes to be known as One Key. And that is going to provide huge flexibility to customers.”

Massive Tech dependency: “Journey world is ruled by the funnel from Google and totally different potential concepts will rebalance the market, which will likely be good. All of us wish to have much less dependencies on one massive tech participant and unfold it out to different massive tech gamers. I believe finally we wish folks to be direct customers and have the app,” he mentioned.

Learn the total interview right here

Tweet of the day

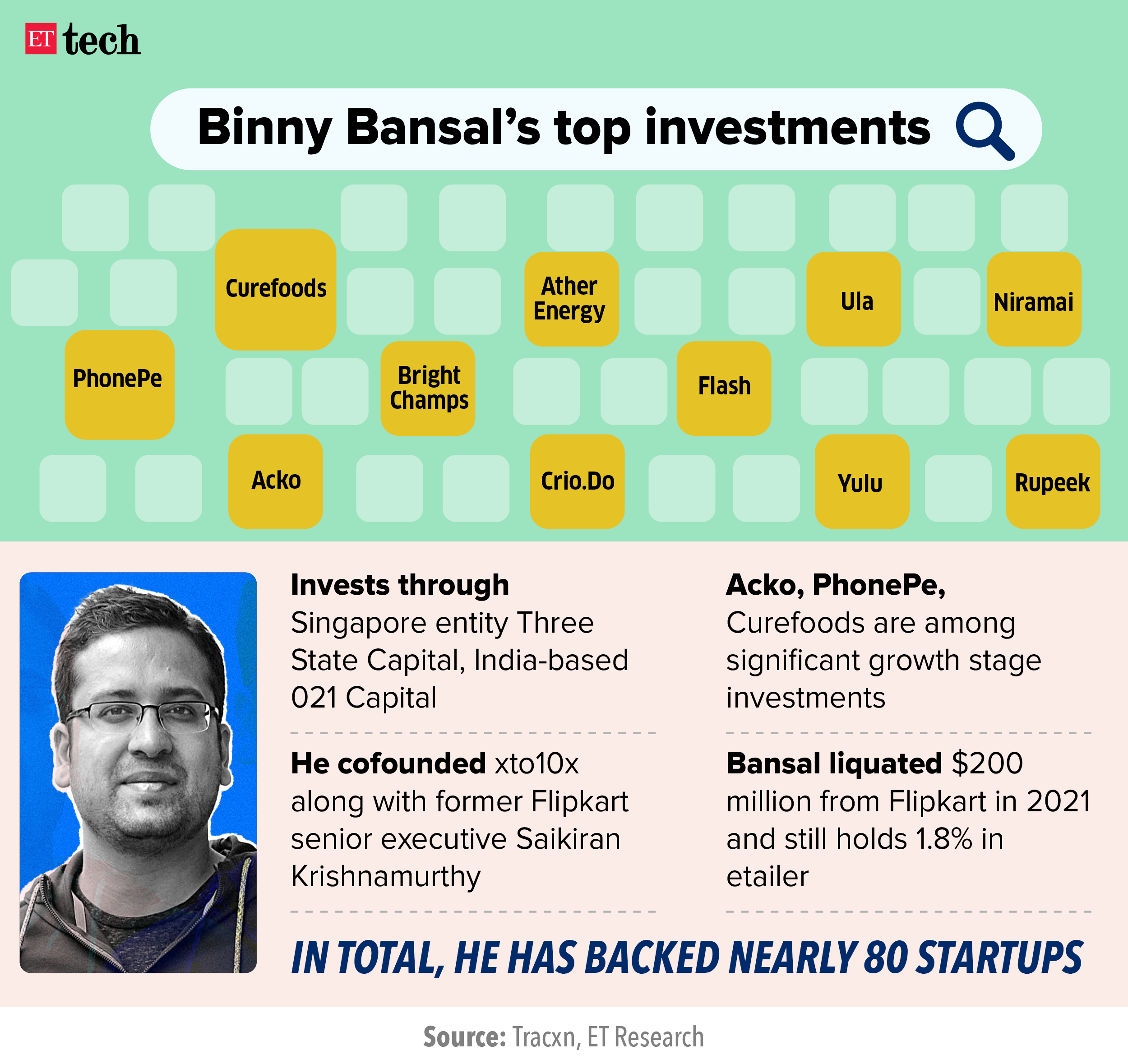

Binny Bansal’s Three State Ventures leads Rs 300 crore funding in Curefoods

Binny Bansal, cofounder, Flipkart

Cloud kitchen startup Curefoods, proprietor of manufacturers like EatFit and Sharief Bhai, mentioned it has raised Rs 300 crore in funding, in a spherical led by Flipkart cofounder Binny Bansal’s Three State Ventures.

Bansal’s second time: Bansal had invested within the cloud kitchen agency again in 2021, when he was part of a $13 million spherical in Curefoods led by Iron Pillar. Curefoods was hived off in October 2020 from Cultfit, which was based by Mukesh Bansal and Ankit Nagori in 2016. Nagori is a former Flipkart govt.

Three State Ventures has invested Rs 240 crore on this spherical together with present buyers IronPillar, Chiratae Ventures, ASK Finance and Winter Capital. This can improve Bansal’s stake within the firm to over 12% from the present 5%. ET had reported on the event final month.

Going hybrid: Curefoods, in accordance with an organization assertion, plans to make use of the brand new capital to broaden its geographical attain and diversify its manufacturers into offline codecs from the present online-only cloud kitchen mannequin. The Bengaluru-based startup is aiming to broaden to tier 1 and tier 2 cities within the North and West of India.

Different Prime Tales By Our Reporters

Cognizant wins £74-million deal from UK govt: Cognizant on Thursday introduced it has gained the UK’s Division for the Surroundings, Meals and Rural Affairs’ (Defra) contract to reinforce the federal government organisation’s provide chain mannequin and add new digital capabilities value £74 million (approx $92 million).

Indian esports trade to develop to $140 million by 2027: The Indian esports trade is anticipated to develop from $40 million in 2022 to $140 million by 2027 in accordance with the State of India Gaming Report 2022 from AWS and Lumikai. The report discovered the variety of esports gamers in India grew four-fold — 150,000 in 2021 to 600,000 in 2022.

World Picks We Are Studying

■ What does it imply to be a boy on-line in 2023? (FT)

■ AI Movies Are Freaky and Bizarre Now. However The place Are They Headed? (Wired)

■ My week with ChatGPT: can it make me a more healthy, happier, extra productive particular person? (Guardian)