The Indian Enterprise and Alternate Capital Affiliation (IVCA), representing personal fairness and enterprise capital funds, is looking for authorities assist submit RBI’s restrictions on different funding funds. This and extra within the final version of ETtech High 5 for 2023! Thanks for studying us each PM.

Additionally on this letter:

■ Kitchens@ baggage $65 million funding

■ ETtech Offers Digest

■ Ajio to change into worthwhile this month

Programming observe: ETtech’s e-newsletter workforce shall be off beginning December 23. We shall be again with a model re-creation of the e-newsletter on January 2, 2024. Wishing you all a Merry Christmas and a Joyful New Yr. Keep tuned to ETtech.com for all of the information and updates. Additionally, comply with us on @ETech and different social media channels.

PE-VC physique seeks govt’s assist to ease AIF curbs

The Indian Enterprise and Alternate Capital Affiliation (IVCA), an trade physique representing personal fairness and enterprise funds, is in discussions with authorities officers to assist ease the wide-ranging curbs the Reserve Financial institution of India (RBI) imposed earlier this week on different funding funds (AIFs).

Driving the information: An RBI round issued on Tuesday prohibits banks and NBFCs from investing in AIFs to stop questionable asset transfers. The RBI goals to stop the evergreening of uncertain company loans, this could doubtlessly choke institutional fund flows to the high-risk and flippantly regulated AIFs.

Jargon busters: An AIF is a privately pooled funding car established or integrated in India that collects funds from subtle buyers — whether or not Indian or international — for funding following an outlined coverage.

Evergreening of loans refers to extending new or further loans to a borrower who’s unable to repay the prevailing loans, thus concealing the true standing of the non-performing belongings (NPAs) or unhealthy loans.

Inform me extra: The trade is anxious concerning the close-ended nature of AIFs, the place establishments with current lending relationships with investee portfolio entities face a good 30-day timeline from December 19, 2023, to liquidate investments, failing which they have to provision 100% for such investments.

SIDBI, which loans funds to small industries, and numerous AIFs are concurrently looking for readability or aid amid the sudden modifications.

Peak XV Companions-backed workplace sharing startup Awfis information IPO papers

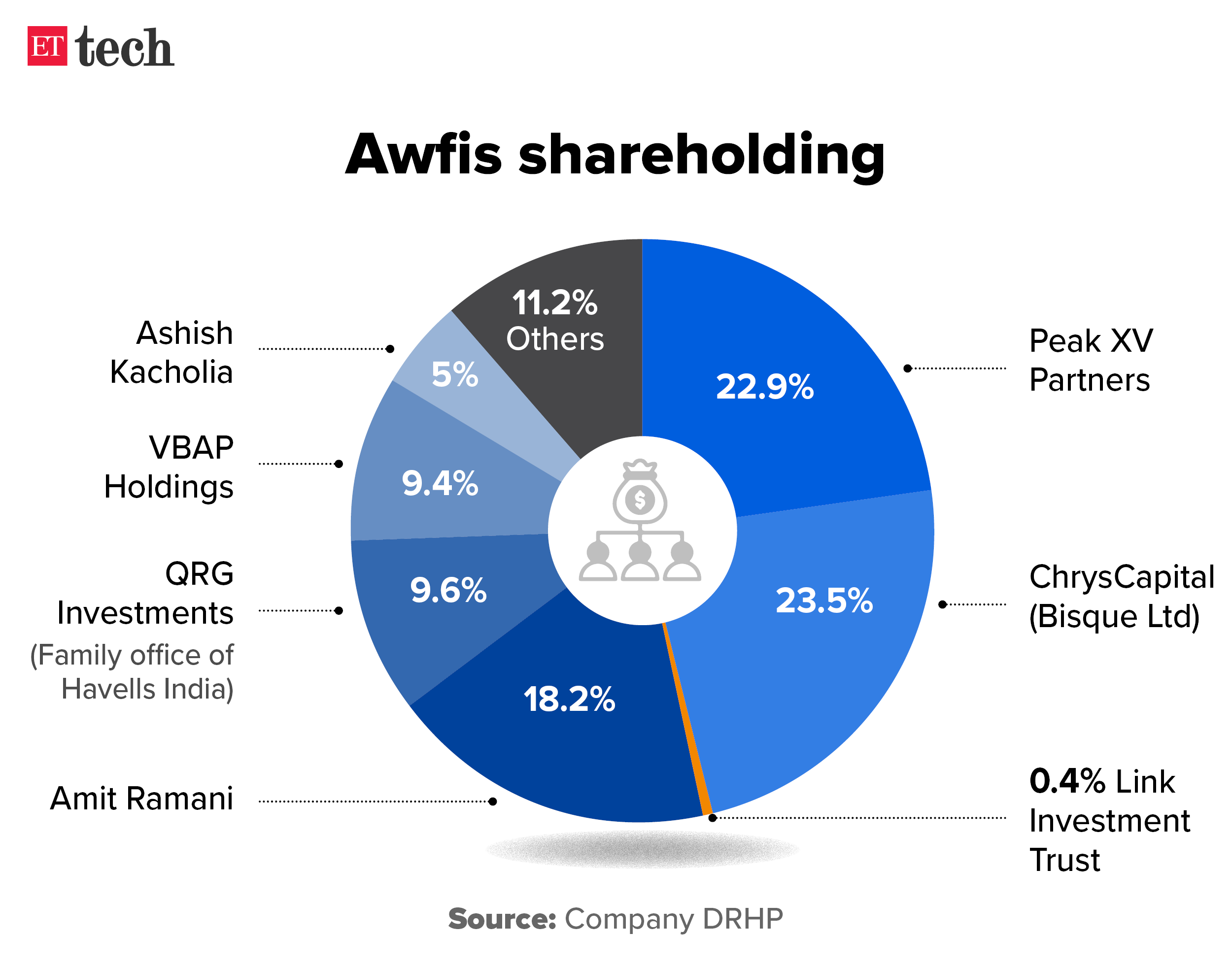

Peak XV Companions-backed Awfis Area Options has filed its draft pink herring prospectus (DRHP) with the markets regulator Securities and Alternate Board of India (Sebi) for an preliminary public providing (IPO). Awfis will difficulty recent shares value Rs 160 crore, along with an offer-for-sale (OFS) element of over 10 million shares.

IPO particulars: Peak XV Companions, previously Sequoia Capital India, will promote over 5 million shares within the office-sharing startup, with Mauritius-based investor Bisque Ltd, a unit of personal fairness agency ChrysCapital, additionally trying to promote almost as many shares within the proposed IPO. Actual property funding belief Hyperlink Funding Belief may even promote over 75,000 shares in Awfis Area Options.

Shareholding sample: Peak XV owns 15 million shares within the agency presently, aggregating to a 22.9% stake. Bisque owns a 23.5% stake, whereas founder and CEO Amit Ramani owns an 18.2% stake. Ramani shouldn’t be promoting any shares within the IPO.

As per the corporate’s final fundraising spherical, which occurred in 2022, the corporate was valued at round $110 million.

Inform me extra: Based on the DRHP, Awfis’ working income surged to Rs 545 crore in FY23, up from Rs 257 crore in FY22. In FY23, it reported a web lack of Rs 47 crore, down from Rs 57 crore reported in FY22. Within the June quarter of FY24, it reported a lack of a bit over Rs Eight crore and an working income of Rs 188 crore.

Covid impression: The Delhi-based firm logged a drop in FY21 income on account of the pandemic-led disruption. It famous that it had offered its purchasers reductions aggregating to Rs 7.Eight crore and Rs 4.three crore in FY21 and FY22, respectively, and terminated eight centres throughout the two fiscals on account of the impression of the pandemic. As of June 30, it had 121 operational coworking centres throughout 16 cities.

Extra IPOs within the pipeline: ET reported on December 20 that SoftBank-backed omnichannel retailer FirstCry is trying to file its draft IPO papers within the subsequent few days to lift $500-600 million. Whereas the agency’s valuation shouldn’t be finalised but, it could be pegged at round $Four billion.

Cloud kitchen service supplier Kitchens@ raises $65 million in funding

Cloud kitchen-focused startup Kitchens@ on Friday mentioned it had raised $65 million in a funding spherical led by London-based personal fairness agency Finnest.

Deal particulars: The agency didn’t disclose the valuation at which the funding occurred, however the funding got here in main funding, founder and chief government Junaiz Kizhakkayil advised us. The agency had earlier raised funds from the likes of DG Ventures and Beenext.

Kitchens@ will use the funds raised on this spherical for its omnichannel, multi-brand superb eating expertise referred to as Dinerium, the agency mentioned in a press release.

Within the works: Kitchens@ is trying to open 150 Dinerium areas within the subsequent six months throughout the nation, with seating capacities ranging between 600 and 1,500, the place clients shall be offered entry to superb eating from throughout 15 manufacturers, Kizhakkayil advised ET.

Extra about Kitchens@: The Bengaluru-based agency supplies companies like ready-made kitchen setups, in addition to provide chain and hiring assist to cloud kitchens.

It really works with eating places like Taco Bell, Subway, Nando’s, Mainland China, Domino’s, Barbeque Nation, Chaayos and Wow Momos, in line with its web site.

Additionally learn | Funding in Indian startups sinks to $7 billion, lowest since 2017

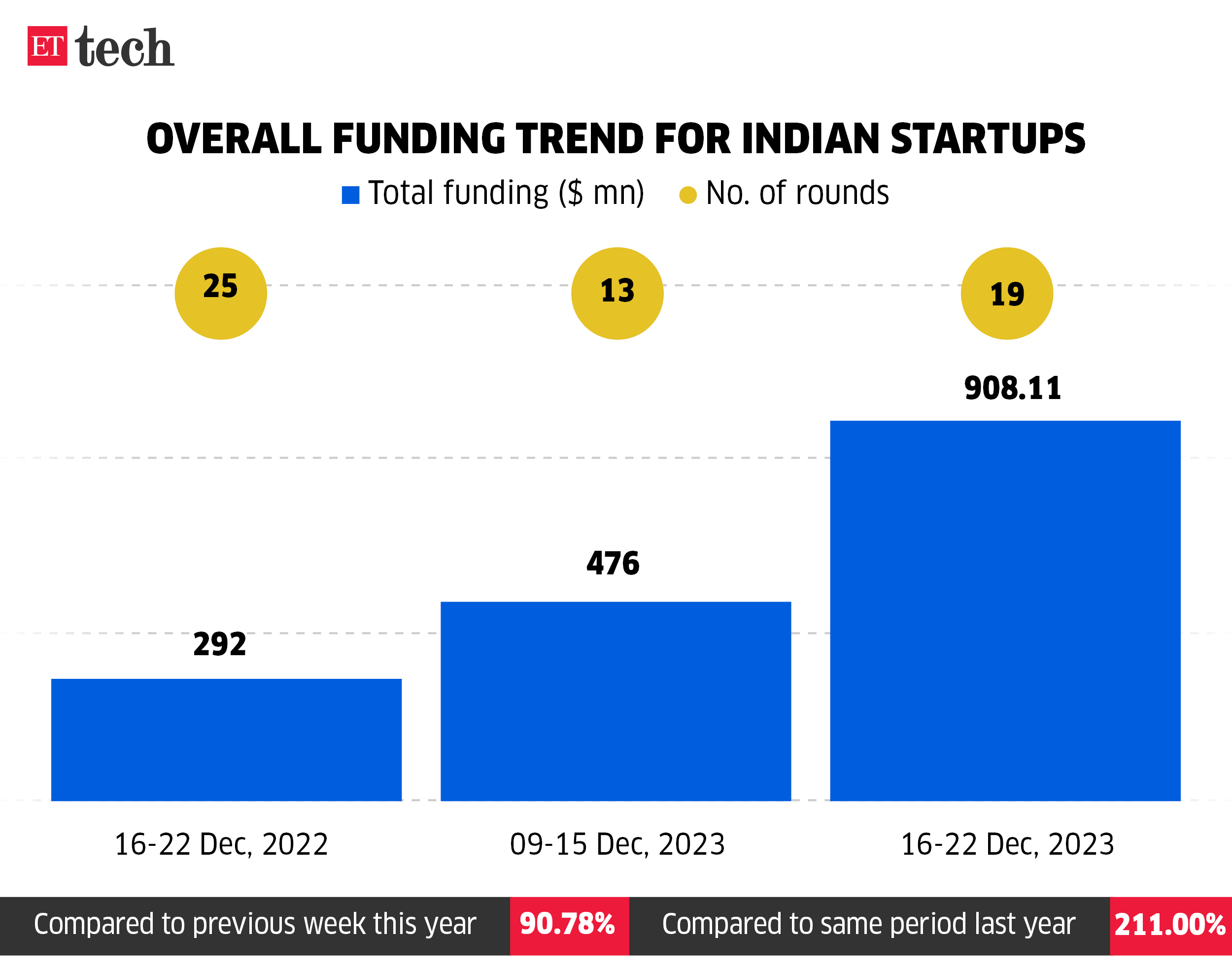

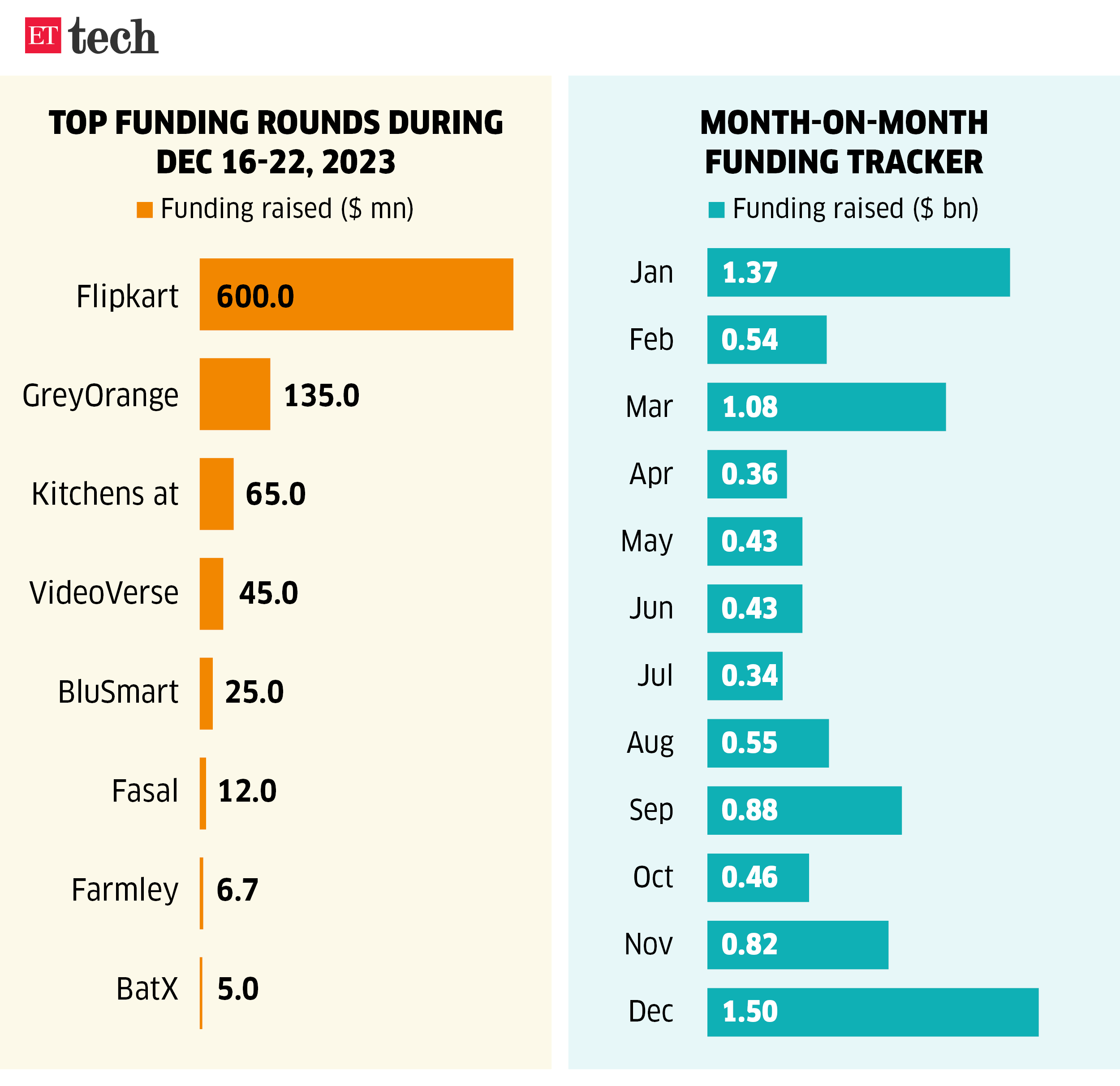

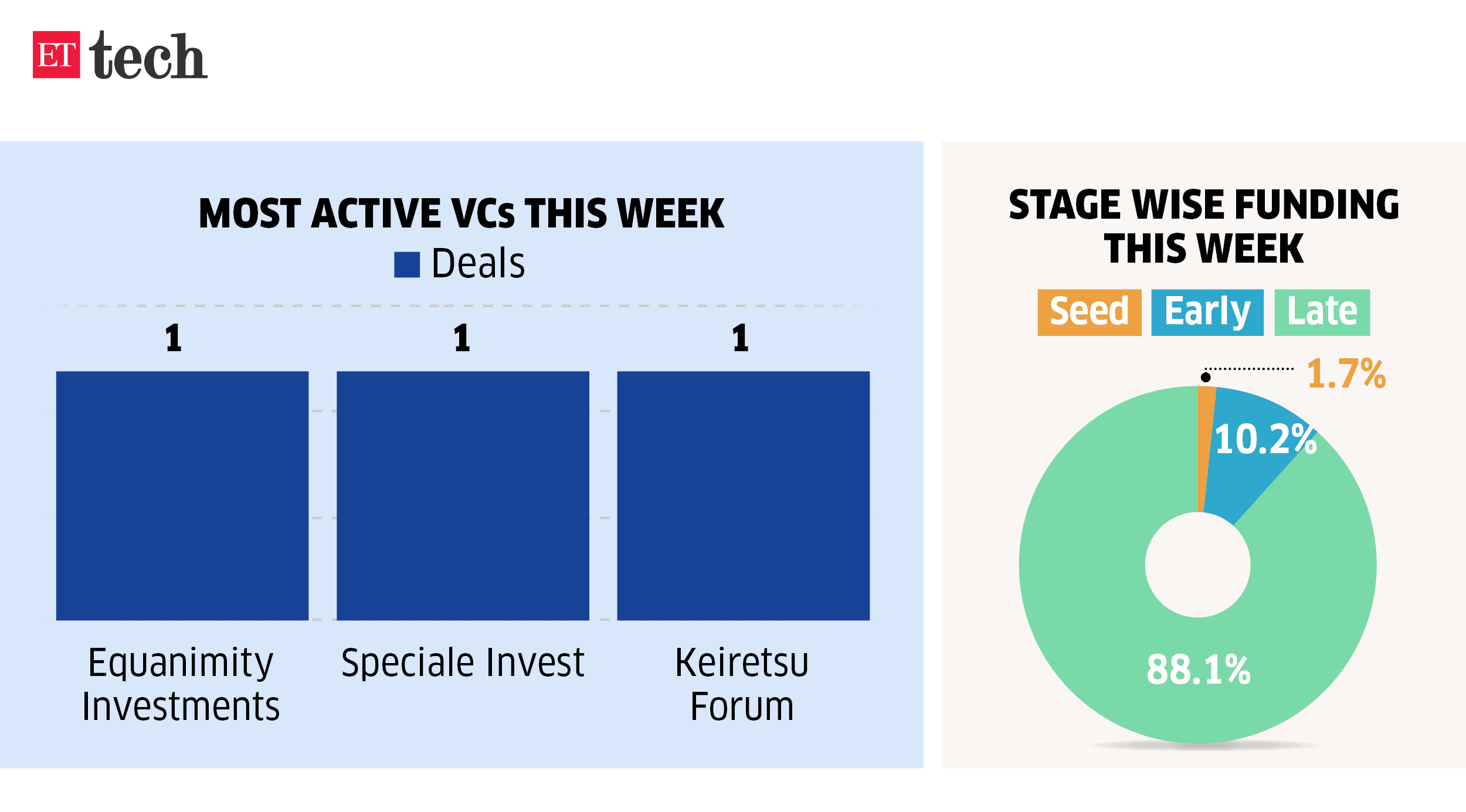

Indian startups raised $908 million this week buoyed by Flipkart’s mega funding

Weekly funding in Indian startups hit a 20-month excessive as a part of a broader revival of enterprise capital deployment in know-how corporations in December this yr.

The large push was due to Walmart’s $600 million capital deployment in Flipkart, as reported by us on December 21.

A complete of 19 startups raised a cumulative of $908 million between December 16- 20, as per Tracxn information shared with ETtech.

On a year-on-year comparability, the week noticed a rise of 211% in worth from $292 million in the identical week final yr. Sequentially, it was 91% increased in comparison with $476 million.

“Enterprise capital corporations and operators are permitting the market to cool down. They took an extended pause for about 1-1.5 years to determine patterns, by way of which corporations have been performing. Seems like offers are lastly selecting up,” a enterprise investor advised us on the situation of anonymity.

Ajio set to change into Reliance Retail’s first worthwhile on-line enterprise

Ajio, the net style enterprise of Reliance Retail, is about to show worthwhile this month, two senior trade executives advised ET.

If this occurs, Ajio will change into the primary on-line enterprise of the nation’s largest retail group to realize the milestone. It’s anticipated to submit Rs 6-Eight crore in Ebitda in December, they added.

Path to profitability: Ajio achieved profitability for the next causes:

- A premiumisation development available in the market helped Reliance, with an enormous worldwide model portfolio, enhance the common billing worth.

- It introduced down logistic prices by fulfilling most orders from bodily shops nearer to the supply level and lowering return charges.

Phrase for phrase: “Reliance wished profitability in Ajio by this fiscal yr and it’s reaching it in December itself. The main target going ahead shall be on worthwhile development since Reliance does not wish to burn cash when the enterprise has achieved scale,” one of many executives mentioned.

At this time’s ETtech High 5 e-newsletter was curated by Gaurab Dasgupta in New Delhi and Megha Mishra in Mumbai.