Comfortable Monday! Edtech agency Eruditus, which is domiciled in Singapore, is making a reverse flip to India. We’ve got all the main points in right this moment’s ETtech Morning Dispatch.

Additionally on this letter:

■ Basic insurance coverage on insurtechs’ radar

■ Sovereign funds up stake in Zomato

■ Indian IT up for US federal offers

Edtech Eruditus joins queue of reverse flips by Indian startups, weighs IPO

Ashwin Damera, CEO, Eruditus

Edtech unicorn Eruditus is planning to maneuver its domicile to India from Singapore, per folks within the know. It can be part of a rising listing of foreign-domiciled startups scripting a comeback to the homeland. Let’s dive in:

Comeback child: SoftBank-backed Eruditus is speaking to 2 of the Large 4 companies and a number of legislation companies for a flip again to India. The transfer is linked to its plans for a possible IPO right here, given how markets are viewing worthwhile companies in multiples on valuation. Greater education-focused Eruditus is valued at $3.2 billion.

Making a beeline: Throughout jurisdictions like Singapore and the US, Indian startups with international holding firms are in numerous levels of coming again to India. We reported first in Might final yr about digital funds agency Razorpay planning to ‘reverse flip’ to India from the US. Different fintechs like Groww, Pine Labs have additionally joined the listing, in addition to ecommerce firms Udaan and Meesho. For fintechs, it’s largely linked to regulatory points, however others are shifting their registered entities in order that they will go public domestically.

Additionally Learn | Extra startups India-bound, map ‘reverse flip’

Numbers sport: Eruditus is now the second largest edtech in India with Rs 3,322 crore ($400 million) in income for fiscal 2023. The corporate, which follows a July-June reporting interval, recorded a 75% soar in full-year income from the earlier yr.

The frontrunner — Byju’s — is but to report its audited FY23 financials. Folks within the know estimate that the beleaguered firm has clocked revenues of round Rs 5,000 crore, however with a lack of over Rs 8,200 crore. It’s but to file FY22 earnings with the Registrar of Corporations, however has introduced its investor with the financials, they added.

Additionally learn | Govt might land $1 billion in taxes from PhonePe’s India shift, new increase

CEOspeak: “Our advertising and marketing value was at 56% of income in FY22 and it’s (now) at 29%. Worker bills, excluding non-cash share appreciation expense, additionally diminished to 27% in FY23 from 46%,” mentioned Eruditus CEO Ashwin Damera. “We’ve got pushed numerous synergies primarily based on inner knowledge and all this has helped develop income,” he added. He declined to touch upon its domicile change plans.

Peer assessment: Compared, main edtech companies like Upgrad reported Rs 1,194 crore in income in FY23, whereas Unacademy posted a income of Rs 907 crore. Byju’s-owned Nice Studying clocked a income of Rs 801 crore, whereas for Physicswallah and Simplilearn it was Rs 798 crore and Rs 701 crore, respectively.

Ram Mandir: Ayodhya places religious apps on a progress curve

India’s burgeoning section of spiritual and religious apps, which has seen buyers together with Peak XV Companions, Elevation Capital, Titan Capital, and India Quotient backing startups in the previous couple of years, is anticipated to get a lift from the Ram temple inauguration.

Driving the information: “That is our Paytm second of demonetisation and the largest occasion for anybody on this house. It doesn’t get greater than this,” mentioned Manu Jain, cofounder of Vama, which gives entry to digital non secular ceremonies, darshans, and astrology companies. Vama has seen a 35% rise in natural searches this month, Jain mentioned.

Investor’s view: The inauguration of the Ram temple in Ayodhya may show to be a shot within the arm for the section. “This sector was once considerably taboo amongst educated founders and buyers. That’s not the case. Given that buyers are inclined to shift their efforts and cash in direction of on-line choices, and high quality founders are getting into this house, this development will work properly,” mentioned Anand Lunia, founding accomplice, India Quotient.

Sacred buying: Fast-commerce platforms akin to BigBasket’s BB Now, Zepto, Blinkit, and Swiggy Instamart are additionally pushing the gross sales of merchandise wanted for non secular ceremonies by creating a distinct class of this stuff akin to lamps, flowers, incense sticks, coconuts and sweets on their apps.

Additionally learn | Ram temple sweets sale: Amazon will get shopper watchdog discover for misleading follow

Kuwait, Singapore sovereign funds place orders for Zomato share

Deepinder Goyal, CEO, Zomato

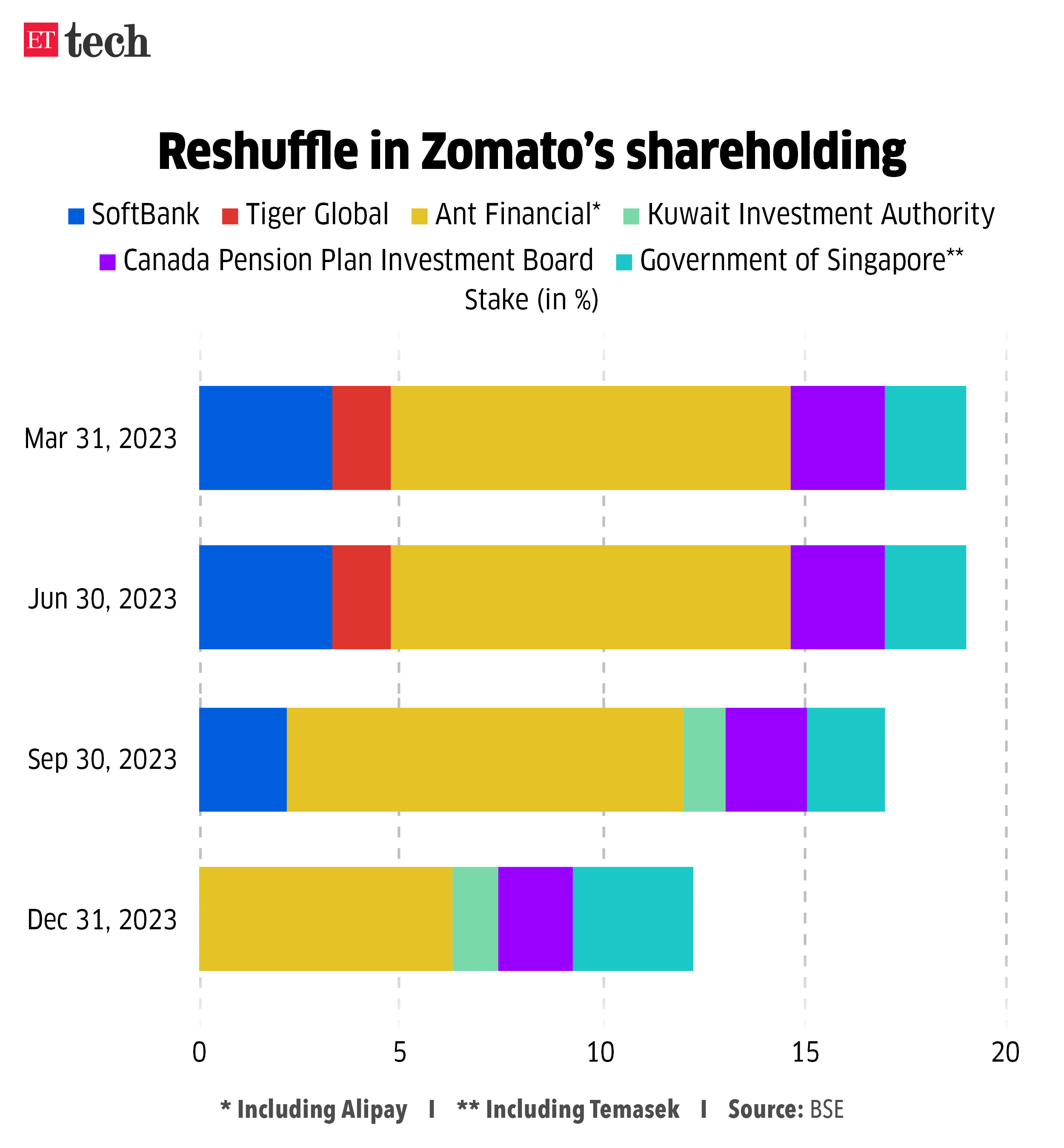

As a few of Zomato’s buyers together with SoftBank and Tiger International made full exits from the food-delivery firm’s cap desk, sovereign funds are regularly selecting up a stake within the Gurugram-based agency.

Driving the information: State-owned funds together with the Kuwait Funding Authority and the Singapore authorities have purchased shares in Zomato. Whereas Kuwait’s sovereign fund held a 1.09% stake as of December 31, the Authorities of Singapore (together with by its funding fund Temasek) owned 3.02% of Zomato.

Cashing out: Japanese investor SoftBank has divested its complete stake in Zomato for $340 million, in opposition to an funding of $300 million it made in Blinkit. Tiger International additionally bought its shares in a phased method by block offers and the open market, totally exiting the corporate within the July-September quarter. Chinese language agency Ant Monetary has additionally diminished its stake in Zomato to six.32% at end-December, from 9.83% as of September 30.

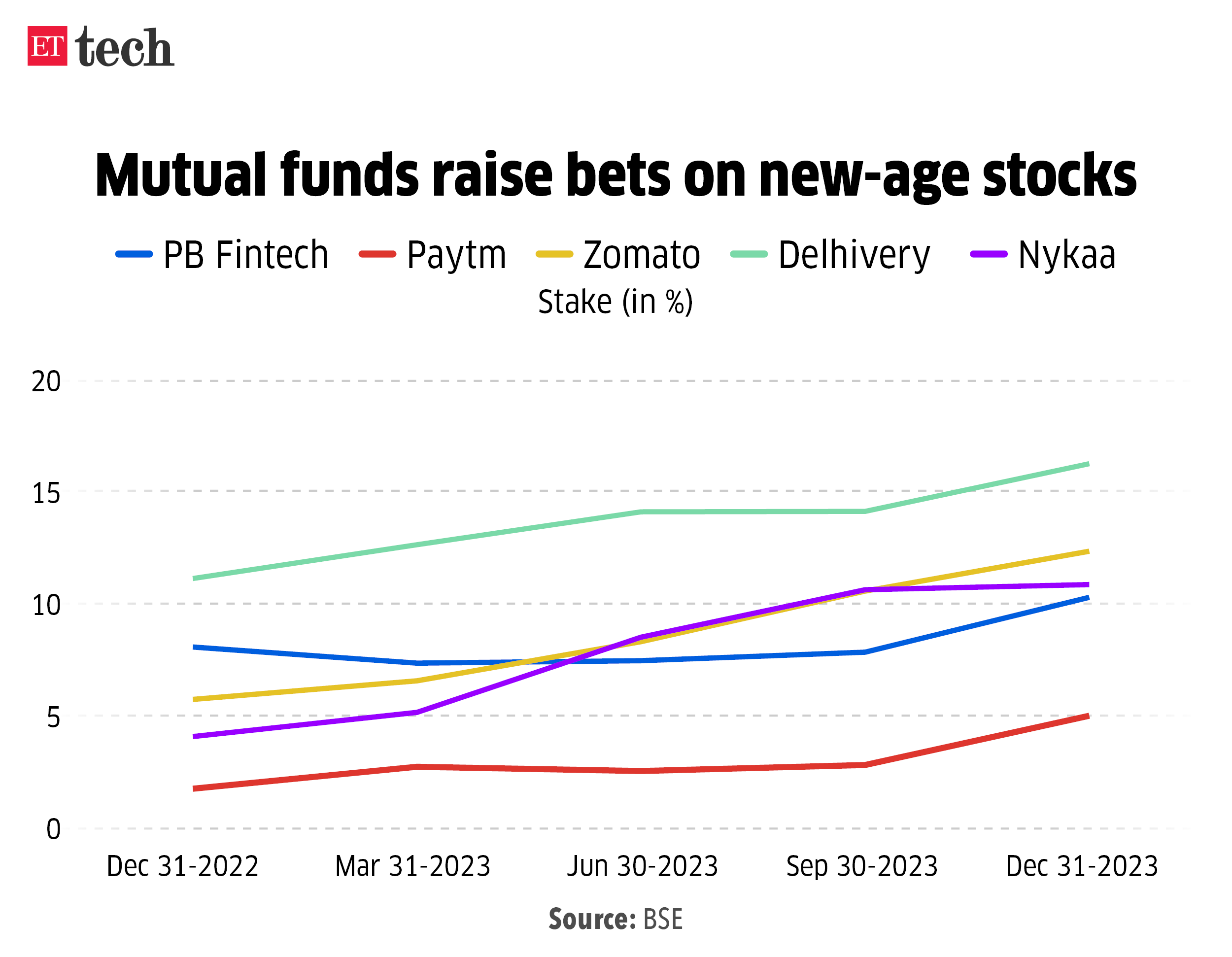

Backside line: According to the broader development of home mutual funds elevating stakes in new-age shares, Zomato additionally noticed MFs up their holding within the firm to 12.34% as of December finish, in opposition to 10.56% 1 / 4 prior. Different listed companies akin to PB Fintech, Paytm, Delhivery, and Nykaa additionally noticed MFs growing stakes in October-December.

Additionally learn | New-age companies journey market surge in buoyant week

With regulator opening doorways, insurtech companies look to remodel into normal insurers

A bunch of new-age insurtech startups akin to Onsurity and Loop Well being are attempting to enter the nation’s medical insurance market after the Insurance coverage Regulatory and Growth Authority of India (Irdai) opened up the closely regulated sector to new members.

Driving the information: Bengaluru-based Onsurity and Pune-based Loop Well being have thrown their hats into the ring to supply medical insurance within the nation, sources instructed ET. “Each these startups need to finally construct merchandise within the group well being house, a sector the place they act as distributors presently,” a senior business government instructed ET.

Additionally learn | Insurtech startups test bills to safe income

Funding these aspirations: In October, IFC, Nexus Enterprise Companions, and Quona pumped $24 million into Onsurity, primarily to fund its aspirations to change into a well being insurer. Loop Well being has raised round $40 million so far from the likes of Y Combinator, Basic Catalyst, Elevation Capital, Khosla Ventures, and others.

Sure, however: Although Irdai opened up functions final yr, the regulatory needle has not moved a lot. A number of firms utilized for the licences underneath a number of classes, however solely three — Acko Life Insurance coverage, Digit Life Insurance coverage, and Credit score Entry Grameen — have gotten the go-ahead. Just lately, Narayana Well being obtained a medical insurance licence.

A founding father of an insurtech startup, which is likely one of the candidates for a normal insurance coverage licence, mentioned funding rounds of startups awaiting the licence are pending.

Additionally learn | Insurtech startups make hay as embedded insurance coverage will get the highlight

Tech increase? a number of US federal contracts up for renewal in subsequent two quarters

.jpg)

Consultants are of the view that whereas it is nonetheless exhausting for Indian firms to crack massive US federal offers which might be up for renewal over the subsequent two quarters, there’s a extra optimistic perspective in direction of Indian-heritage suppliers.

Knowledge decoded: In response to knowledge sourced by ET, the contracts are from the likes of the Basic Providers Administration, US Cyber Command, Division of Vitality, NASA, Federal Aviation Administration, and Division of Training. Many of those are within the neighborhood of a billion {dollars}, whereas a couple of are considerably above that threshold.

Main deal wins: Over the previous 4 quarters, Indian IT majors have reported a number of massive and mega offers. A few of them have been:

Additionally learn | For IT, a $16 billion deal feast on the desk

Not that simple but: “Indian distributors don’t have anything main within the US federal contracts section. A lot of the federal contracts go to some well-established gamers who’re largely US-based as these require workers to have various ranges of safety clearance which Indian distributors with their offshore workers can not receive,” mentioned Hansa Iyengar, senior principal analyst, Omdia Analysis.

Different High Tales By Our Reporters

IT provides bears a bull hug: what’s driving the rally in tech shares? Expertise companies, the relative stragglers within the present bull run in Indian shares, single-handedly carried the broadest benchmarks to new data by the primary two weeks of January, belying odds of muted earnings efficiency.

High cop to move Karnataka fact-checking unit: Within the run-up to the Basic Elections this yr, Karnataka has shortlisted 5 companies for its fact-checking unit — Gauri Media, Logically Infomedia, Trylika Expertise, Newsplus Communications, and OW Knowledge Leads. Senior IPS officer Pronab Mohanty will head the unit.

International Picks We Are Studying

■ The Imaginative and prescient Professional’s first killer app is the online, whether or not Apple likes it or not (The Verge)

■ Cryptographers Simply Obtained Nearer to Enabling Totally Personal Web Searches (Wired)

■ Mistral turns into the speak of Davos as enterprise leaders search AI features (FT)