India’s shopper web companies have voiced their disapproval of the ex-ante framework within the proposed digital competitors legislation. This and extra in immediately’s ETtech Morning Dispatch.

Additionally on this letter:

■ Startups brace for funding surge

■ PM lays basis stone of chip initiatives

■ ETtech Performed Offers

New antitrust legislation for giant tech companies shouldn’t stifle innovation: consultants

The proposed digital competitors legislation will assist curb potential antitrust behaviour by giant expertise corporations, however the authorities should guard in opposition to stifling innovation or making compliance onerous, stated consultants in regulatory affairs.

Driving the information: A panel led by company affairs secretary Manoj Govil prompt a brand new antitrust legislation with an ex-ante framework to control giant digital gamers. A variety of massive expertise companies, together with Apple, Google, Meta, Amazon and Flipkart, had opposed such an thought of their submission earlier than the committee final yr.

Learn ETtech’s detailed explainer on what the proposed legislation appears to be like to control right here.

Taking a stance: Very like massive tech companies reminiscent of Google, Meta and Amazon, giant Indian shopper web corporations like Zomato, Swiggy, Flipkart and Oyo have opposed ex-ante laws on digital competitors.

Zomato, Swiggy, Flipkart and Amazon have been subjected to investigations by the Competitors Fee of India for alleged antitrust violations. Fintech agency Paytm and on-line journey portal MakeMyTrip stated they’re in favour of ex-ante laws, albeit with caveats.

Additionally learn | ETtech Full Stack | No level Googling ‘swadeshi’

Pre-emptive strike: One of many key facets of the brand new legislation is that it’ll look to prescribe sure measures to stop monopolistic behaviour, and penalise corporations not following these norms. The ex-ante framework compares to the present ex-post method the place corporations are investigated for alleged violations of the antitrust legislation and penalised subsequently.

Consultants on the proposed legislation: Natasha Treasurywala, associate at legislation agency Desai & Diwanji, stated the suggestions might probably affect not simply innovation and evolution of merchandise by massive tech corporations but additionally shopper selection. Unnati Agrawal, associate at IndusLaw, referred to as for a stability “between the necessity for regulation and the distinctive realities of the Indian financial system to keep away from unintended penalties in order that the customers don’t find yourself with a drugs that’s worse than the illness”.

Additionally learn | Unique: Web corporations mail dissent notice in opposition to IAMAI’s stand on digital competitors invoice

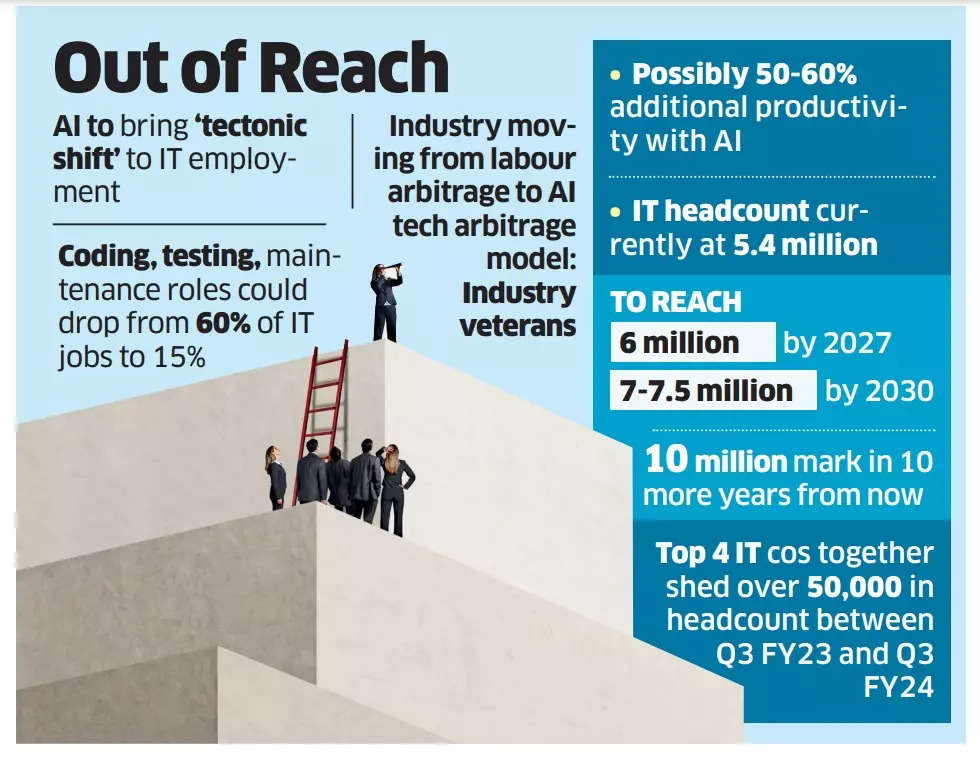

IT’s 2030 employees doubling goal appears to be like distant on stoop, GenAI

India’s $250 billion info expertise (IT) sector, which was anticipated to double its workforce by 2030, will doubtless miss the goal, in keeping with business consultants.

Causes: An ongoing cyclical stoop in demand for expertise companies in addition to the long-term risk of synthetic intelligence (AI)-induced job losses might see the sector make use of nearly 7.5 million by the tip of the last decade from the present stage of 5.four million staff, in keeping with information from a prime hiring agency. Recruitment consultancy TeamLease Digital had earlier estimated that the Indian IT workforce would increase to 10 million by 2030.

Quote, unquote: AI-based automation is the numerous issue impacting headcount, whereas macroeconomic elements are cyclical with a revival doubtless in 2025, stated Ganesh Natarajan, former CEO of Zensar Applied sciences and founding father of 5F World. “With ChatGPT and GenAI (generative AI), coding can also be getting destroyed. Because of this, these roles, which account for practically 60% of all IT jobs, might drop precipitously to 15%,” he stated.

Headcount dips: India’s prime 4 IT corporations – Tata Consultancy Providers, Infosys, Wipro and HCLTech – reported a mixed headcount drop of over 50,000 on the finish of the third quarter of FY24, in comparison with the earlier interval.

AI affect: Even because the expertise hiring business braces for AI-driven effectivity resulting in short-term strain on income and headcount additions, there can be an uptick in demand for AI-ready abilities finally, stated Vineet Nayar, former HCL Applied sciences CEO.

Startups brace for funding surge in 2024, says Bain report

Startups funded closely in 2020-2021 might search contemporary capital in 2024, probably boosting enterprise capital funding exercise this yr, in keeping with a report by Bain & Firm, and Indian Enterprise and Alternate Capital Affiliation (IVCA).

Again to fundamentals: Traders will flip to extra conventional companies to pump in funds, the report added. This was echoed by Sai Deo, associate at Bain & Co, who stated that whereas expertise sectors stay dominant when it comes to deal quantity, buyers are exhibiting rising curiosity in conventional industries.

“For instance, offline retail, credit-focused banking, monetary companies and insurance coverage (BFSI) corporations might see elevated curiosity from VCs,” she stated.

A boring 2023: Confronted with rising rates of interest in 2023, growth-stage startups delayed fundraising and buyers turned extra cautious. This resulted in a major drop in mega-round offers (exceeding $100 million) – from 48 in 2022 to a mere 15.

As per the India Enterprise Capital Report 2024, investments in India declined to $9.6 billion in 2023, in comparison with $25.7 billion in 2022.

Inversely, smaller offers (underneath $50 million) fared higher, experiencing a smaller decline of round 45%. The quantity dropped from 1,501 to 852, in keeping with the report.

Additionally learn | Tech-first VCs line up for new-age shopper manufacturers, offline companies

Inexperienced shoots: The report highlighted generative AI as a booming sector. GenAI purposes attracted essentially the most funding, with a large leap from $15 million in 2022 to $250 million in 2023.

Exit exercise: Investor exits remained robust in 2023, prioritising offering liquidity to restricted companions (fund sponsors) because of the high-interest fee setting.

The Bain & Firm report stated that exits surged virtually 1.7 instances to succeed in $6.6 billion in 2023. Crossover funds led the pack, accounting for practically 65% of complete exit worth.

Different High Tales By Our Reporters

Sabyasachi Goswami, CEO, Perfios

Perfios secures $80 million, attains unicorn valuation: Fintech-focused software program startup Pefios has secured $80 million from Lecturers’ Enterprise Development (TVG), the late-stage enterprise and development funding arm of Ontario Lecturers’ Pension Plan. The funding spherical has catapulted Bengaluru-based Pefios to a billion {dollars} in valuation, making it the second firm to realize the unicorn standing this yr.

Aged care startup Kites Senior Care baggage Rs 45 crore funding: Kites Senior Care has secured Rs 45 crore in a collection A funding spherical, led by Ranjan Pai, chairman of Manipal Schooling and Medical Group (MEMG) by way of his household workplace.

Tapfin baggage $four million from Elevar Fairness: Sustainability platform Tapfin, which focuses on offering a wide range of companies together with financing and insurance coverage to startups and micro, small, and medium enterprises (MSMEs) inside the sustainability ecosystem, has secured $four million in a seed funding spherical led by Elevar Fairness.

Battery recycling agency Lohum raises $54 million in funding: Vitality transition supplies maker Lohum has raised Rs 450 crore ($54 million) in a main funding spherical. Singularity Development Fund, which counts CaratLane founder Mithun Sacheti amongst its backers, led the spherical.

AI startup platform RapidCanvas raises $7.5 million: RapidCanvas, an AI platform constructed for companies, has raised $7.5 million in a funding spherical led by Accel, with participation from Valley Capital Companions. The funds can be used for buyer acquisition by way of advertising and gross sales enlargement, in addition to for buyer retention by way of funding in analysis and improvement.

Healthtech startup Sugar.match raises $5 million: Sugar.match, a healthtech startup that seeks to handle and reverse kind 2 and pre-diabetes, has raised $5 million in a funding spherical led by world tech-focused funding agency B Capital.

Paytm seeking to migrate UPI funds to 4 banks, eyes TPAP standing earlier than March 15: Paytm is racing in opposition to time emigrate its banking companies from Paytm Funds Financial institution to different lenders. The Nationwide Funds Company of India, which runs the Unified Funds Interface (UPI) railroad, is working to certify Paytm’s software to grow to be a third-party cost app, two senior bankers stated.

Meesho kicks off Rs 200-crore Esop buyback: Ecommerce agency Meesho on Wednesday introduced an worker inventory choice (Esop) buyback programme value Rs 200 crore. The buyback programme, its largest up to now, could be open to each present and former staff.

Nazara Applied sciences units apart $100 million for acquisitions: Cellular gaming and sports activities media firm Nazara Applied sciences on Wednesday stated it’s setting apart about Rs 830 crore, or $100 million, for mergers and acquisitions in markets like India, Europe and North America.

Karnataka HC extends interim keep on Byju’s EGM until March 28: The Karnataka Excessive Court docket on Wednesday prolonged its interim keep on academic tech firm Byju’s plea difficult the validity of the extraordinary common assembly held final month that sought to take away founder Byju Raveendran because the chief government officer.

International Picks We Are Studying

■ China’s greatest self-driving automotive platforms, examined and in contrast (Wired)

■ Trump says a TikTok ban would solely assist ‘enemy of the individuals’ Fb (BBC)

■ Visa and Mastercard are pouring cash into Africa (Remainder of World)