MSME-focused digital lenders are gaining traction as banks decelerate on unsecured shopper loans. This and extra in at present’s ETtech Morning Dispatch.

Additionally on this letter:

■ Peak XV’s new fund

■ B2B, manufacturing tech drove IPOs for five years

■ CCI clears Slice-North East SFB merger

MSME fintechs steal present as shopper lending loses fizz

All these years, digital lending has been principally synonymous with unsecured shopper credit score. However that’s slowly altering. Enterprise-focused fintech lenders are more and more grabbing the limelight with extra conventional lenders opening as much as work with them.

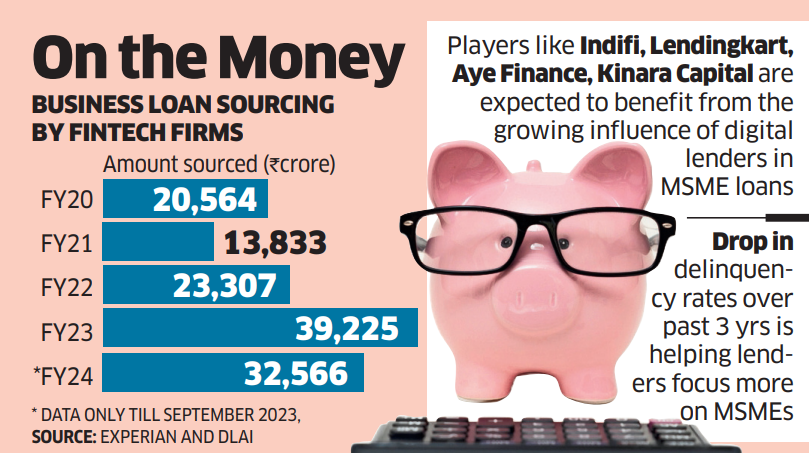

New tendencies: Macroeconomic components like a fast restoration for the MSME sector after Covid-19 and regulatory diktats to examine the unbridled progress of shopper lending are serving to funds move into MSME loans. Moreover, a fall in delinquency is making the sector extra enticing.

Numberspeak: Per business knowledge, round 85% of the full sub-Rs 1 lakh MSME loans sourced by fintechs final yr have been given out within the first half of the present fiscal. At Rs 32,566 crore, the speed of sourcing such loans in H1 2024 was a lot sooner than that of final yr. By way of market share, MSME loans are a lot smaller than the full quantity of shopper loans given out by fintechs.

Driving progress: The federal government has made it simpler for small companies to register themselves via the Udyam portal. Additionally, the RBI has allowed banks to comply with the federal government’s classification of such companies for his or her precedence sector mortgage mandates.

Giant fintech NBFCs have began displaying stronger financials, which can also be prompting banks to begin working with them on higher phrases.

General, nationwide establishments like Sidbi (Small Industrial Improvement Financial institution of India) and others are co-opting fintechs to take monetary companies to the small enterprises.

Additionally learn | RBI’s hardening cautionary stand on unsecured lending and its influence on the bigger market

Ola Electrical plans e-autorickshaw launch forward of IPO

IPO-bound Ola Electrical has finalised plans to launch an electrical autorickshaw, more likely to be referred to as Raahi, within the subsequent few weeks, folks within the know instructed ET.

The fundamentals: The product is consistent with Ola’s wider plans to enter the industrial automobile enterprise. It’s going to compete with the likes of Mahindra Treo, Piaggio Ape e-city and Bajaj RE within the electrical three-wheeler section.

Market alternative: Mahindra, Piaggio and Bajaj value their electrical autorickshaws from Rs 2 lakh to upwards of Rs 3.5 lakh. In keeping with authorities transport web site Vahan, greater than 580,000 electrical three-wheelers have been bought final yr, a 66% rise over 2022. Electrical three-wheelers comprised over 50% of complete three-wheeler gross sales in 2023.

IPO in sight: The launch is a part of a slew of bulletins main as much as its preliminary public providing (IPO), sources mentioned. The agency is trying to increase as much as Rs 5,500 crore via a recent challenge, other than a proposal on the market of 95.2 million shares by present traders.

Buzzing with exercise: Ola Electrical has been engaged on opening its gigafactory — to fabricate its personal battery cells — by the tip of this quarter. In February, the corporate prolonged the battery guarantee for all its scooters. It additionally mentioned it might arrange 10,000 fast-charging factors and broaden its service centre community.

Peak XV to arrange evergreen fund backed by agency’s companions

(From left) Peak XV Companions managing administrators Rajan Anandan, Shailendra Singh, Mohit Bhatnagar and GV Ravishankar

In a transfer that may allow the enterprise fund’s companions to take bets on a wider set of alternatives past its personal fund, Peak XV Companions is organising a brand new automobile backed by its inside pool of capital.

Go deeper: The everlasting capital automobile (PCV) will permit the agency to broaden and make investments throughout totally different areas, methods and sectors. These embrace public market corporations, enterprise funds in different areas and specialisations that don’t compete with Peak XV’s present strategy. It’s a approach for the fund’s companions and prime management to diversify their publicity past the present portfolio.

Jargon buster: Evergreen funds, as PCVs are additionally recognized, can exist in perpetuity because the income are ploughed again into the automobile itself. Typical enterprise capital and personal fairness funds have fastened tenures of seven to 10 years, after which they should return capital to LPs.

Verbatim: “The Peak XV Anchor Fund is a everlasting capital fund that may act like an inside steadiness sheet. It’s going to drive immense alignment with our institutional restricted companions by enabling us to be a major investor in our personal funds,” Shailendra Singh, managing director, Peak XV Companions, instructed ET.

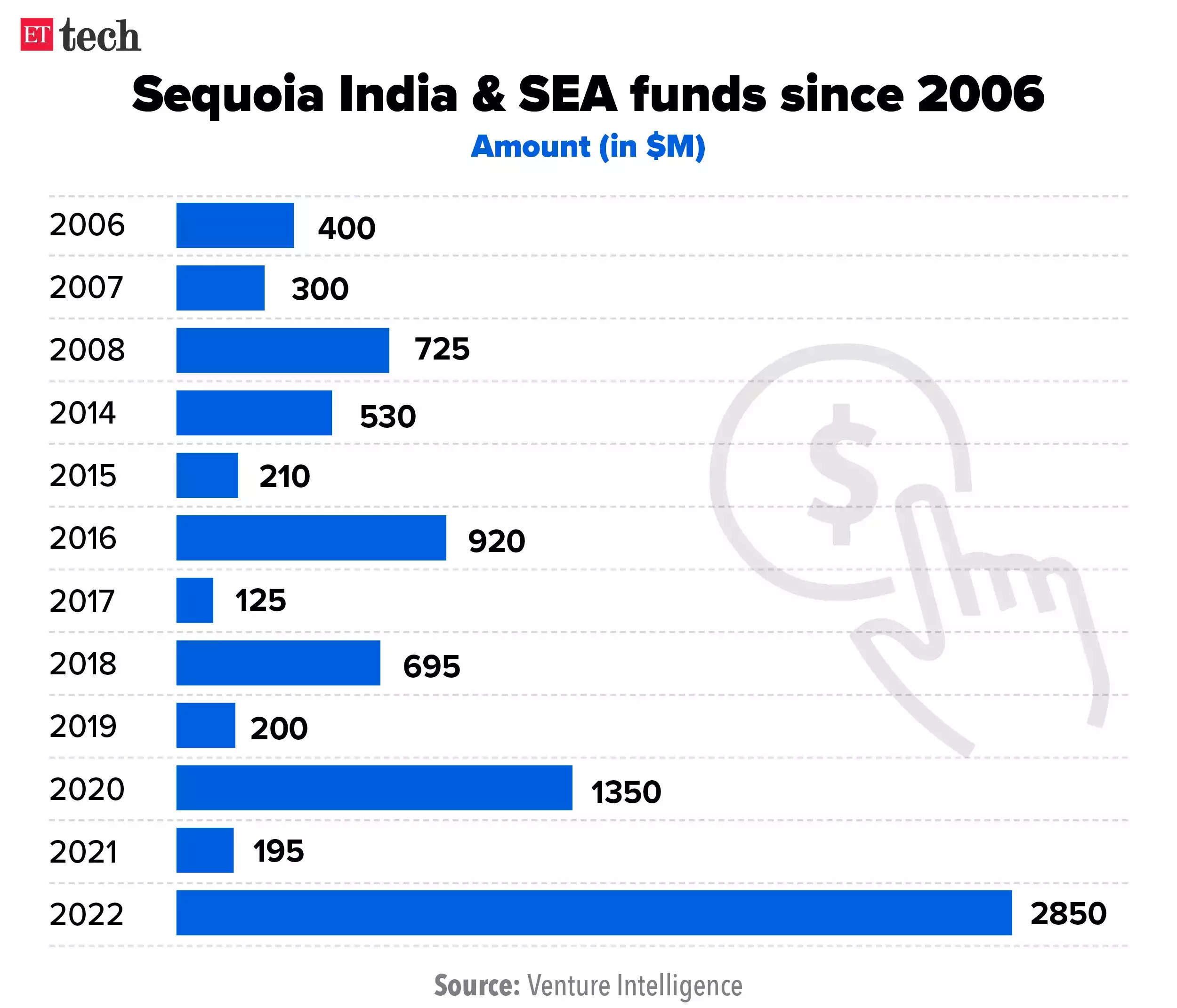

Catch up, fast: In 2022, Peak XV had introduced a $2.85 billion India and Southeast Asia fund. In June 2023, US-based Sequoia Capital cut up from its India and Southeast Asia, and China partnerships. The India and Southeast Asia partnership, which has backed prime web startups together with Zomato, Razorpay, Pine Labs, Unacademy and Cred, was renamed Peak XV Companions. It at present has over $9 billion value of belongings below administration.

B2B, manufacturing tech drove IPO market in previous 5 years: report

Public listings on the bourses have been crowded by corporations from the business-to-business (B2B) and manufacturing know-how sectors up to now 5 years, Boston Consulting Group and enterprise capital agency Matrix Companions mentioned in a joint report.

Particulars: Up to now 5 years, there have been 11 preliminary public choices throughout the B2B area, within the specialty chemical business, that includes corporations akin to Chemplast and Senmar.

Corporations from sectors akin to digital manufacturing companies (EMS), digital gear, auto elements and associated industries, in addition to aerospace and defence additionally went public.

Promising sectors: The report expects a major enhance in IPOs throughout the electrical automobile (EV) sector, beginning with Ola Electrical. “However additionally, you will see numerous (IPOs from) OEMs (unique gear producers), motor corporations, charging infrastructure corporations and battery corporations. That shall be a giant pattern,” Sudipto Sannigrahi, managing director at Matrix Companions, instructed ET.

Additionally learn | SME board IPOs potential route for Indian startups, as enterprise funding declines: Blume report

Different High Tales By Our Reporters

Rajan Bajaj, founder and CEO, Slice

CCI approves merger of Slice with North East Small Finance Financial institution: The antitrust regulator has cleared fintech Slice’s merger with North East Small Finance Financial institution. Garagepreneurs Web, which owns the model Slice, will merge with its in-house non-banking finance firm Quadrillion Finance and the mixed entity, together with the financial institution’s microfinance entity RGVN Microfinance, will merge with NESFB.

Workflow automation platform Nanonets raises $29 million led by Accel: AI-based doc workflow automation platform Nanonets has raised $29 million in a funding spherical led by Accel. The funds shall be used for analysis and improvement to enhance its algorithms, in addition to for scaling its advertising and marketing and gross sales efforts.

Google ties up with Election Fee to deal with misinformation throughout polls: Google India in a weblog publish mentioned its product options are designed to raise authoritative data on varied election-related matters. “We’re collaborating with ECI to allow folks to simply uncover essential voting data on Google Search – akin to easy methods to register and easy methods to vote – in each English and Hindi,” Google mentioned.

First semicon chip from Dholera plant by 2026-end: PSMC’s Frank Huang | The primary semiconductor chip from the brand new plant being arrange by the Tata Group and Taiwan’s Powerchip Semiconductor Manufacturing Company in Gujarat’s Dholera, shall be able to roll out by the tip of 2026, in accordance with Frank Huang, chairman of PSMC.

New HP India MD sees ‘no finish’ in India units demand: Laptop computer and private pc maker HP India will roll out its home growth plans over the following 9-12 months to cater to the demand for the units within the nation which has “no finish”, HP India managing director Ipsita Dasgupta mentioned.

International Picks We Are Studying

■ Binance’s prime crypto crime investigator is being detained in Nigeria (Wired)

■ How livestream realtors helped make Xishuangbanna a increase city (Remainder of World)

■ China’s imprecise hopes for tech to reboot its economic system (Bloomberg)