Welcome to a brand new version of Full Stack, a spot the place you’ll discover unfiltered commentary on all issues expertise.

Please maintain the bouquets, brickbats and recommendations coming. You may attain me at samidha.sharma@timesofindia.com and comply with me on Elon Musk’s X @samidhas.

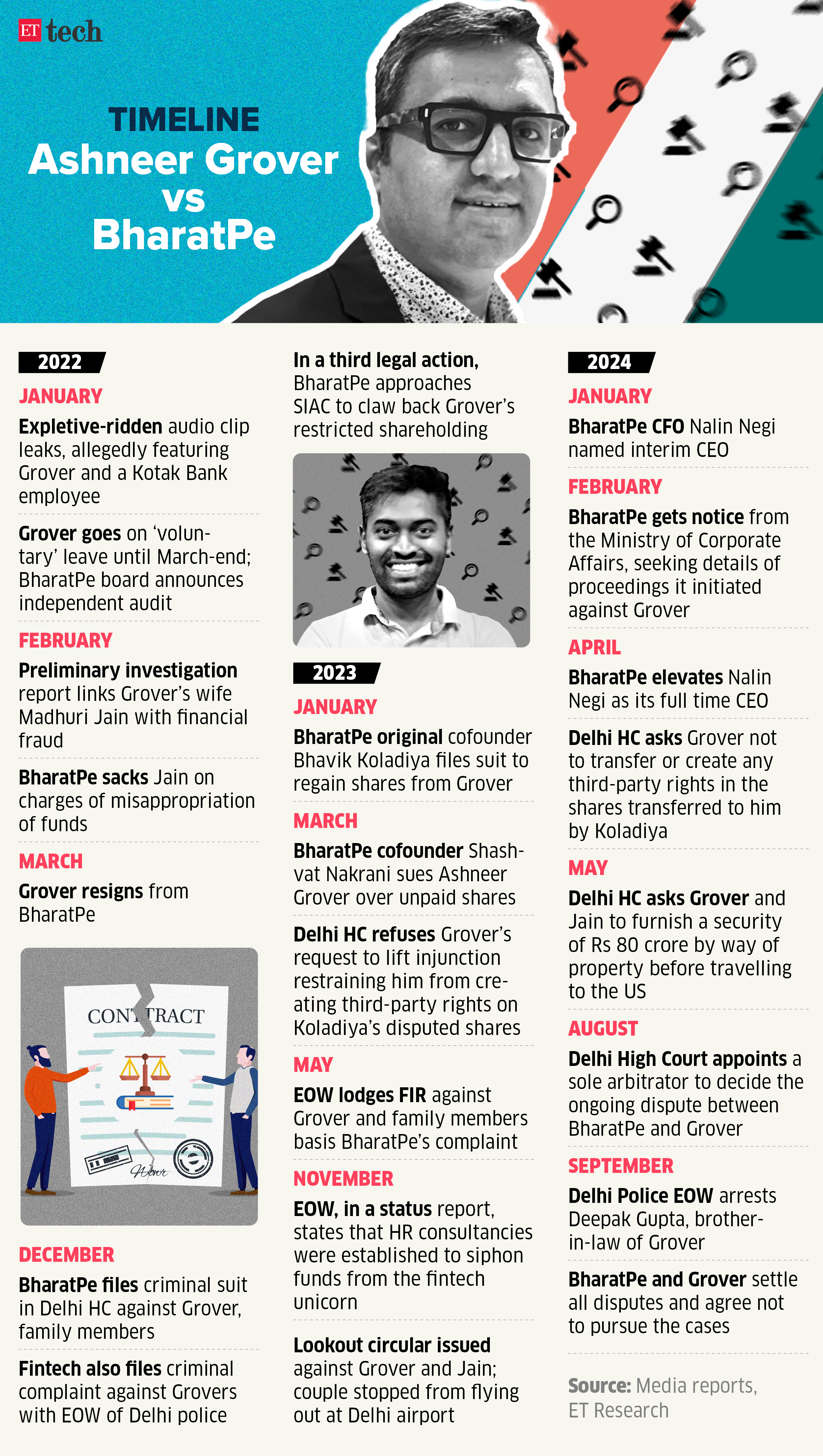

This week marked the top of a long-drawn authorized battle between BharatPe, a as soon as rising fintech star valued at $2.7 bn (at its peak), and its cofounder Ashneer Grover. What started in January 2022 when an expletive-laden phone chat between Grover and a Kotak Mahindra financial institution official leaked, shortly snowballed into one of many ugliest public spats between a new-age startup backed by top-notch buyers and its founder.

Grover, his spouse Madhuri Jain, had been subsequently sacked on allegations of misappropriation of funds and company governance lapses. The 2 events had been entangled in a number of courtroom circumstances — civil and felony — over the past two years.

However on Monday, a settlement deal was struck with BharatPe and Grover agreeing to drop these a number of expenses in opposition to one another on the situation that the erstwhile CEO will give up his stake within the fintech, and disassociate from the corporate going ahead. In a single stroke, this meant buyers misplaced an opportunity to make an instance of this incident to discourage future circumstances of company governance failures, which have hit the picture of the Indian startup economic system considerably over the previous two years.

Additionally Learn | The brand new rage in startup city

BharatPe’s Grover and edtech startup Byju’s have been the 2 most high-profile cases the place solo aggressive founders have been engaged in protracted litigation preventing shareholders, lenders and regulation enforcement companies at the same time as their startups have floundered.

‘Buyers copped out as an alternative of pushing via with the costs. In India, these sorts of authorized circumstances can go on for years, which may maintain denting the worth of the corporate. That is one motive why shareholders haven’t any upside to proceed preventing,’ stated a founder after the BharatPe information broke on Monday.

Additionally Learn | BharatPe vs Ashneer Grover settlement: making sense of the authorized battle between the 2 events

The truce might have come on the again of a attainable arrest of Grover’s spouse Jain, pushing the couple to conform to the phrases of the settlement dished out by BharatPe. Whereas an Financial Offence Wing (EOW) investigation continues, the settlement between the 2 events as soon as once more put the glare on the shortage of stringent punishment for monetary fraud and misappropriation of firm funds — not solely within the startup world, however throughout India Inc.

So, what’s the harm? Since stepping down from an operational position at BharatPe in March 2022, Grover has created a model for himself via social media, podcasts, the fact present ‘Shark Tank’, and speeches and lectures he delivers at campuses across the nation. The direct relationship he has constructed on social media channels along with his viewers helped him create a story very completely different from what you’ll see within the mainstream enterprise media.

Posting selfies from the courtroom, hanging partnerships with streaming platforms for exhibits, detailing his ‘troublesome’ entrepreneurial journey, is a method to show how he’s taken on his shareholders and buyers for the great of the corporate. Grover’s followers recognize his in-your-face, brash type. However the true query is, how conscious are they that he’s engulfed in a plethora of allegations of monetary fraud which ought to ideally not make him a ‘mannequin entrepreneur’?

In distinction, the worldwide expertise world has seen large names like FTX founder Sam Bankman-Fried and Theranos founder Elizabeth Holmes being sentenced to very lengthy jail phrases for committing monetary fraud, and defrauding buyers.

Threat buyers say, submitting felony circumstances and pursuing them in India is laborious and an especially long-drawn affair. However with every occasion the place an out-of-court deal or personal settlement is reached, there are various new ones that may emerge.

What’s much more problematic is that some founders who’ve confronted scrutiny for alleged involvement in company governance failures, reemerge and lift new capital that tarnishes the general fame of the business. The worry then is that the new-age tech ecosystem that was anticipated to face out as being completely different from the outdated guard has began to undergo from the identical lacunae which have existed for many years in company India. Certainly, that rot mustn’t be allowed to seep in.

Samidha Sharma is Editor – ETtech. She’s been overlaying the tech and new-age digital economic system for over a decade, and has had a ringside view of the business and its individuals.