Regardless of a big development in income, Groww posted a web loss in FY24. This and extra in at the moment’s ETtech Prime 5.

Additionally within the letter:

■ Increase time for non secular apps

■ Prosus’ ecomm plans for 2025

■ Antitrust probe sought in opposition to q-comm gamers

Groww pays Rs 1,340 crore tax invoice for domicile shift, results in Rs 805 crore of losses

Groww cofounder Lalit Keshre

Stockbroking platform Groww reported a 119% soar in income to Rs 3,145 crore for the yr ended March 31, 2024, from Rs 1,435 crore within the earlier yr.

Inform me extra: Regardless of the income surge, Groww posted a web lack of Rs 805 crore after a one-time tax cost of Rs 1,340 crore, associated to the relocation of its headquarters from the US to India. Operational revenue, nevertheless, rose to Rs 535 crore, from Rs 458 crore in FY23.

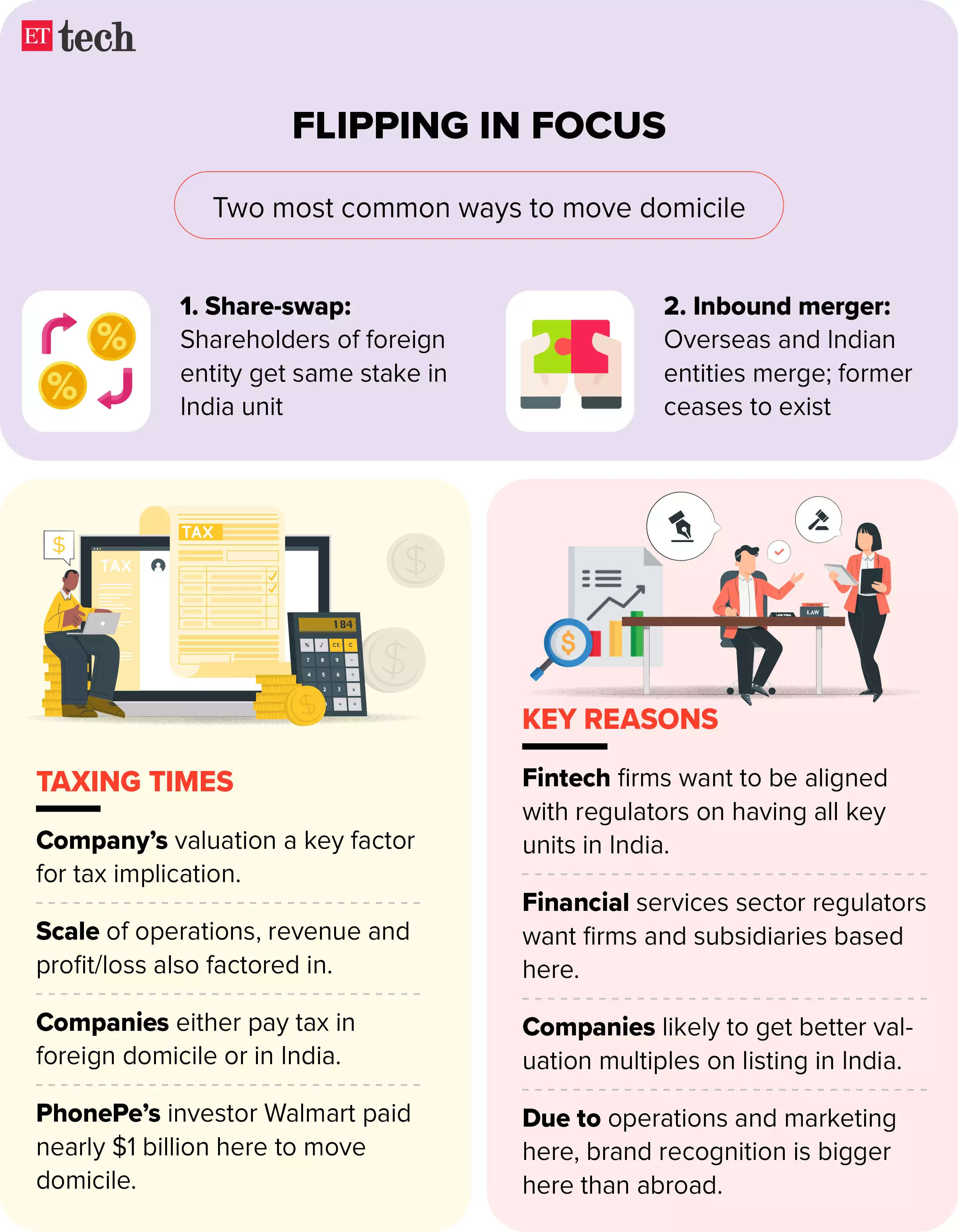

Expensive relocation: The relocation follows a rising pattern amongst Indian startups, often known as “reverse-flipping”, the place companies shift their domicile to India to profit from the nation’s evolving startup ecosystem. The transfer, nevertheless, comes with important tax implications. For instance, fintech big PhonePe confronted a tax invoice of Rs 8,000 crore for the same transfer in 2022, and Razorpay is anticipated to pay as much as $200 million because it completes its restructuring, as reported by us.

Recap: Income from Groww’s core broking enterprise greater than doubled in FY24 to Rs 2,899 crore from Rs 1,294 crore in FY23, as beforehand reported by us.

Diversifying income: On September 26, ET reported that low cost brokers like Groww had been more and more coming into the enterprise of offering margin-trading amenities, in search of to diversify their income channels, particularly with regulatory scrutiny impacting the core revenue-generating enterprise of futures and choices buying and selling.

Additionally Learn: Groww surpasses Zerodha, turns into primary dealer by way of lively shoppers

PhonePe FY24 working income up 73% to Rs 5,064 crore, loss down 28%

PhonePe CEO Sameer Nigam

Digital funds main PhonePe narrowed its web loss by 29% within the final monetary yr to Rs 1,996 crore from Rs 2,795 crore in FY23.

Numbers:

- Working income was Rs 5,064 crore vs Rs 2,914 crore a yr in the past

- Internet loss fell 29% to Rs 1,996 crore

- General bills climbed 31% on-year to Rs 7,756 crore

Inform me extra: PhonePe diversified its income streams by way of the distribution of mutual funds, credit score and different measures, which helped the corporate stabilise its topline and present sturdy development.

The corporate can be constructing income channels from its greater than 4 crore service provider base by promoting sound containers and point-of-sales machines.

What else: PhonePe has tightened its steadiness sheet with regard to cashback and incentive-based bills by spending solely Rs 15 crore in cost incentives in FY24. Compared, it had spent Rs 950 crore in FY19, on the peak of the cashback battle with rivals Paytm and Google Pay. The fintech agency additionally minimize down its customer support crew by 60% to round 400 brokers.

Additionally Learn | UPI market share cap directive a spoiler for IPO plans: PhonePe’s Sameer Nigam

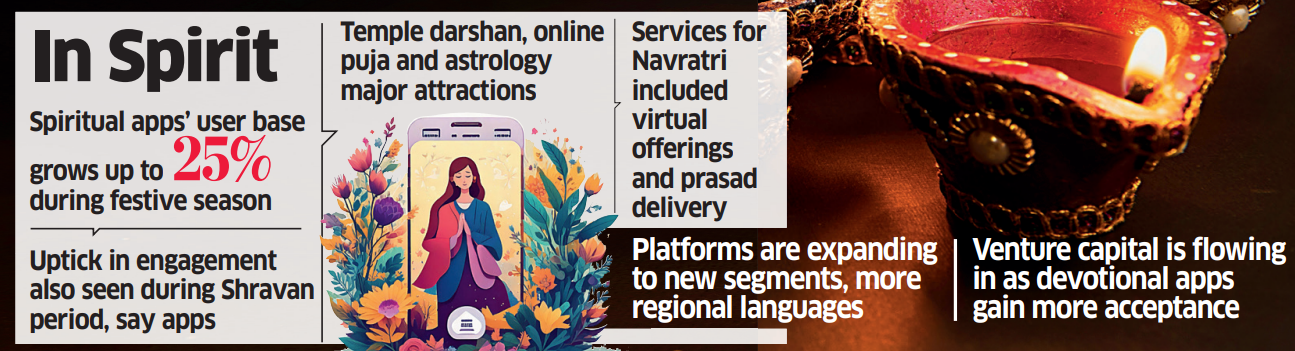

Increase time for non secular apps; consumer exercise set for surge in Diwali

Non secular and devotional app makers anticipate a surge in enterprise this Diwali, after growth of providers comparable to on-line puja and digital choices to the deity throughout Navratri led to a pointy enhance in consumer engagement, stated business executives.

Festive increase: Apps comparable to AppsForBharat, Vama.app, Astrotalk and DevDham witnessed important development this Navratri, which ended on October 12, and are gearing up for Diwali, which falls on November 1 this yr.

New customers: “Due to Navratri, we launched new services,” Manu Jain, cofounder of Blume Ventures-backed Vama. app, informed ET. “In consequence, we’re seeing an uptick of round 20-25% (month-on-month) in new customers general.”

Prashant Sachan, founding father of AppsForBharat, the mum or dad firm of Sri Mandir, stated that in the course of the latest Shravan season, the platform noticed round 850,000 darshans and 12,000 devotees participated in on-line pujas.

Rising sector: India’s burgeoning spiritual and non secular apps phase has attracted important funding from enterprise capital companies. On July 7, ET reported {that a} post-Covid-19 pandemic surge in on-line engagement and a rising curiosity in non secular practices in latest occasions had revived the fortunes of apps providing non secular and devotional providers.

Prosus to spice up ecommerce revenue to $400 million for 2025

Prosus NV plans to ship $400 million in adjusted earnings earlier than curiosity and tax from its ecommerce operations within the yr to end-March, and sees this enhancing in future, chief govt officer Fabricio Bloisi stated.

Quote, unquote: “In fiscal yr 2024, the group improved its ecommerce adjusted earnings earlier than curiosity and taxes (Ebit) by greater than $400 million, and our intent is to maintain that tempo up this yr and ship $400 million in adjusted Ebit from our ecommerce operations,” he stated in a letter about his first 100 days as CEO of the South African-Dutch tech group. “I don’t anticipate this tempo of enchancment to decelerate subsequent yr both.”

Ecommerce development: Within the first half of the yr, ecommerce income development accelerated from fiscal 2024, producing about 3 times the adjusted Ebit than it did throughout all of final yr, he stated.

“It’s crucial that our core ecommerce enterprise turns into a much bigger supply of profitability and free money circulation for the group,” Bloisi added.

Additionally Learn | ETtech Unique | Closing new offers in India regardless of Byju’s debacle: Prosus CEO Fabricio Bloisi

Retail group seeks predatory pricing probe into Swiggy, Blinkit, Zepto

India’s largest group of retail distributors has requested the antitrust authority to research three fast commerce firms – Zomato’s Blinkit, Swiggy and Zepto – for alleged predatory pricing, a letter confirmed on Sunday.

Driving the information: In a letter dated October 18, All India Shopper Merchandise Distributors Federation (AICPDF), which represents 400,000 retail distributors of main firms together with Nestle and Hindustan Unilever, informed the antitrust physique that fast commerce companies had been practising predatory pricing – or providing deep reductions and promoting under price to lure prospects.

Information reveals: Annual gross sales on Indian fast commerce platforms are set to exceed $6 billion this yr, with Blinkit having a virtually 40% market share, and Swiggy and Zepto round 30% every, analysis agency Datum Intelligence stated.

Additionally Learn | Fast commerce’s burning brighter as gamers add extra gasoline

Right this moment’s ETtech Prime 5 e-newsletter was curated by Riya Roy Chowdhury in Bengaluru.