Manipal Group boss Ranjan Pai has pumped Rs 1,400 crore into Bjyu’s subsidiary Aakash Institute, enabling the embattled edtech main to clear its debt to Davidson Kempner. This and extra in at the moment’s ETtech Prime 5.

Additionally on this letter:

■ ETtech Offers Digest

■ Blinkit’s festive season rush on Dhanteras

■ Infographic Perception: Festive season to create frontline jobs

Programming be aware: We’ll be off for the following few days. ETtech’s every day newsletters will probably be again on November 15. Wishing all our readers a brilliant and affluent Diwali. 🪔 🪔

Ranjan Pai books an Aakash seat with Rs 1,400 crore to clear Davidson Kempner debt

Manipal Schooling and Medical Group chairman Ranjan Pai

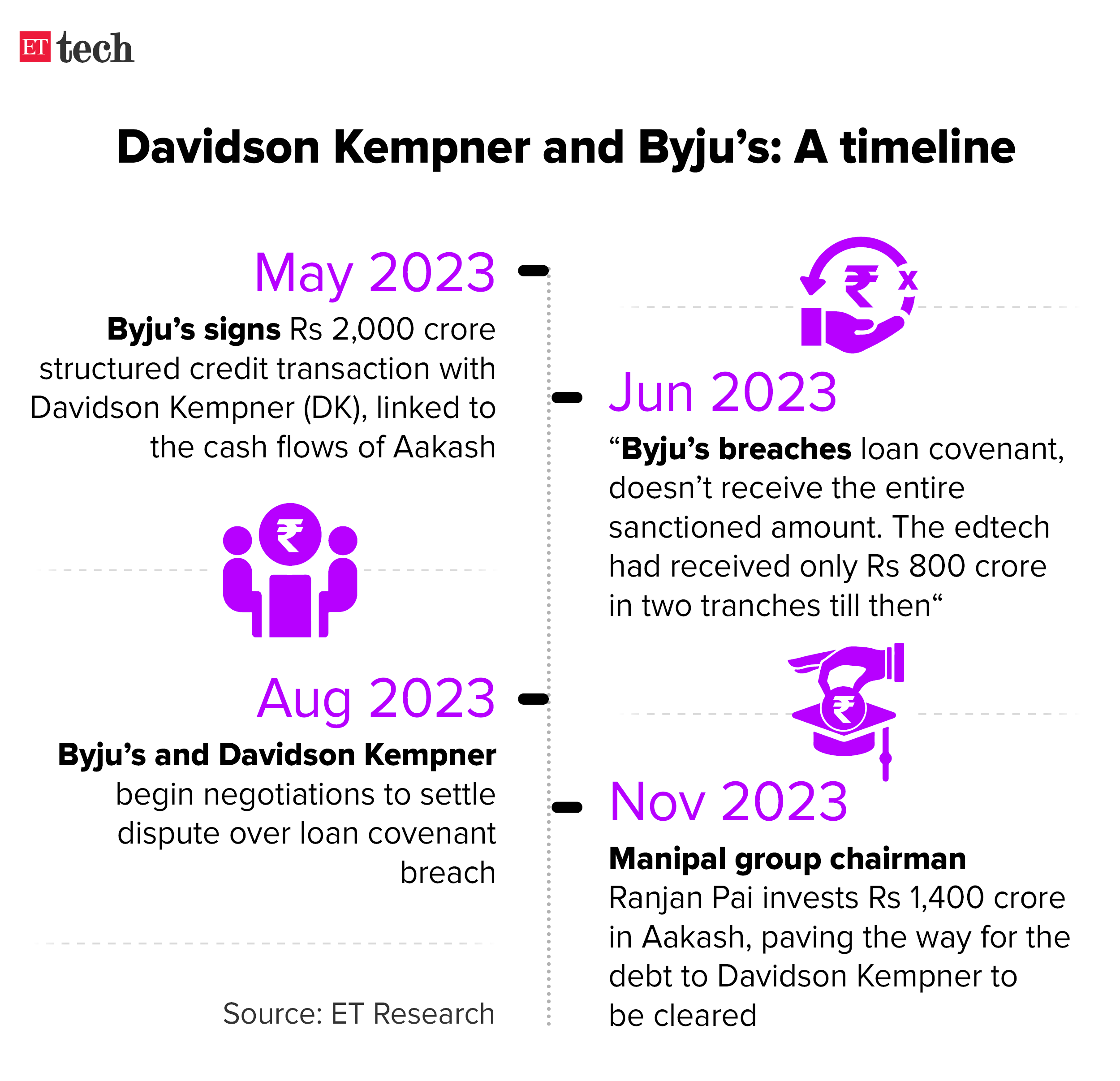

Ranjan Pai, chairman of Manipal Schooling and Medical Group, has invested Rs 1,400 crore (roughly $168 million) in Byju’s test-prep subsidiary, Aakash Institute. This funding is to clear the corporate’s debt to US-based lender Davidson Kempner Capital Administration, in accordance with sources accustomed to the matter.

Mortgage particulars: In Could, Byju’s entered right into a structured credit score deal value Rs 2,000 crore ($240 million) with Davidson Kempner, utilizing the money flows of Aakash Institute. Nevertheless, Byju’s acquired solely about Rs 800 crore ($96 million) in two tranches, after which it breached a mortgage covenant.

Pai issues: He’s prone to get two board seats at Aakash as a part of the funding and will probably be approaching the antitrust regulator quickly.

Achieve for Davidson: Out of the Rs 1,400 crore being transferred to Davidson Kempner, Rs 800 crore is the mortgage quantity, whereas the remaining Rs 600 crore accounts for curiosity. This can be a 75% acquire for the US lender.

Pai-Chaudhry connection: Pai’s funding in Aakash coincides with Aakash Chaudhry’s completion of the share-swap in Byju’s mum or dad firm, Assume and Study, as per the preliminary deal introduced two years in the past. Chaudhry, Aakash’s promoter, is ready to return as CEO. ET had reported on October 12 that Pai was in talks with non-public fairness corporations to put money into the teaching enterprise as soon as the share-swap was executed.

Within the subsequent 30-45 days, Pai is predicted to finalise ongoing funding discussions for Aakash, securing a projected 25-30% stake within the firm. His investments will probably be in the direction of Aakash and never Assume and Study.

Learn ETtech’s detailed protection on the developments at Byju’s

HP, Lenovo amongst firms prone to get PLI nod quickly

The Centre is prone to approve 10 IT {hardware} manufacturing proposals from the 40 that it has acquired underneath the production-linked incentive (PLI) scheme, sources instructed ET. Corporations whose proposals haven’t made the minimize have been requested to submit reworked functions with extra particulars.

Who made the minimize? Proposals from HP India, Lenovo India and Flexotronics are prone to be accepted. Padget (Dixon Applied sciences), VVDN, Netweb, Syrma, Optiemus and Kaynes Tech are a number of the different vital firms that will additionally make the minimize.

Inform me extra: An official mentioned that within the coming days, 20 extra firms are prone to obtain approvals underneath the scheme. “Our goal is (to approve) as much as 30 firms, which will probably be needed for the merchandise to have important mass not simply in India however in worldwide markets as properly.”

Extra investments: In August, the federal government had mentioned that it had acquired proposals from 40 firms with anticipated incremental investments of Rs 5,010 crore. This was in the direction of further manufacturing value Rs 4.65 lakh crore over six years, together with exports of Rs 28,288 crore in the course of the interval.

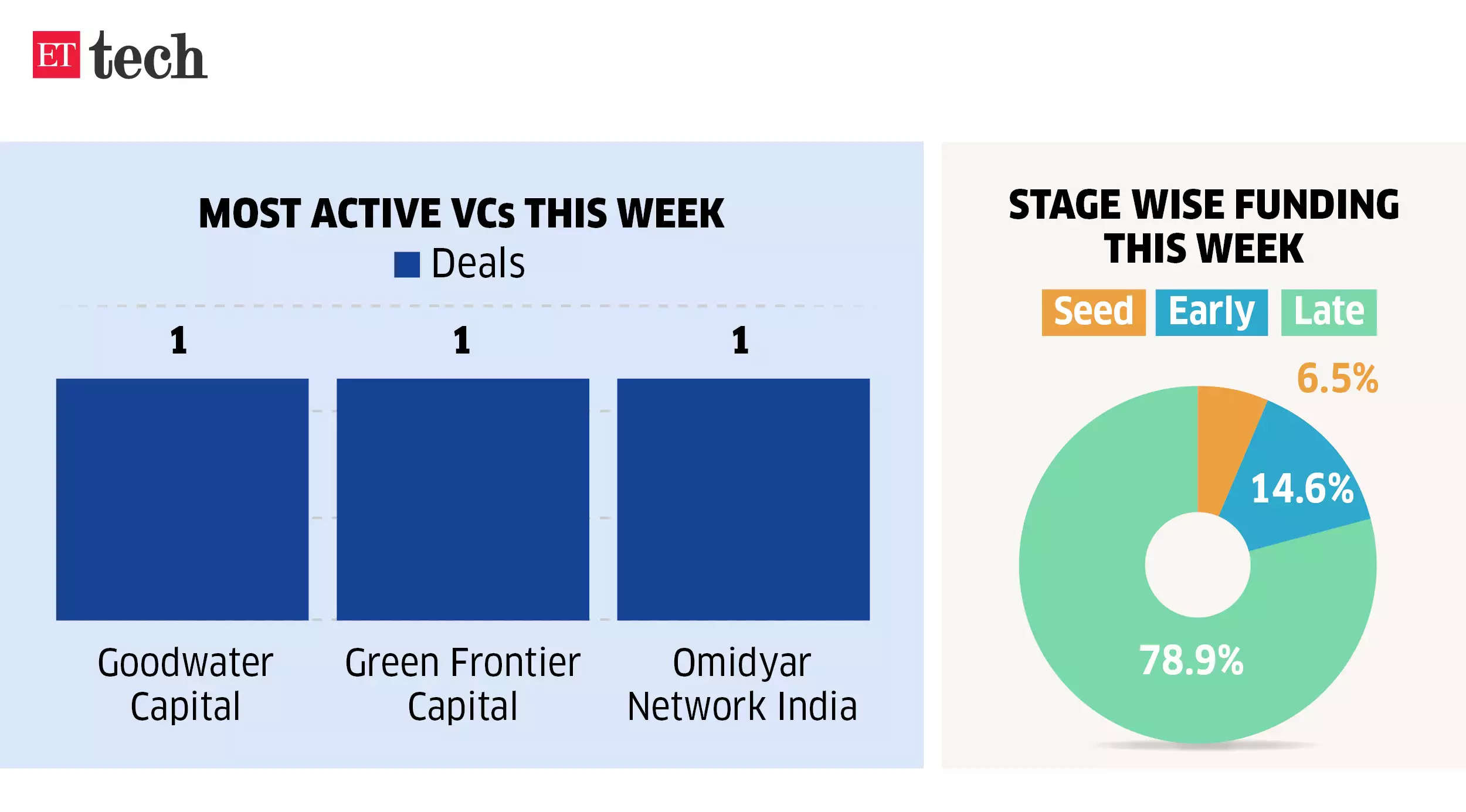

ETtech Offers Digest: Weekly funding up on 12 months at $167 million, however dips sequentially

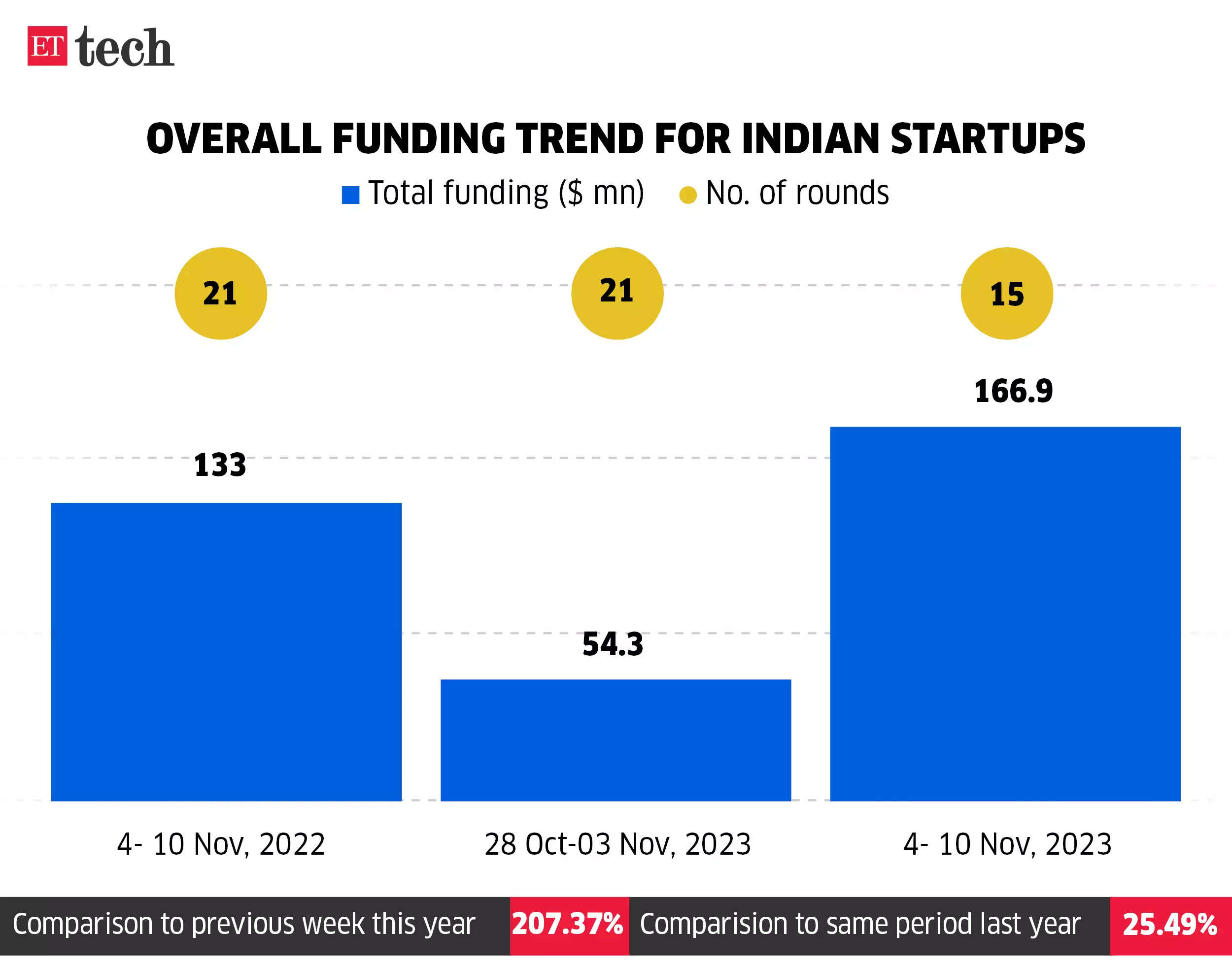

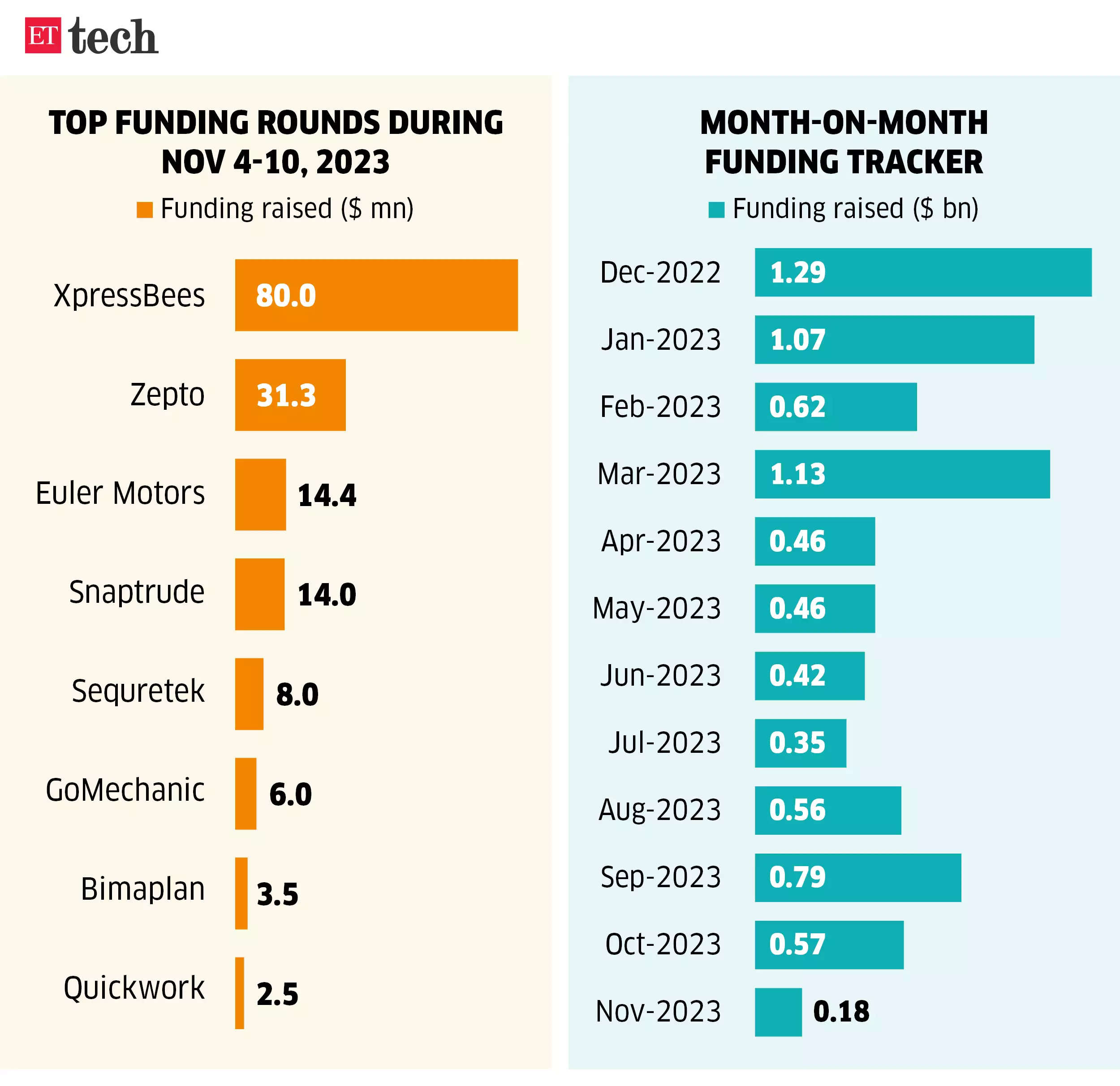

The funding local weather for Indian expertise startups improved 12 months over 12 months, with $166.9 million deployed throughout 15 funding rounds within the week of November 4-10, in accordance with knowledge from Tracxn.

Within the comparable week in 2022, startups had raised $133 million throughout 21 funding rounds. The offers this week averaged about $11.13 million every, versus $6.33 million per deal in 2022.

Sequentially, the week noticed a 29% decline by way of complete quantity, and a 207.5% rise in worth phrases. The continuing funding winter started to set in from September 2022

Learn in regards to the high offers of this week right here

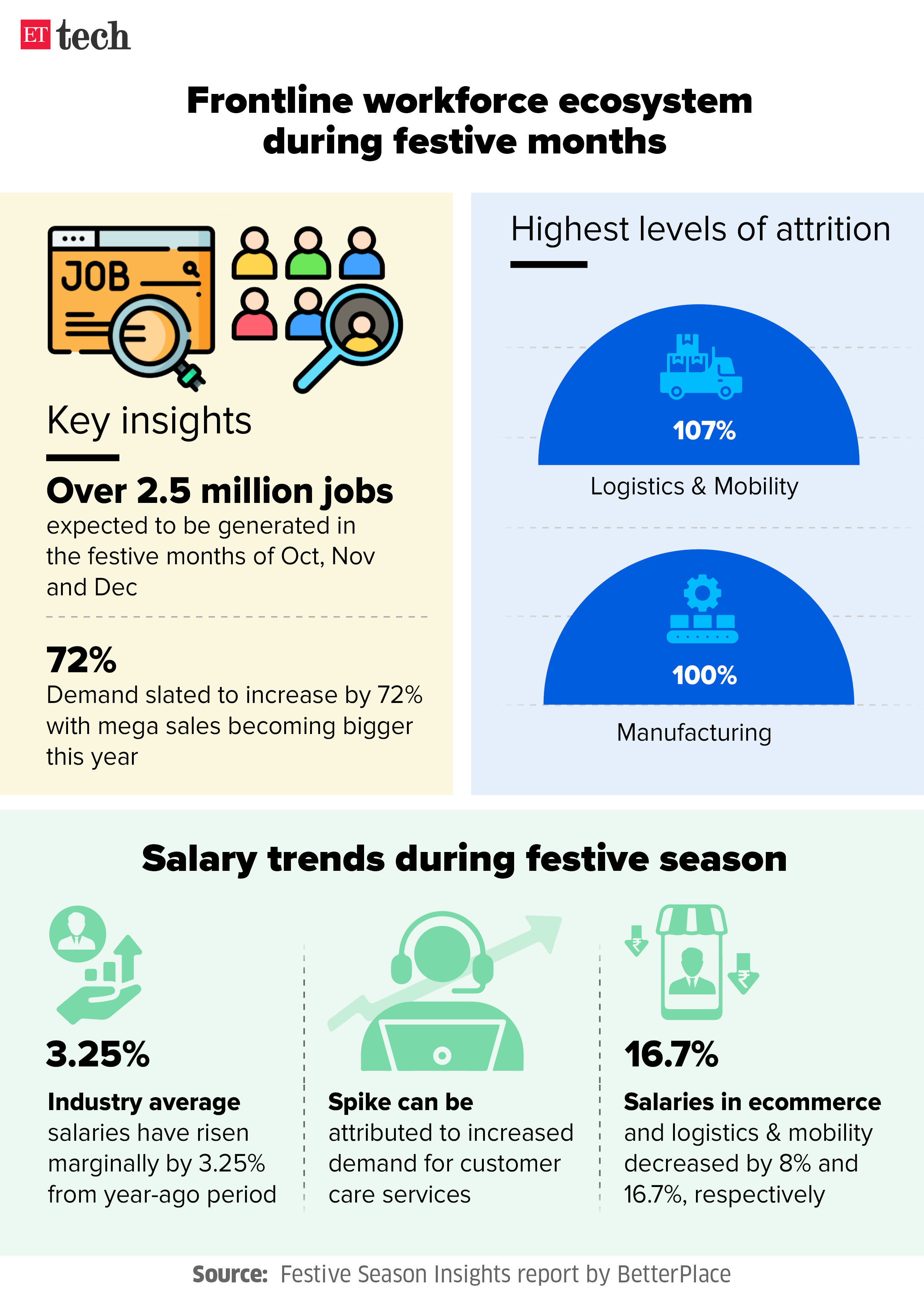

Infographic Perception | On-line festive season to create 2.5 million frontline jobs

The present festive season is anticipated to log a 72% year-on-year enhance in demand, producing new employment alternatives as companies scramble to satisfy the surge in demand, per a report by SaaS platform BetterPlace.

Quote unquote: “The festive season is a giant alternative for frontline staff. Furthermore, we’re seeing that industries that rent semi-skilled staff pay salaries which are increased than these of industries that rent unskilled staff,” mentioned Pravin Agarwala, cofounder and Group CEO, BetterPlace.

Gross sales off to a brilliant begin: We had earlier reported that Flipkart and Amazon India—the 2 largest ecommerce gamers within the nation—had each indicated that their festive gross sales had begun on a brilliant be aware.

Sources instructed us that Flipkart is on track to clock round Rs 33,000-36,000 crore in gross merchandise worth (GMV) in the course of the ongoing festive season sale. This can mark a rise of 15-20% from the GMV recorded by the ecommerce main in 2022.

Dhanteras: Gross sales of gold cash, silver cash and brooms surge on Blinkit

Zomato’s quick-commerce arm Blinkit witnessed a major enhance in gross sales of gold and silver cash, together with different Dhanteras-related objects on Friday, signifying a shift in how India is searching for festivals.

Why the surge? Dhanteras, or Dhanatrayodashi, which occurs to fall on November 10 this 12 months, marks the start of the Diwali pageant in numerous areas throughout the nation. It’s thought of auspicious to purchase objects manufactured from gold, silver and brass on today, as they’re believed to carry prosperity and success into individuals’s lives.

“Dhanteras muhurat (auspicious time) hasn’t even began and we’re already near hitting half of the gold and silver cash gross sales from final 12 months,” Blinkit CEO Albinder Dhindsa wrote on X.

Issues in demand: Along with the uptick in gold and silver coin gross sales, there was a notable enhance within the buy of brooms, thought of auspicious throughout this time, Dhindsa added.

“We realized that it’s auspicious to purchase jhadu (brooms) at the moment when brooms obtained stocked out in any respect our darkish shops on Dhanteras 2 years in the past,” Dhindsa wrote.

Contemporary flowers and leaves had been one other high-selling class for Blinkit, mentioned Dhindsa.

Merchandise like metal utensils and residential electronics had been additionally amongst these experiencing elevated demand on quick-commerce platforms.

In the present day’s ETtech Prime 5 e-newsletter was curated by Megha Mishra in Mumbai and Siddharth Sharma in Bengaluru.