Hello, that is Pranav Mukul in New Delhi. This week, on February 13 and 14, once I attended India’s largest edtech gathering – the ASU + GSV & Emeritus Summit, arguably probably the most well-known (or notorious), relying on who you ask – one identify from the Indian edtech scene was lacking.

Nevertheless, beleaguered Byju’s identify was solely lacking from the formal setup, together with the record of audio system, programme agenda and different such literature. Off-stage, it was among the many most mentioned names at an occasion attended by the who’s who of the ecosystem.

My colleague Digbijay and I spoke to famed edtech investor GSV Ventures’ managing associate Deborah Quazzo and requested her in regards to the affect of the entire Byju’s episode on the sector and investor sentiment.

On the sidelines of the occasion, Upgrad cofounder Ronnie Screwvala huddled up with a gaggle of founders and edtech leaders to debate the best way ahead from the notion hit, which the sector has taken because of the doings of only one firm. My colleague Jessica Rajan bought the main points of this closed-door assembly.

Each Quazzo and Screwvala echoed a standard thought in regards to the Byju’s episode – the vital function of traders, in addition to investments, in circumstances of company misgovernance.

“Edtech goes out and in of favour… It’s a very exhausting sector to get worthwhile, to keep up progress. It’s additionally bought all types of regulatory friction… however the larger challenge we’re listening to is about India… is there (a difficulty) about transparency or governance. I wish to argue that it’s the investor’s duty to drive these necessities (on company governance),” Quazzo instructed us in an interview.

Additionally learn | From $22 billion to $1 billion: Byju’s valuation at BlackRock backside

In the meantime, Screwvala additionally emphasised upon the necessity for traders to boost the proper questions on the proper time. He additionally underscored that the sector wanted to vary with frugality.

“I feel it’s a joint accountability of the founder and 51 traders, who clearly felt that it was extra vital in a board assembly to ask, ‘When’s your subsequent secondary?’ versus ‘I do not see a chief monetary officer (CFO) within the room’”, he stated, highlighting that the Byju’s case doesn’t maintain the entire studying, skilling, schooling sector to ransom.

An nameless quote I learn on the web lately didn’t make a lot sense initially. It went: “Don’t attempt to make your presence seen, simply make your absence felt.”

Nevertheless, attending the two-day occasion in a brisk and sunny Gurugram made that message very clear certainly.

Edtech Information

Byju’s asset sale hangs fireplace amid investor flare-ups: Byju’s plan to promote belongings, together with Nice Studying, has stalled amid mounting monetary challenges stemming from time period mortgage B (TLB) investor calls for and discord with stakeholders, stated potential consumers who’ve been approached. They’re ready in expectation of a decreasing of the acquisition value, they instructed ET.

Ronnie Screwvala meets edtech founders to debate affect of Byju’s controversy: Upgrad founders Ronnie Screwvala and Mayank Kumar met with a number of edtech founders to debate the affect of the Byju’s controversy on the trade. In addition they addressed varied issues pertaining to the edtech sector, equivalent to teaching laws.

Screwvala had stated on Wednesday that an excessive amount of fundraise could be detrimental to the sector, because it must concentrate on change with frugality.

Put up Byju’s, traders anxious about governance at startups: GSV Ventures’ Deborah Quazzo | Current developments round troubled edtech agency Byju’s has put the highlight on governance amongst Indian startups, Deborah Quazzo, managing associate of edtech investor GSV Ventures, instructed ET in an interview.

High Tales This Week

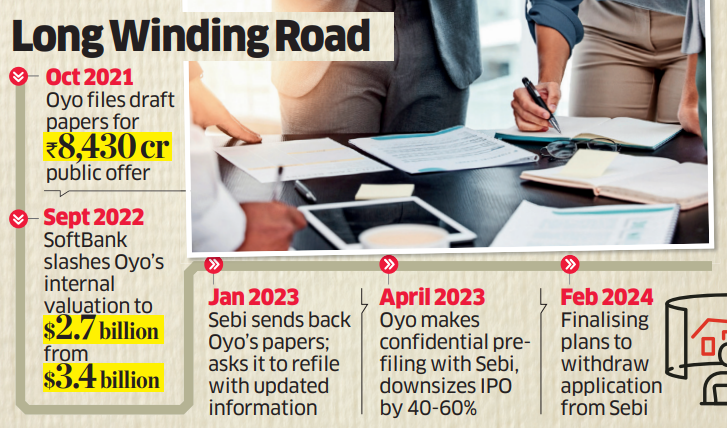

Oyo could again out of IPO plan, go for personal elevate: Oyo Inns & Houses, which first filed a draft software for an preliminary public provide (IPO) of over $1 billion in October 2021, is finalising plans to withdraw the papers from the Securities and Alternate Board of India (Sebi), folks conscious of the event instructed ET. This successfully calls a halt to the hospitality startup’s plans to go public, they stated.

Tata, Uber purpose for strategic alliance to drive digital enterprise: The Tata Group has initiated discussions with Uber Applied sciences to forge a strategic partnership with an purpose to bump up site visitors volumes and engagement on Tata’s digital platform, stated folks with information of the matter.

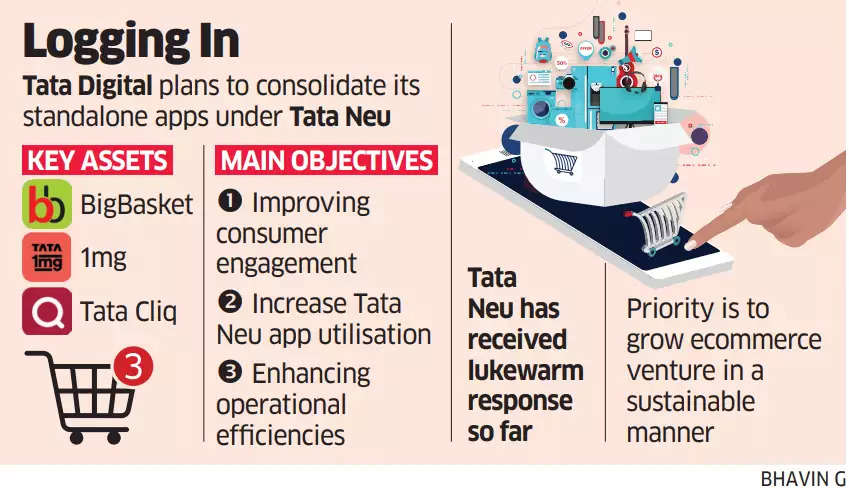

Tata Digital explores operational integration: Tata Digital is exploring integration of the operational constructions of key group belongings equivalent to BigBasket, 1mg, and Tata Cliq to streamline operations, cut back prices, and improve market responsiveness, stated folks conversant in the matter.

ET Interview | AI is not going to solely remedy challenges for India but in addition for the world: Satya Nadella | Synthetic intelligence (AI) is not going to solely assist remedy India’s distinctive structural challenges and assist enhance productiveness and societal advantages, however these options for India could turn into related for the remainder of the world as properly, Satya Nadella instructed ET throughout his annual go to to the nation final week.

Tesla could head to India on incentive-paved highway: US electrical automaker Tesla might quickly arrange store in India, with the federal government near finalising a coverage to increase concessional import duties on electrical automobiles exceeding Rs 30 lakh (about $36,000) for 2-Three years.

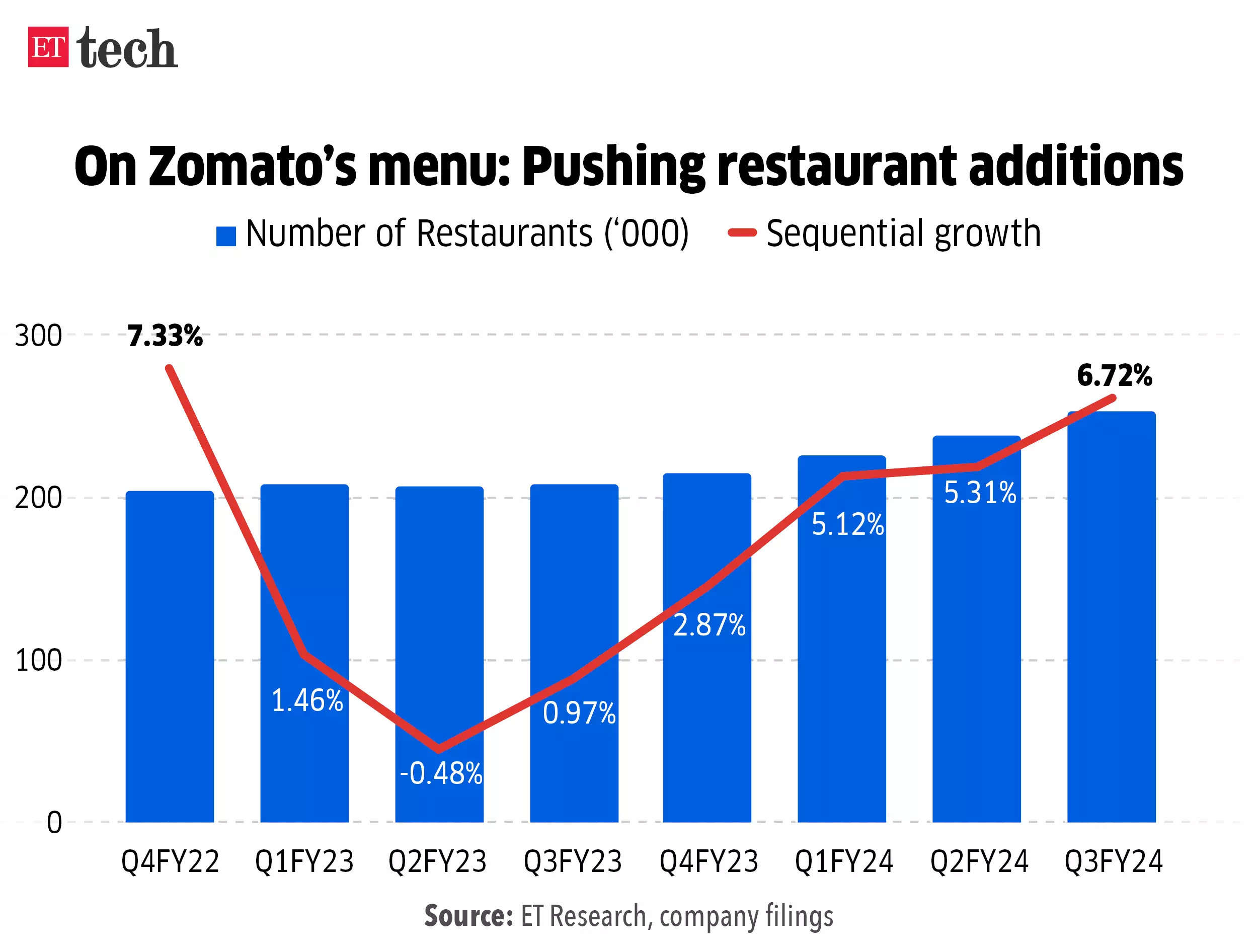

Zomato steps up restaurant signups as slowdown bites: Zomato final week indicated restaurant additions on its platform as a major contributor to the 27% year-on-year progress within the gross order worth (GOV) at its food-delivery enterprise, contemplating that the corporate is witnessing a broader slowdown in discretionary spending.

Google pushing a substitute for WhatsApp enterprise messaging: The US search large is pushing an alternate cell phone messaging system within the nation that might disrupt the rising use of WhatsApp by enterprises for speaking with prospects.

Paytm Nook

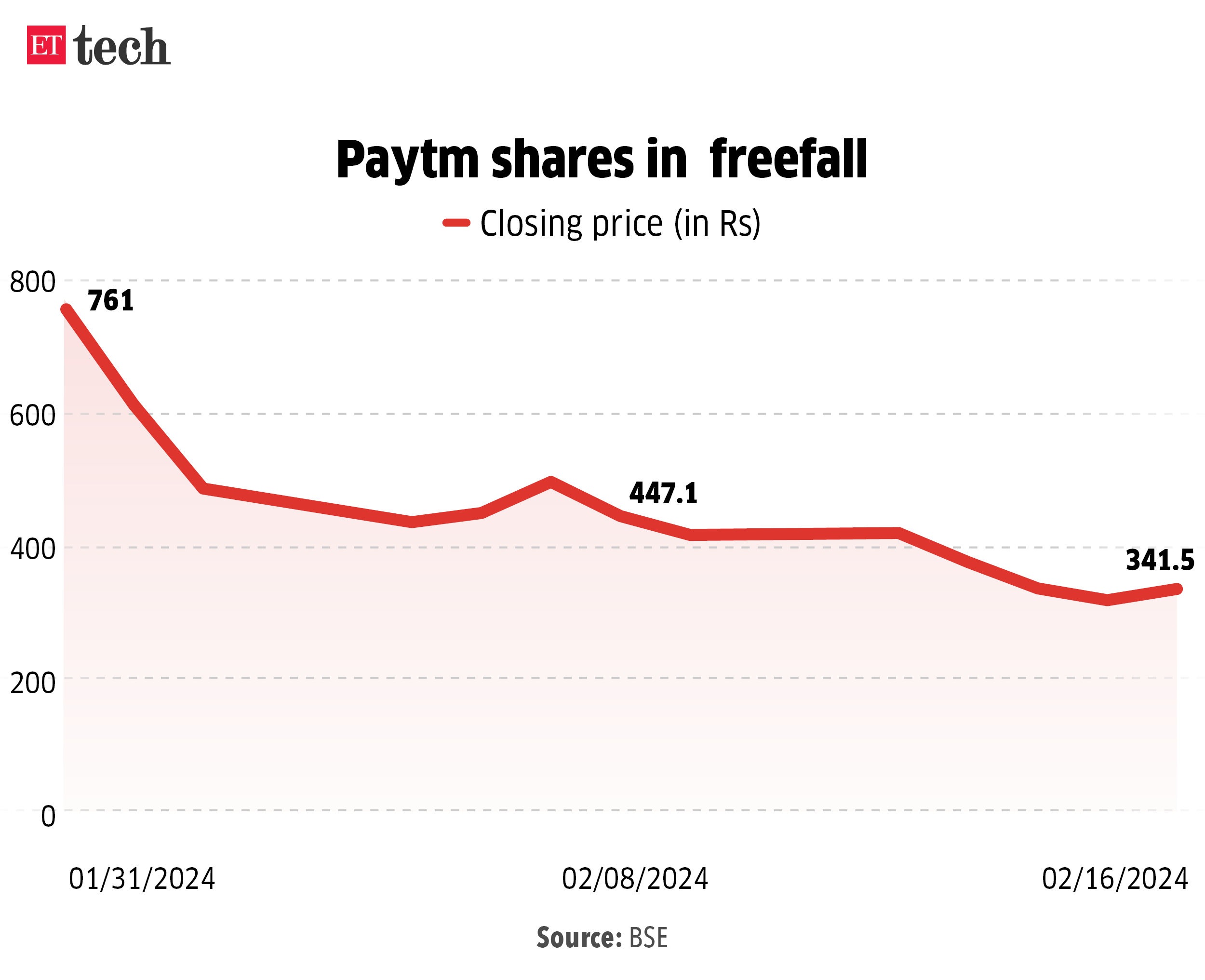

Paytm shifts back-end fee settlements to Axis Financial institution from Paytm Funds Financial institution: One 97 Communications, which runs Paytm, has shifted its nodal accounts or escrow accounts to private-sector lender Axis Financial institution, the corporate stated in a submitting to the BSE.

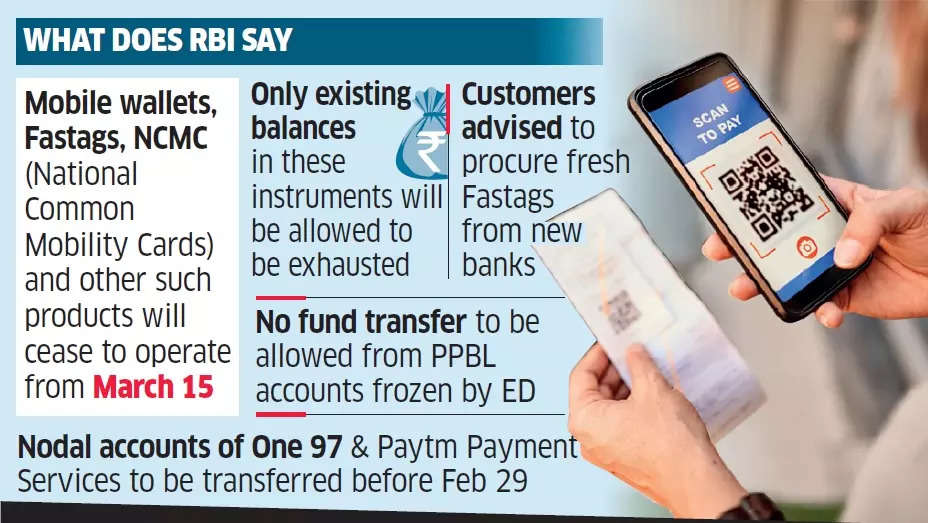

The central financial institution additionally gave Paytm Funds Financial institution a 15-day extension to proceed providing banking companies, past which prospects will solely have the ability to withdraw funds from these accounts, pay as you go wallets or Fastags.

Additionally learn |RBI’s Paytm FAQs: What occurs to your EMIs, electrical energy payments?

Earlier this week, RBI governor Shaktikanta Das had instructed reporters that there was “hardly any room” to assessment the motion taken in opposition to Paytm Funds Financial institution.

ED quizzes Paytm Funds Financial institution officers: The Directorate of Enforcement (ED) quizzed Paytm Funds Financial institution officers this week in reference to its probe into alleged violations of Overseas Alternate Administration Act (Fema) by entities utilizing the financial institution, sources instructed ET.

Additionally learn | Paytm Funds Financial institution taken out of NHAI record to promote Fastags

Paytm’s UPI funds: Two contrasting developments | Digital funds main Paytm, which is run by One 97 Communications, has seen a stagnation in Unified Funds Interface (UPI) funds originating from its funds financial institution during the last six months.

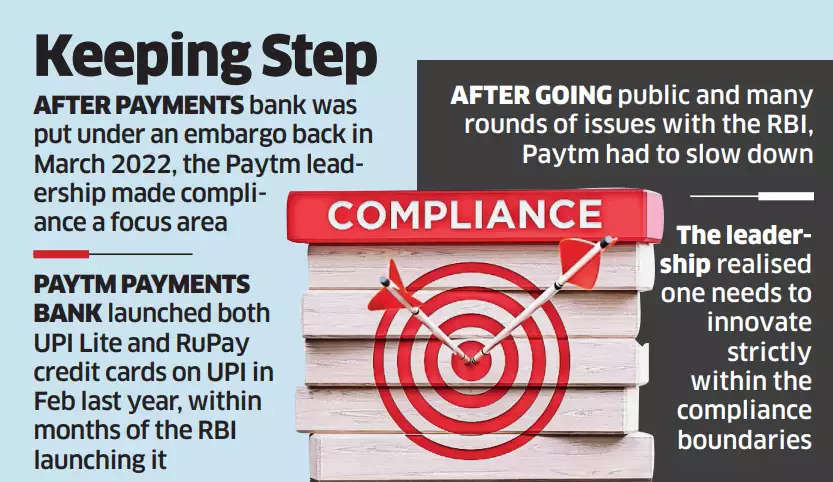

Paytm’s change to compliance-first mode seen too little, too late: After the funds financial institution was put underneath an embargo again in March 2022, the Paytm management did make compliance a spotlight space, in keeping with a number of folks within the know. Whereas the corporate would possibly declare its excessive compliance requirements, it appeared to have fallen in need of the RBI’s expectations.

Additionally learn | Paytm Cash appoints Vipul Mewada as CFO

Different Fintech Strikes

Visa, Mastercard cease enterprise funds by way of business playing cards submit RBI directions: In a transfer that caught the trade abruptly, the RBI requested card networks like Visa and Mastercard to cease card-based business funds made by firms and small enterprises.

Additionally learn | Right here’s why RBI positioned B2B card pay on full maintain

P2P corporations go straightforward on partnership enterprise as RBI sounds alert: In response to the founders of a number of of those lending platforms, on condition that the Reserve Financial institution of India is scrutinising the sector, they’re adopting a “wait-and-watch” coverage earlier than stitching these deep integrations.

IT/Hiring Information

HCLTech asks staff to report back to workplace thrice per week: India’s third largest software program companies agency HCLTech has requested its staff to report back to workplace thrice per week beginning February 19. Workers who don’t comply with the directive will face disciplinary motion as per firm coverage.

Additionally learn | Financial institution of America names Infosys US unit for over 57,000 customers knowledge leak

India IT companies corporations heighten candidate scrutiny, take longer to shut mandates: India’s IT companies expertise panorama continues to current a bleak image for the subsequent two quarters ending September 2024 with mandate fulfilment or conversion ratio at an all-time low of about 25%, a pointy decline from the pre-pandemic interval (FY20) fulfilment ratio of 48-52%.

About 13,500 staff from Byju’s, Paytm get on job-hunting mission: The job market at the moment has over 6,500 energetic and accessible professionals from Paytm and one other 7,000 from Byju’s, confirmed knowledge from in style job boards and portals put collectively for ET by specialist staffing co Xpheno.

Different High Reads

ETtech Offers Digest: Startup funding jumps 77% to $144 million this week