Embattled edtech startup Byju’s has arrived at a settlement with the Board of Management for Cricket in India. Particulars on this and extra in in the present day’s ETtech High 5.

Additionally on this letter:

■ Freshworks Q2 outcomes

■ Ola Electrical CEO slams MayMyIndia

■ Unicommerce information RHP for IPO

Byju’s reaches settlement with BCCI; no NCLAT ruling but

Byju Raveendran, the founding father of edtech agency Byju’s, and the Board of Management for Cricket in India (BCCI) have reached a settlement of their Rs 158-crore sponsorship dues dispute.

Driving the information: The Nationwide Firm Regulation Appellate Tribunal (NCLAT) has not handed an order on the matter as a gaggle of US lenders has opposed the settlement, claiming that the cash belongs to them and never Raveendran.

The edtech agency had raised a $1.2-billion time period mortgage B from these lenders.

Firm’s stance: Arun Kathpalia, counsel for the founder, knowledgeable the NCLAT on Wednesday that a part of the settlement quantity was already paid on Tuesday. The settlement cash is being paid by the edtech founder’s brother and firm board member, Riju Ravindran, who can also be the biggest shareholder.

Recap: The BCCI had moved NCLT underneath the Insolvency and Chapter Code (IBC) over a default of Rs 158 crore by Byju’s father or mother, Assume & Be taught.

The corporate had signed a jersey sponsorship settlement with BCCI in March 2019 for 3 years, which was prolonged by a 12 months. The corporate made the funds till September 2022, and the dispute is over the nonpayment throughout the interval October 2022 to March 2023.

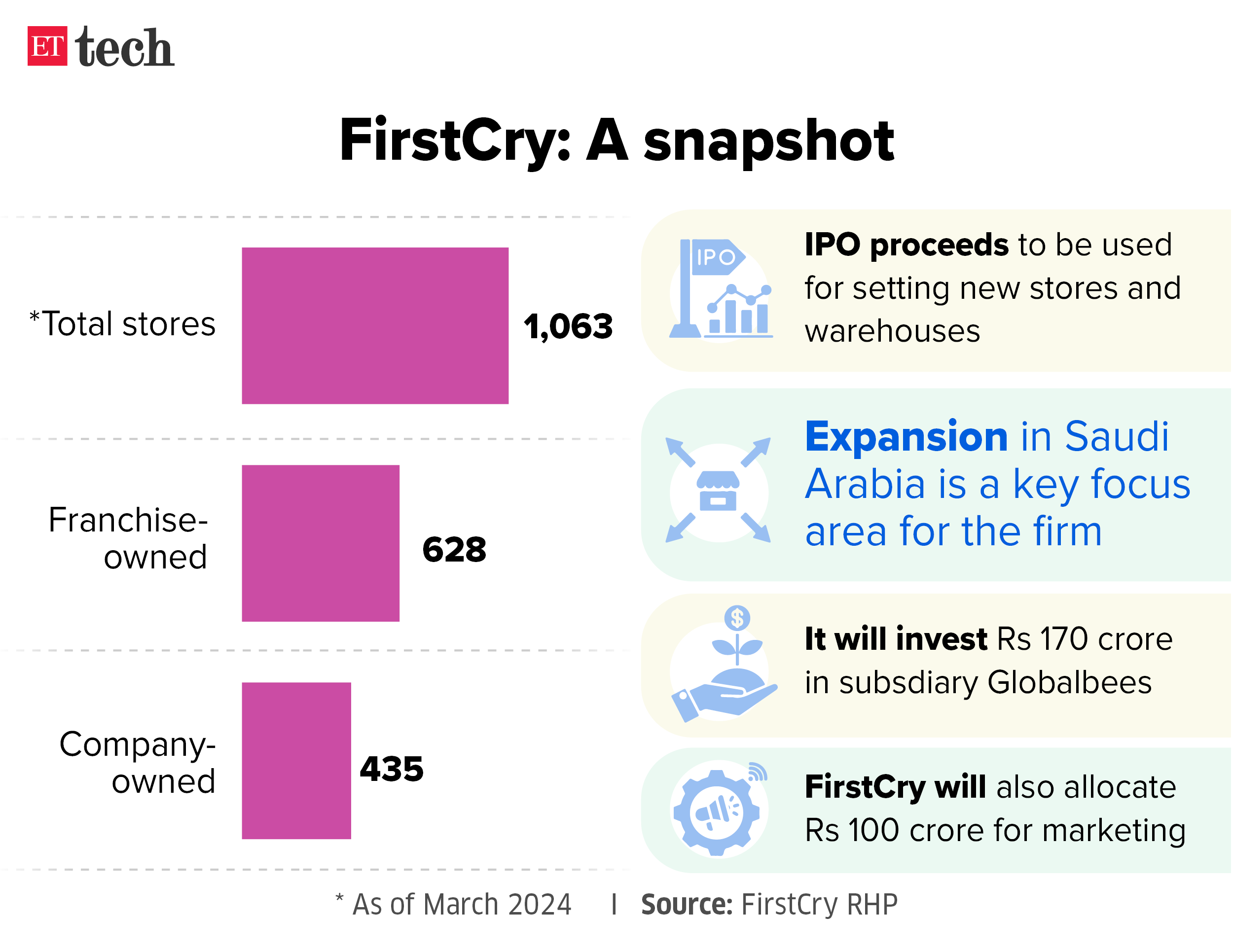

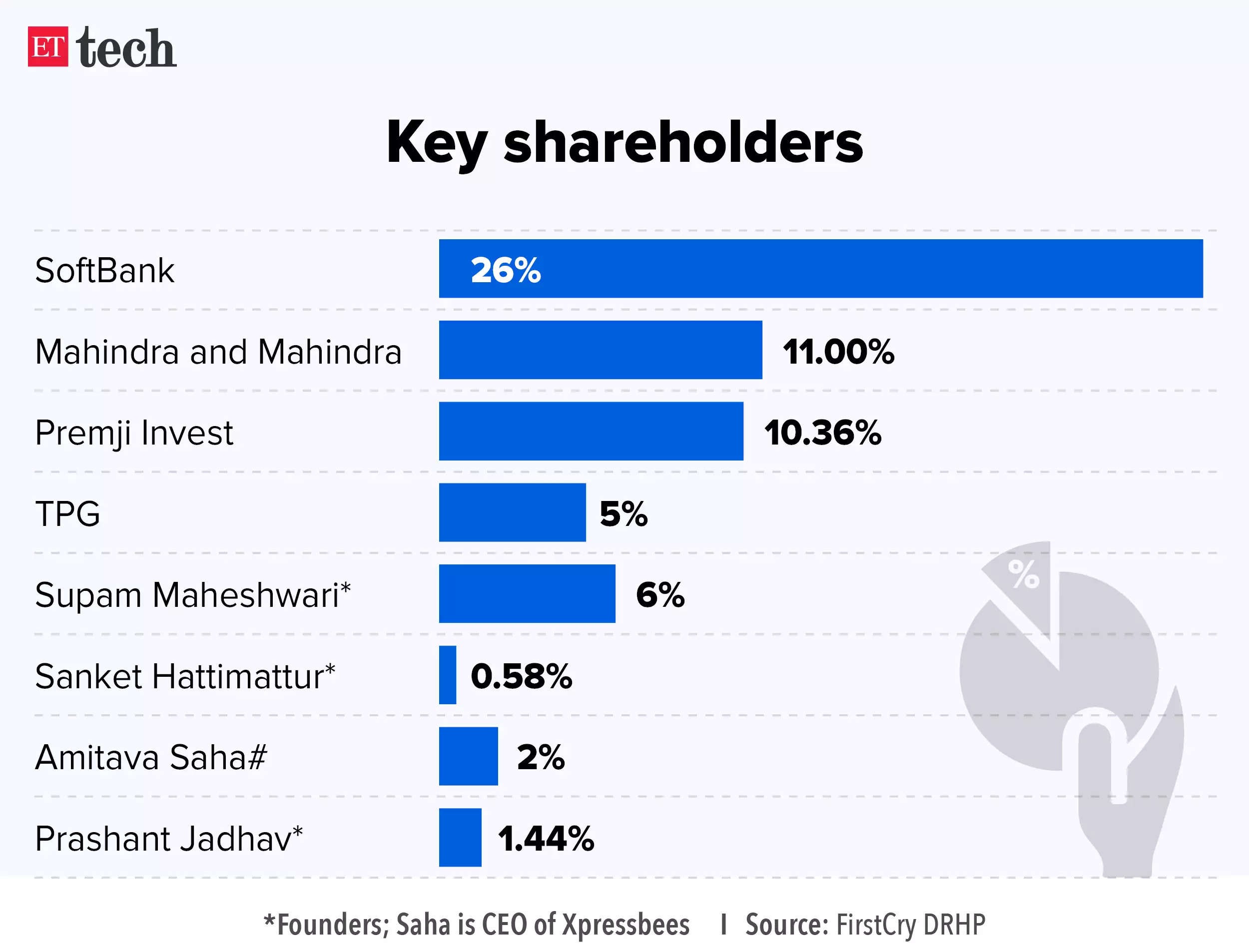

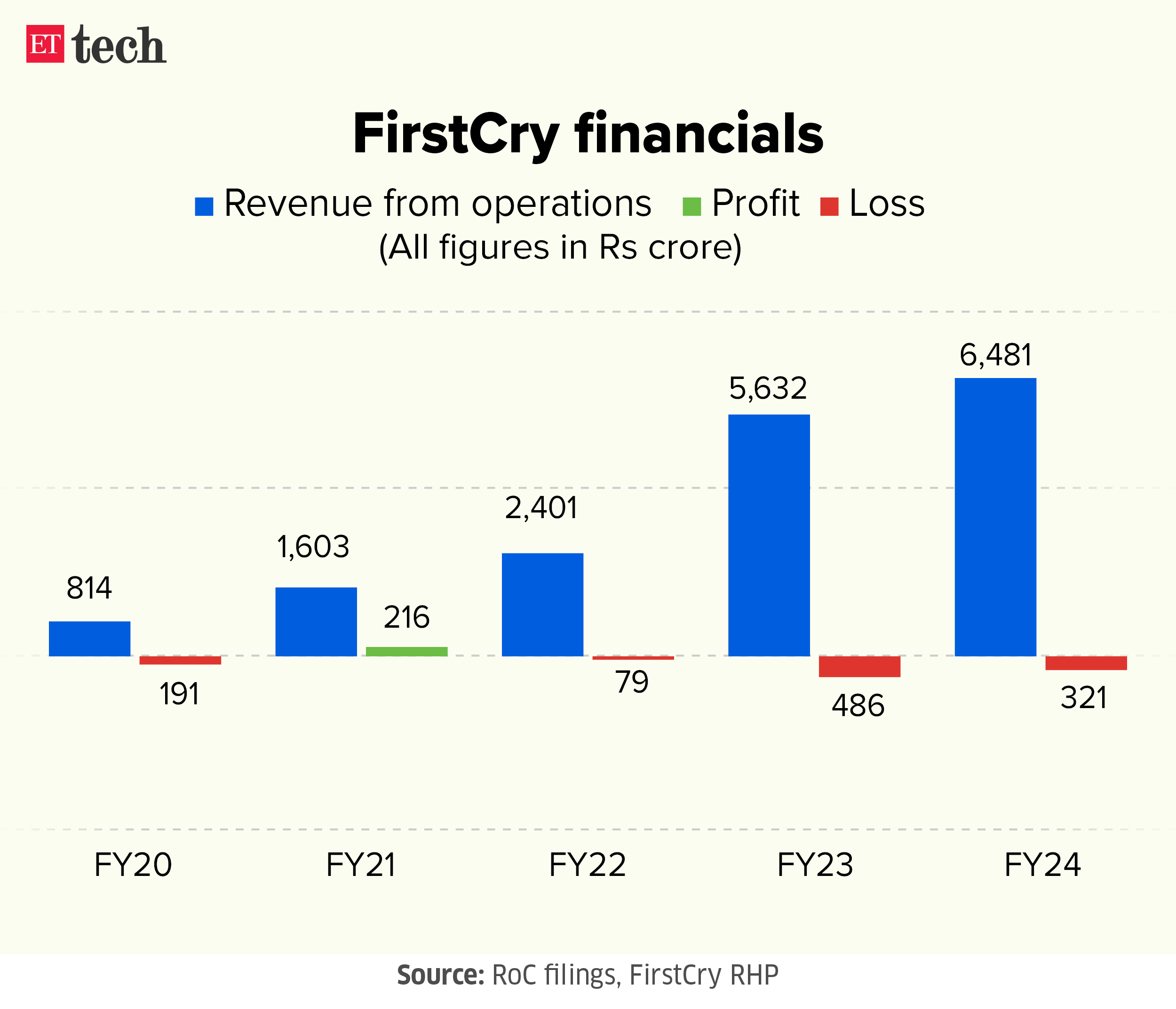

FirstCry information RHP; agency logs 15% soar in FY24 income

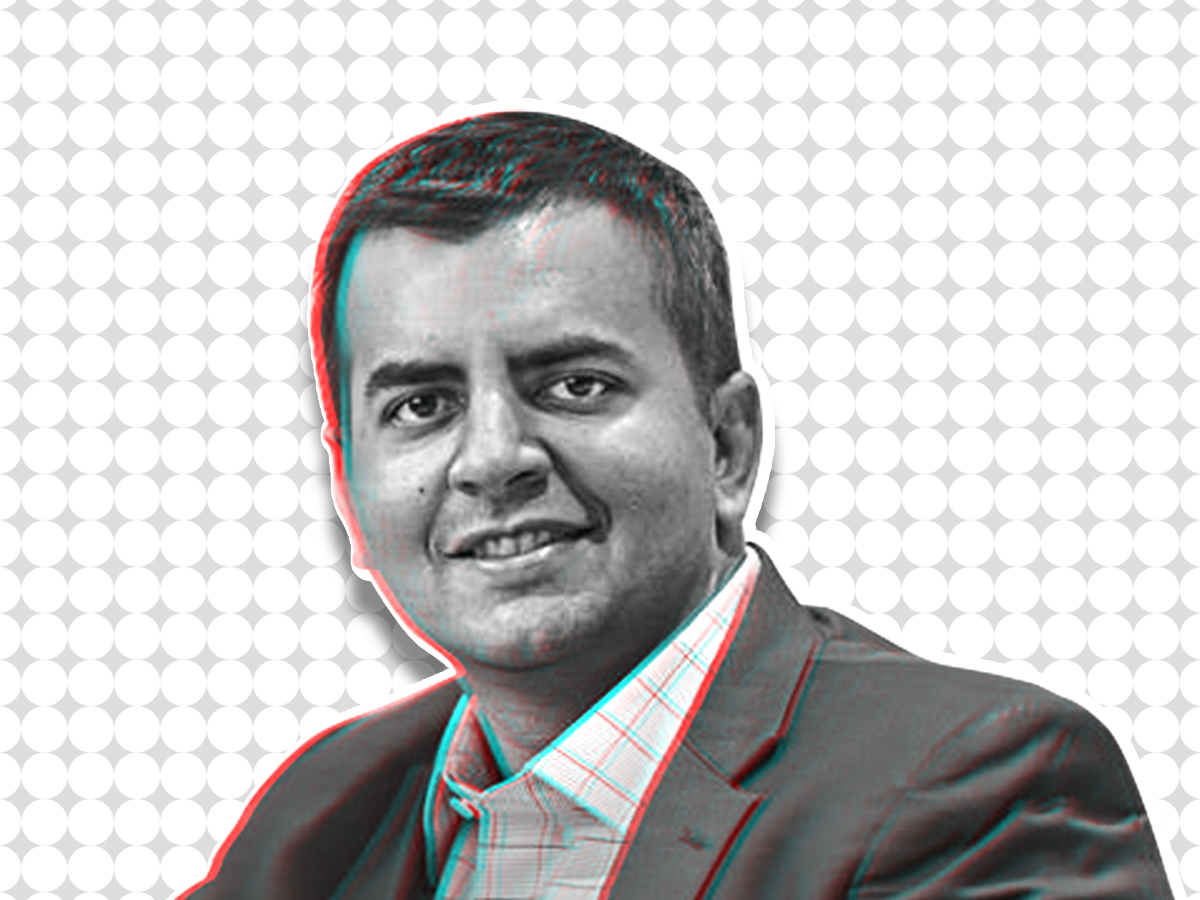

Supam Maheshwari, chief government, FirstCry

The preliminary public providing (IPO) of Brainbees Answer, which operates kidswear model FirstCry, is scheduled to open on August 6, whereas bidding for the anchor portion will open for a day on August 5, as per its crimson herring prospectus (RHP).

IPO particulars: The proposed public concern of the Pune-based agency contains a contemporary concern of fairness shares valued at Rs 1,666 crore and an offer-for-sale (OFS) element of as much as 5.44 crore shares by current shareholders.

The worth band will likely be introduced on Thursday.

The Supam Maheshwari-led agency is more likely to value itself at round $three billion for its public concern, folks within the know informed us.

Who’s promoting: Underneath the OFS, SVF Frog, a Cayman Islands-registered entity of SoftBank, will promote 2.03 crore fairness shares and automaker Mahindra & Mahindra (M&M) will offload 28.06 lakh shares.

Others offloading stake within the OFS are PI Alternatives Fund, TPG, NewQuest Asia Investments, Apricot Investments and Schroders Capital.

SoftBank holds about 26% stake in Brainbees Options, whereas M&M owns an 11% stake within the multi-brand retailing platform.

FY24 financials:

- Working income grew 15% throughout the 12 months, whereas losses have been down 34%

- Globalbees—its ecommerce roll-up subsidiary—reported Rs 1,209 crore in income, contributing 18% to the father or mother’s income

- FirstCry’s worldwide enterprise posted a income of Rs 753 crore, rising over 50%

Additionally learn: Ola Electrical costs IPO at Rs 72-76 per share

Freshworks reviews 20% income development in Q2 to $174 million

Dennis Woodside, CEO, Freshworks

Nasdaq-listed software-as-a-service (SaaS) agency Freshworks’ income surged 20% on 12 months to $174 million within the second quarter of calendar 12 months 2024.

Key highlights:

- Freshworks pared losses to $20.1 million throughout the quarter, from $35.6 million throughout the identical interval a 12 months in the past

- The Chennai-based agency upped its annual income steerage marginally to $707-$713 million, in contrast with its prior expectations of $695-$705 million

- The corporate’s shares rallied round 12% on the Nasdaq

CEO communicate: “Freshworks delivered a stable Q2, rising income to $174.1 million with a free money move margin of 19%. Our outcomes mirror our rising monetary self-discipline and our capacity to satisfy the wants of consumers with our AI-powered options,” Dennis Woodside, CEO & President of Freshworks, stated in an announcement.

This marks the primary reporting interval since Freshworks appointed Woodside because the CEO in Could, taking the reins from founder Girish Mathrubootham who assumed the function of the agency’s government chairman.

AI bets: The CEO stated that the agency is “betting large” on its AI capabilities, and the corporate has seen buyer adoption for Freddy AI double sequentially.

Freshworks stated it ended the quarter with over 1,200 clients utilizing Freddy Copilot and 900 clients utilizing Freddy Self Service capabilities.

‘Opportunistic’: Ola Electrical CEO Bhavish Aggarwal slams MapMyIndia

Bhavish Aggarwal, founder, Ola Electrical

Days after MapMyIndia sued Ola Electrical for allegedly stealing its knowledge, the EV startup’s founder and chief government Bhavish Aggarwal has defended his agency.

Driving the information: Addressing the allegations, Aggarwal stated, “We’re not even within the map enterprise, however there will likely be opportunistic gamers throughout the trade.”

Recap: We reported on July 29 that CE Information Methods, the father or mother firm of MapMyIndia, which had offered providers to Ola, has stated that the latter has “copied” MapMyIndia’s proprietary knowledge by co-mingling and reverse engineering the licensed product.

The lawsuit was filed simply days earlier than Ola Electrical is ready to drift its preliminary public providing (IPO) on Friday.

Ola’s take: “We want to state unequivocally that these allegations are false, malicious and deceptive. Ola Electrical stands by the integrity of its enterprise practices. We are going to suitably reply to the discover shortly,” the corporate stated.

Unicommerce information RHP for IPO; SoftBank, AceVector to dump 25.6 million shares

Gurgaon-based Unicommerce Esolutions, which offers know-how merchandise to handle the net operations of shops, has filed its crimson herring prospectus for an preliminary public providing (IPO) of its shares.

Inform me extra: The IPO, which doesn’t have a contemporary concern element, will see an OFS of as much as 25.6 million shares.

The OFS element has been truncated from the sooner plan of offloading 29.eight million shares. It is going to see SoftBank and promoter AceVector Group (previously Snapdeal) promote stakes.

Board growth: Unicommerce expanded its board in December, inducting former SoftBank India head Manoj Kohli, FMCG sector veteran Ullas Kamath and Sheroes founder Sairee Chahal as unbiased administrators.

Ecommerce gross sales grew 16% throughout the one week interval of mid-year gross sales

Ecommerce gross sales grew 19% in worth phrases throughout the one week interval of mid-year gross sales between July 19 and July 25, in comparison with the July 14 to July 20 sale interval final 12 months, ecommerce enablement agency Unicommerce stated.

Driving the information: The sale interval was led by Amazon’s Indian Prime Day gross sales on July 20 and 21, with plenty of gross sales additionally going down on different platforms. Main rival Flipkart had its GOAT (Best of All Time) gross sales from July 20 to July 25, whereas trend and wonder market Nykaa had its Scorching Pink Sale between July 19 and July 28.

At present’s ETtech High 5 publication was curated by Riya Roy Chowdhury in Bengaluru and Megha Mishra in Mumbai.