American gorilla glass maker Corning is establishing a producing unit in Tamil Nadu at an funding of Rs 1,000 crore, we now have learnt. This and extra in right now’s ETtech Morning Dispatch.

Additionally on this letter:

■ PhonePe doubles down on gateway enterprise

■ Infosys CFO Nilanjan Roy resigns

■ Tide appears to develop India service provider base

Gorilla glass producer Corning to arrange manufacturing facility in Tamil Nadu

Key Apple provider and American gorilla glass maker Corning Inc is investing Rs 1,000 crore to arrange a producing facility in Tamil Nadu, a number of sources conscious of the event advised ET.

India entry particulars: The power can be arrange at Pillaipakkam, close to Sriperumbudur, on a 25-acre plot, which can be expanded if the necessity arises, and can make use of round 300 individuals.

This marks the formal entry of one other Apple provider into India, bolstering the increasing ecosystem of the corporate in addition to digital element producers within the nation.

Corning can be working with its Indian accomplice Optiemus Infracom for this facility.

Inform me extra: Corning is a extremely specialised participant with a monopoly within the gorilla glass market. Earlier, in September, the Telangana authorities mentioned the corporate had determined to spend money on the state. Nevertheless, sources mentioned the corporate selected Tamil Nadu due to the electronics ecosystem accessible within the state in addition to the proximity to different Apple suppliers.

Catch up fast: On October 26, union minister for electronics and data know-how Ashwini Vaishnaw took to X and mentioned, “Corning to start show glass ending in India subsequent 12 months – preliminary capability of 30 million items.”

Final week, we reported how Apple was wanting to herald its different suppliers to the nation as there have been delays in offering approvals to a few of their giant Chinese language suppliers.

Zomato sees a possibility in catering enterprise

Rakesh Ranjan, CEO – meals supply, Zomato

Meals supply platform Zomato is mulling diversification into the catering enterprise, a senior firm government advised us.

Within the works: Zomato is in search of to leverage its established community of restaurant companions as a part of a broader technique to service giant orders, Rakesh Ranjan, chief government for meals supply, mentioned in an interview.

The agency can be wanting so as to add extra choices to its loyalty programme, Gold, regardless of issues concerning the potential influence on profitability.

Additionally learn | Zomato, Swiggy search a route to succeed in backside of the pyramid

Exploring extra use instances: “If I need to have a gathering of 20 individuals at dwelling…proper now meals supply doesn’t lend itself nicely into that type of a use case. It’s winter, I need to have a celebration, or I need to do a small picnic within the native park. There are tons of such use instances within the offline world. It’s solely about tying a few of these free threads…so that is what we’re going to be specializing in,” Ranjan mentioned.

Driving the information: The transfer is in step with the Gurugram-based firm’s broader technique to introduce extra use instances for meals supply to develop its complete addressable market.

This June, Zomato launched the multi-cart characteristic permitting customers to order from a number of eating places concurrently.

Ranjan mentioned Zomato seeks to construct “events” for purchasers to order extra by initiating operational modifications and advertising and marketing campaigns.

Additionally learn | Pushed by Gold subscriptions, Zomato’s meals enterprise retains swelling

PhonePe’s subsequent huge wager: accelerating service provider income, D2C manufacturers

Digital funds main PhonePe is doubling down on the web fee gateway enterprise, concentrating on ecommerce corporations with a full stack providing throughout playing cards, UPI and internet banking.

Selecting up the thrill: PhonePe is chasing gaming apps, direct-to-consumer manufacturers and huge ecommerce gamers with its fee gateway. The Walmart-backed fintech is chasing market share at a time when rivals Paytm, PayU, Cashfree and Razorpay are all prohibited by the RBI from onboarding new retailers.

Until date, PhonePe was centered on client funds and offline QR code funds. Now, it desires to go after on-line service provider funds as nicely.

Moreover, PhonePe desires to get on the vendor facet of open supply commerce platform ONDC, too. By January, it should begin onboarding retail shops on the ONDC platform to allow them to promote to patrons on the app.

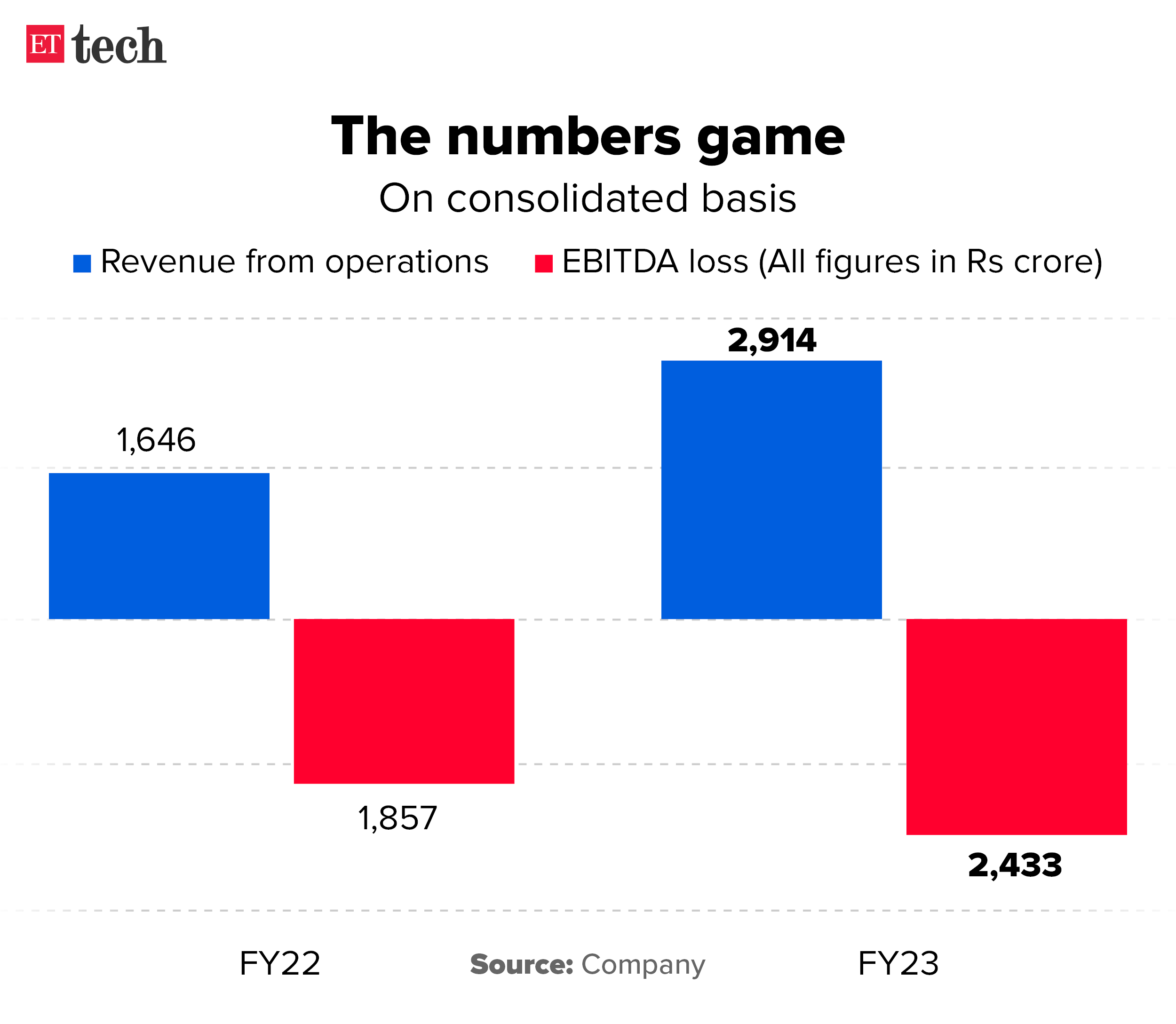

Rationale behind the transfer: PhonePe has greater than 500 million registered customers and 37 million retailers and settles $1.Three trillion price of transactions yearly. However with a valuation of $12 billion, its income within the final fiscal was lower than Rs 3,000 crore.

Its rival Paytm reported a Rs 7,990-crore topline in FY23 leveraging credit score, service provider funds and others.

The founders purpose to vary this and need to strengthen its income strains.

Inform me extra: PhonePe provided fee gateway companies solely by UPI achieved by its personal clients. However now it has constructed capabilities to course of card funds in addition to internet banking transactions.

PhonePe can be providing a fraud detection instrument to its enterprise clients and an specific checkout facility to its small enterprise clients. Collectively, the concept is to construct income channels from service provider funds.

Additionally learn | PhonePe is about to launch client lending by January 2024

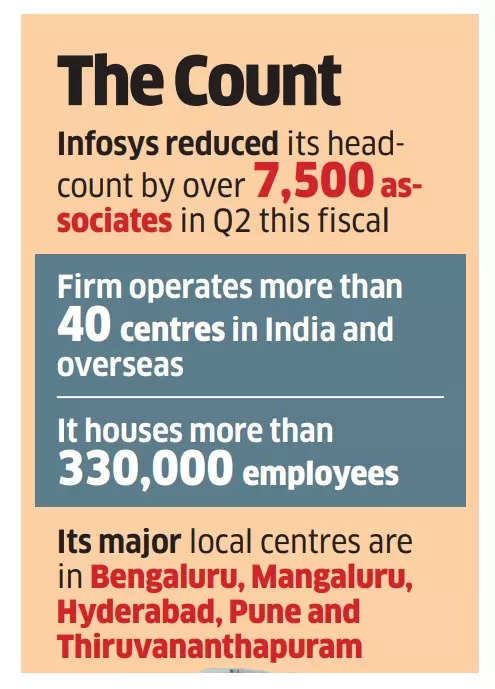

Management disaster deepens at Infosys, CFO quits

Nilanjan Roy, CFO, Infosys

The management disaster at IT big Infosys has deepened with chief monetary officer (CFO) Nilanjan Roy resigning from his place.

However why? Roy, who has been serving within the function since 2018, determined to step all the way down to pursue his “private aspirations out of Infosys”.

Roy’s final day can be March 31, 2024, Infosys mentioned in a regulatory submitting. Present government vp and deputy chief monetary officer Jayesh Sanghrajka will take cost as the brand new CFO efficient from April 1, 2024.

Sounding alarm: “The management vacuum growing at Infosys is turning into fairly alarming with Nilanjan’s departure. (Chairman) Nandan (Nilekani) and Salil want to put down their plans to regular the ship in 2024,” mentioned Phil Fersht, chief government of US-based IT analysis and analyst agency HFS Analysis.

Exodus continues: Early this 12 months, Mohit Joshi and Ravi Kumar S, each presidents at Infosys, had been employed by friends Tech Mahindra and Cognizant, as their respective CEOs.

In different information: Infosys has referred to as upon workers to work from workplace at the very least three days per week and plans to quickly make it necessary after administration requests to renew the traditional workplace routine went largely unheeded, ET has learnt.

The brand new rule, if enforced, will revive the pre-pandemic attendance system.

Tide intends to up its buyer base in India

Oliver Prill, international chief government officer, Tide Banking

UK-based Tide, a banking software for companies, is aiming to extend the variety of its clients in India to about half 1,000,000, from round 200,000 presently.

Particulars: The corporate can be planning to develop its India headcount from round 800 presently to 2,000 within the subsequent three years. Tide had introduced its India launch in 2021.

“The small companies within the nation are digitising quickly and at Tide, we’re able to assist them digitise their financials by our platform,” international chief government officer Oliver Prill advised ET.

What’s extra? Tide is in a complicated stage to roll out credit score for its clients within the nation and is already in partnership with some lenders.

In January, Tide will launch invoice funds in partnership with NPCI Bharat Billpay and is about to roll out invoicing, financial institution transfers and ATM money withdrawal for its service provider companions in India.

Extra concerning the Tide: Tide India is run by Gurjodhpal Singh, who was earlier with digital funds agency PayU.

It runs a pay as you go pockets in partnership with Transcorp, which is a pay as you go fee licence holder within the nation. Tide gives an expense card which is powered by RuPay on this pay as you go pockets and permits its clients to simply accept funds, handle payouts and preserve monitor of their bills.

Different Prime Tales By Our Reporters

Sangram Singh, CEO, Indifi

Indifi hires Axis Financial institution exec Sangram Singh as its CEO | Indifi Applied sciences, which focuses on lending to micro, small and medium enterprises (MSMEs), has roped in Axis Financial institution government Sangram Singh as its chief government.

Right here’s what India Googled in 2023 | The historic Chandrayaan-Three moon touchdown, India’s G20 presidency, the Karnataka elections and the Uniform Civil Code had been among the many high information themes that had Indians keying of their queries on Google.

Lightrock loses accomplice and CFO Kushal Agrawal | Kushal Agrawal, accomplice and CFO at Lightrock India, which has backed startups equivalent to Porter, Dunzo and Shiprocket, has determined to step down from the funding agency.

Pepperfry reduces losses to Rs 187.6 crore, income up 10% in FY23: Mumbai-based furnishings and residential items firm Pepperfry marginally narrowed its losses for the fiscal 12 months ended March 2023, whereas recording 10% improve year-on-year in working income to Rs 272.Three crore.

International Picks We Are Studying

■ New York Joins IBM, Micron in $10 billion chip analysis complicated (WSJ)

■ Metaverse apart, Zuckerberg has had a surprisingly good 12 months (FT)

■ Google’s NotebookLM goals to be the last word writing assistant (Wired)