Experience-hailing app Rapido has been held liable to pay items and providers tax (GST) for its cab service. This and extra in at present’s ETtech Prime 5.

Additionally on this letter:

■ Paytm to concentrate on profitability

■ Flipkart Pay to push festive gross sales

■ Startups GenAI adoption

Rapido liable to pay GST for cab providers: Karnataka AAR

(L-R) Rishikesh SR, Aravind Sanka, Pavan Guntupalli, founders, Rapido

The Karnataka Authority for Advance Rulings (AAR) has held that ride-hailing platform Rapido is liable to pay items and providers tax (GST) for its cab providers.

Driving the information: Rapido submitted that it fees a subscription price to its driver companions—as towards charging them a fee—and doesn’t make any income on the fare.

Nonetheless, the AAR dominated that Rapido’s providers, although being offered by way of unbiased four-wheeler service suppliers, will appeal to GST.

Recap: The ruling would make Rapido – which simply raised $120 million in funding – liable to earlier tax dues on its cab providers, however individuals conscious of the matter mentioned the Bengaluru-based firm is evaluating an attraction.

Particulars of AAP order: “The applicant (Rapido’s dad or mum firm Roppen Transportation) is liable to pay GST on the availability of providers offered by the unbiased four-wheeler cab service supplier (one that has subscribed to applicant’s Rapido app) to his passengers on the applicant’s app platform, being an ecommerce operator, when it comes to Part 9 (5) of the CGST Act 2017,” the order learn.

GST confusion: In April, ET reported that to keep away from a tax arbitrage, bigger platforms Ola and Uber had additionally rolled out subscription-based fashions for his or her three-wheeler reserving providers. Moreover, ride-hailing platforms corresponding to Uber have approached the finance ministry, GST Council and the AAR looking for readability on whether or not their enterprise was liable to the oblique tax or not.

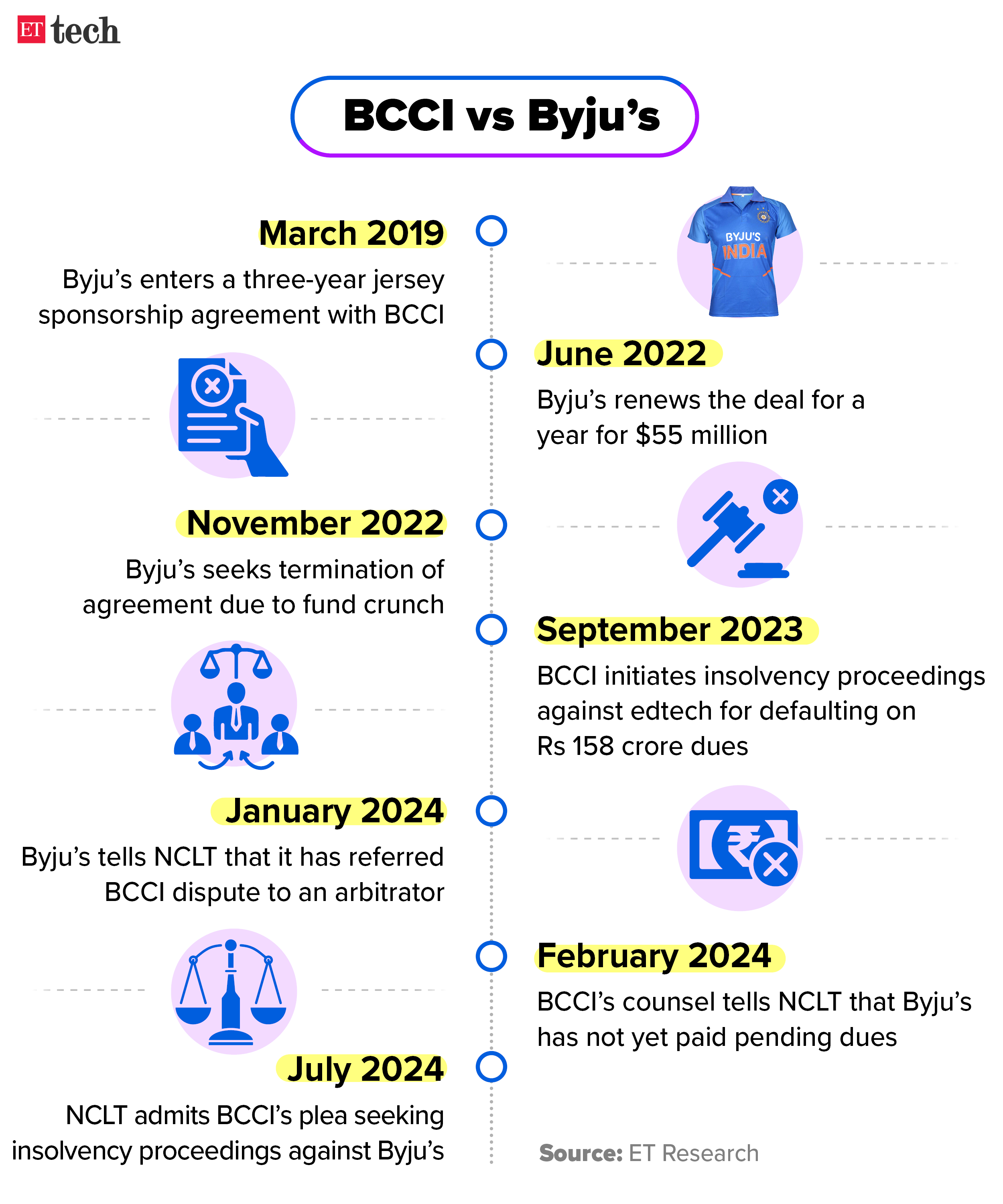

Byju’s founder near settling dues with BCCI, lawyer tells NCLAT

Byju Raveendran, founder, Byju’s

Embattled edtech founder Byju Raveendran is near settling his agency’s debt with the Board of Management for Cricket in India (BCCI), his counsel knowledgeable the Nationwide Firm Legislation Appellate Tribunal (NCLAT) on Tuesday.

Inform me extra: The due quantity is predicted to be paid in three tranches. “We’ve got nearly resolved the matter. A sure amount of cash must be transferred by RTGS by four p.m. at present, one other quantity must be paid by Friday, and the steadiness must be paid by subsequent Friday, which is August 9,” mentioned Raveendran’s advocate.

Background: The insolvency proceedings have been introduced earlier than the NCLT attributable to Byju’s unpaid dues of Rs 158 crore associated to sponsorship rights from the BCCI.

Individually, the Karnataka Excessive Courtroom disposed of a plea by Raveendran looking for suspension of the insolvency proceedings because the NCLAT bench had taken up the attraction.

BCCI stance: Tushar Mehta, who represented the BCCI, mentioned “some discussions” have been underway between the events concerned within the proceedings and requested that the listening to be pushed to July 31, which the opposite events and the tribunal agreed to.

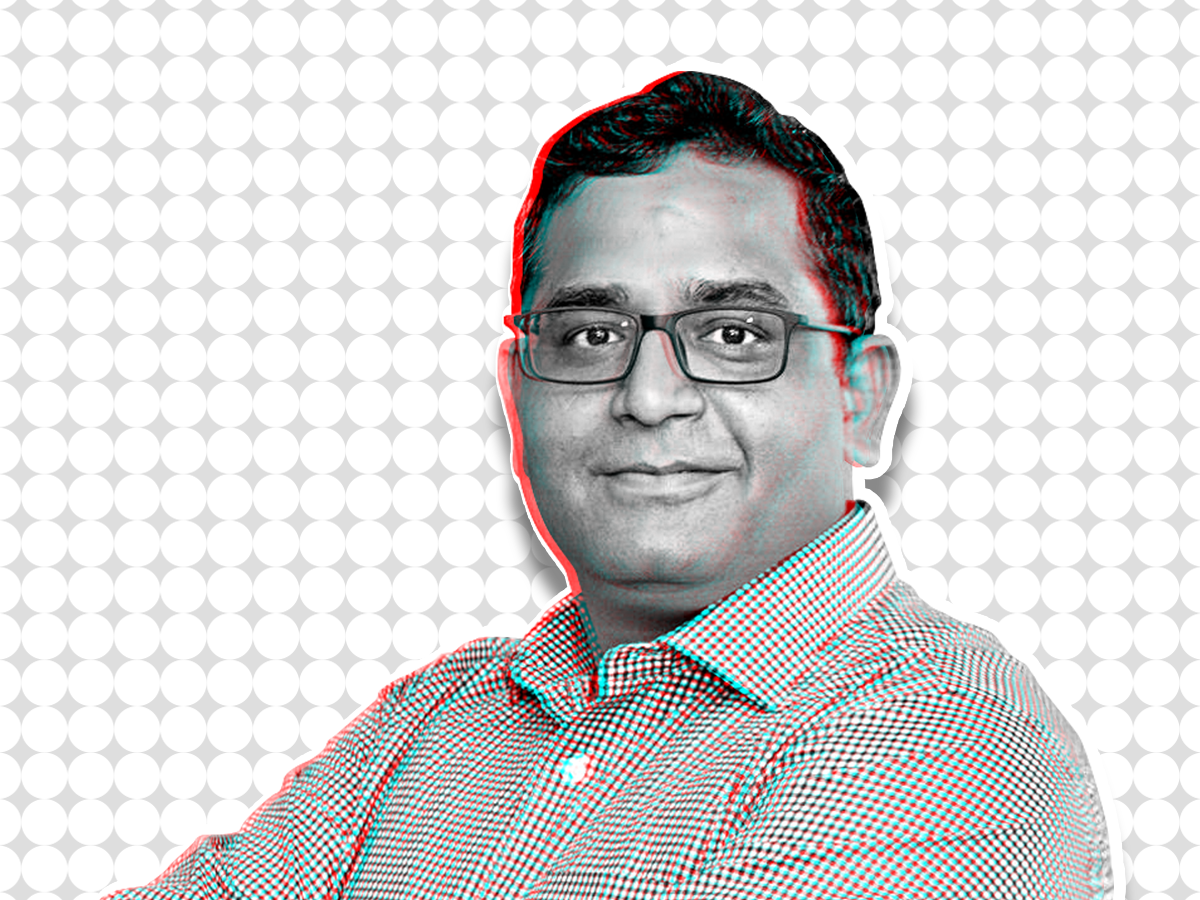

Paytm to concentrate on profitability regardless of fewer digital cost incentives in price range

Vijay Shekhar Sharma, CEO, Paytm

Paytm stays targeted on attaining profitability in at the least one quarter this monetary yr, regardless of fewer incentives for digital funds through RuPay debit playing cards and Unified Funds Interface (UPI) within the price range, founder and CEO Vijay Shekhar Sharma mentioned on Tuesday.

Driving the information: The central authorities has decreased the allocation to Rs 1,441 crore, from the Rs 3,500 crore initially proposed by the finance minister within the interim price range in February.

Paytm soundbox: The corporate launched a Close to Subject Communication (NFC) card soundbox, a tool that may course of UPI QR and tap-based card funds.

The brand new gadget is obtainable at a rental of Rs 150 – the identical as present soundboxes. Beforehand, soundboxes would solely include a QR code for UPI funds, however now small retailers utilizing this gadget also can course of credit score and debit card funds.

Catch up fast: Paytm not too long ago obtained the federal government’s nod for a $6 million funding in a key subsidiary. The FDI approval will allow the fintech agency to strengthen its funds arm which processes on-line transactions.

Paytm reported a wider lack of Rs 840 crore within the quarter ended June 30, 2024, from Rs 358.four crore in the identical interval a yr in the past. Consolidated income declined 33.5% to Rs 1,639.1 crore through the quarter.

Flipkart consolidates fintech choices forward of festive gross sales

Flipkart has built-in its numerous fintech providers right into a single vertical named Flipkart Pay.

Inform me extra: The ecommerce main will supply a number of providers underneath the Pay vertical on its buying app, together with UPI, recharge and invoice funds, insurance coverage, buy financing, co-branded bank cards and buy-now-pay-later (BNPL) providers.

“The brand new fintech platform is designed to reinforce buyer engagement and drive a seamless cost expertise for its prospects,” it mentioned in an announcement.

Doubling down: Flipkart has been increasing its fintech choices over the previous few months after its subsidiary PhonePe was hived off in 2022.

Flipkart on July 10 launched invoice cost providers permitting recharges for Fastag, electrical energy invoice, DTH, broadband and cell invoice funds. It had added UPI providers to its choices in March.

Flipkart’s in-house fintech enterprise Tremendous.Cash additionally launched a beta model of its cell app on the Android app retailer in June.

Accelerating with AI: Startups share how they’re turning the gears with GenAI

Synthetic Intelligence is now not the protect of AI companies alone. A few of India’s greatest and hottest startups throughout sectors like ecommerce and fintech are deploying AI, a current report by EY discovered.

Inform me extra: The applying of AI will not be restricted to only customer-facing chatbots. It is usually used for advertising and content material technology, fraud detection, danger administration, funds and payroll options, amongst others.

Quote, unquote: Rohit Pandharkar, AI accomplice, EY, mentioned, “There isn’t a poverty of ambition or expertise in Indian startups attempting to leverage AI.”

Nonetheless, from a worldwide perspective, Indian startups haven’t been pioneers, in contrast to somebody like Swedish unicorn Klarna, which used the know-how to switch 700 human brokers, he added.

At this time’s ETtech Prime 5 e-newsletter was curated by Riya Roy Chowdhury in Bengaluru and Megha Mishra in Mumbai.